Educating Your Clients: How To Detect Fraudulent Tax Preparers

Searching for the right tax preparer can be hazardous. Many scam artists prey on taxpayers’ inexperience and need for expedience. They submit bad...

Explaining Tax Refund Delays to Your Clients

The question every tax preparer hears is, "How long till I get my tax return?" Families have plans for that money to go on vacation, make household...

From Tax Preparer To Business Owner

So, you're ready to strike out on your own. Maybe you just graduated with your accounting degree. Perhaps you've worked for years for another...

What Are the Biggest Challenges That You Face as a Tax Professional?

Every job comes with its challenges, but tax professionals seem to have a difficult time when the entire nation has the same deadline for completing...

Growing Your Accounting Business In 2024

Is owning your own business living up to your expectations? Like many accountants, you may have understood the demand for accountants better than...

What are The Necessary Qualifications and Steps to Become a Tax Preparer?

Working as a tax preparer could be a full-time or seasonal job and is in high demand during tax season. Are you good with numbers, find taxes...

Will Software Replace Professional Tax Preparers?

There are several options for individuals and families looking to DIY their taxes. The IRS has a Free File program with the Free File Alliance, a...

Make 2024 The Year You Scale Up Your Tax Preparation Business

Growth is one of the primary business goals shared across markets. You’ve worked hard to set up your company, build a brand, and service clients....

How Can I Determine if my Current Tax Software Suits my Tax Services Business?

Proper tax software is integral to running a successful tax services business. Without the right tools, you may fall short of meeting the most...

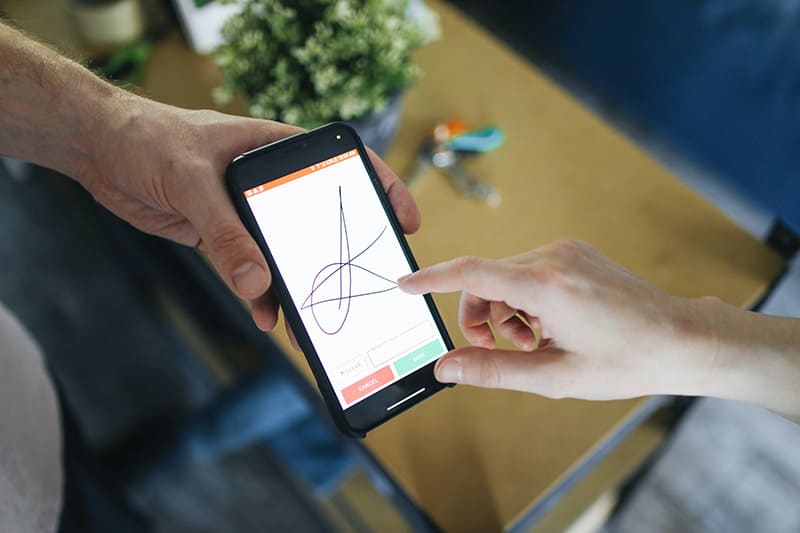

Digital Signatures: The Ultimate Timesaver For Tax Preparers

Until recently, the IRS required wet-ink signatures on hard-copy documents for tax filing. They’ve relaxed their stance on hard copies in recent...

Recent Posts

8 Tax Season Challenges for Preparers—and Ways to Turn Them Into Wins

Tax season challenges keep getting more complicated. Between shifting regulations, tighter deadlines, and the constant juggling of client needs, it’s easy to feel overwhelmed. Small firms have it even harder. With fewer hands on deck, managing it all can seem like a...

11 Tax Professional Strategies to Reclaim Your Time This Tax Season

If you're like most tax professionals, your day starts with a pile of client files, a full voicemail box, and that nagging feeling that there aren't enough hours to get it all done. Research shows that each interruption costs you 20 minutes of focus time, and during...

Dispelling Myths Around Cloud-Based Tax Preparation Software

Remember the days of crashed computers during tax season, lost files, and that constant worry about backing up your data? If you're still wrestling with traditional tax software, you're probably all too familiar with these headaches. Yet something holds you back from...

The Benefits of Getting Tax Software Early in the Season

Is now the right time to buy your tax software for the 2025 season? This question might be on your mind as you plan for the future of your tax preparation business. The truth is, investing in business tax software early can make your upcoming tax season smoother and...

Using Tax Software When You Don’t Have an EFIN

Starting a tax preparation business? Maybe you're exploring software options while your EFIN application processes, or perhaps you haven't started the application yet. Either way, you need to understand how your software experience changes without this vital IRS...