We’ve been transitioning into a paperless society for over twenty years, yet we have more paper now than before. Although scanning technology and computer storage were available, the process needed to be more precise, safer, and easier to manage for clients who weren’t tech-savvy.

Times have changed: The technical infrastructure is in place, the people are better prepared, and file encryption makes cyberspace safer than paper files in a locked file drawer in your office.

Why Go Paperless?

You may ask, “Why fix it if it isn’t broken?” Your accounting business has functioned just fine for decades. Switching would be a hassle, so why bother? There are several compelling reasons for the switch:

Safety

Yes, hackers out there sometimes break through a firewall. However, few hackers could break through the level of encryption required by cloud-based professional tax software. On the other hand, anyone with a crowbar can break into an office building and bust open a file cabinet. Then there’s the danger of emails. Emails are far easier to hack than a cloud-based tax software client portal.

Broader Client Base

With current technology, you can work from anywhere worldwide without missing a beat. That means you can advertise for clients statewide rather than just your surrounding neighborhood. The chance to scale up your business is much higher. It also makes it so you can choose which clients you service. If you want to handle a specific niche because you’re killing it in that particular field, do it. You can use targeted advertisements that draw in your desired clientele rather than taking everyone because you’re out of options.

Competitive Advantage

Let’s face it: your competitors are switching to digital files. You must stay current to meet your clients’ ever-evolving needs to gain any advantage. Our society does everything online, like downloading movies, ordering groceries, paying bills, playing games, researching, making travel plans, and more. Few people want (or can afford) to take time off work to drop off paperwork if they can snap a picture with their phone and send it at their convenience. With e-signatures, online meeting spaces, secure communications, and instant transfer document storage, convenience is the name of the game.

How To Switch

- Make A Plan

Your plan should look something like this:- If it won’t be you, appoint someone responsible for the transition.

- Make a master list of every type of document in the office with how your team uses it so that you can grant access to the right people.

- If you find redundancies, decide which process is most efficient and adopt the approach.

- Scan in documents. If you process paperwork in stages, make sure there are notes on every file so anyone accessing it knows where to find what they need.

- Make file names intuitive. Keep it consistent. Use electronic tags (the same as category file folder tabs), so it’s easy to pull up the correct documents. A cheat sheet for everyone entering data would be helpful while learning the new system.

- Assign Access

Your cloud-based tax preparation software should be able to segregate information so people who don’t need to see personal client or company information can’t access it. For example, you would give a receptionist different access than a CPA. - Thoroughly Test The System

Before clients access the system, test everything. It is better to take your time to work out the bugs. Clients who try to use the system and find it nonfunctional may not try again, complicating things for you both. It also comes off as unprofessional. - Sell The System

Getting new clients on board will be easy. Existing clients may take more work. Like any good sale, you must point out why the system is better for them than for you. Here are some sample talking points:- We’re upping our security to protect your financial information better.

- We’re making things more accessible so you can easily send documents without taking time off work.

- There will be no need for you to drop by to sign anything. You can view the documents and talk to us through our secure system or over the phone at your convenience. Once you’re satisfied, you can sign the forms with a click of a button and instantly have access to your copy.

The key is to tell them well in advance so they can ask questions and feel comfortable with the transition. Then, give them clear instructions on accessing the client portal to prevent problems. Even if the portal is intuitive by your standards, you should send an instruction sheet with a letter in advance so the least tech-savvy among them can figure it out.

Converting to a paperless office isn’t easy, especially when you already have established clients who are happy with your current system. Ensure you plan for the transition at your least busy time so you can work out any issues before the busyness of the next tax season hits you.

Video

Infographic

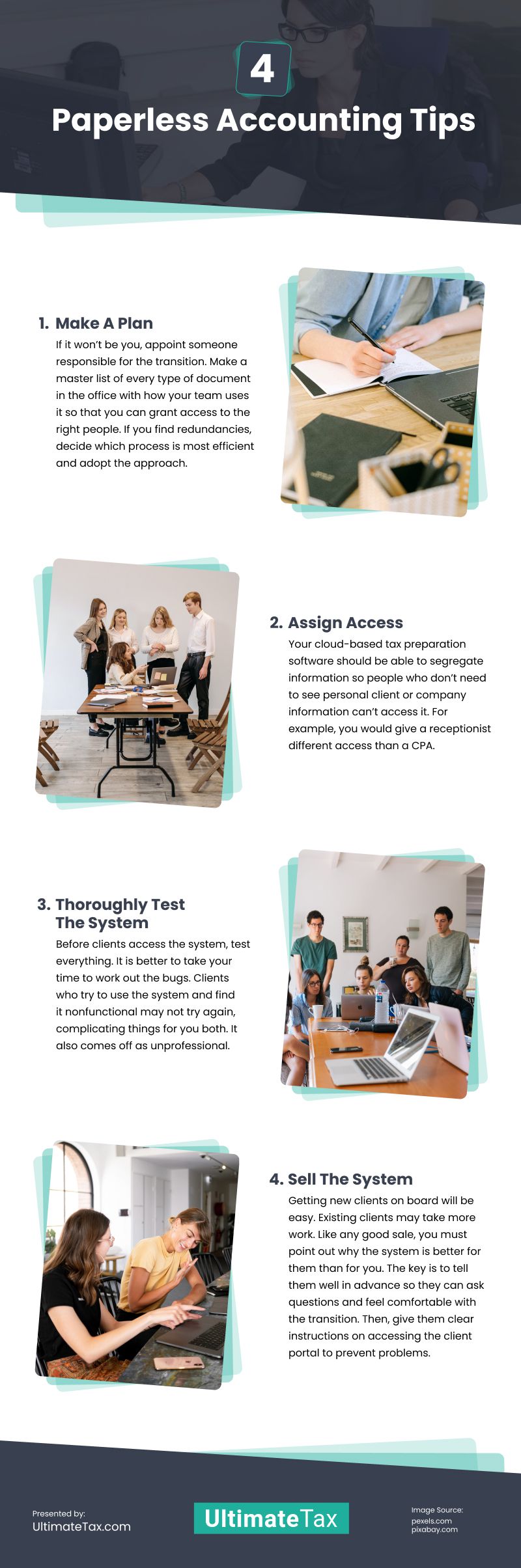

Switching to a paperless office is difficult, especially with satisfied long-term clients. Plan the transition during your slowest period to address any issues before the next tax season. Discover in this infographic the four helpful paperless accounting tips.