With tax season fast approaching, it’s time to prepare for your busiest time of year. Waiting until February or March to get your office ready for the influx of clients will leave you overworked, frazzled, and unable to meet demand.

So, how do you prepare your office for tax season? Read on for seven tips on how to make this the best and most profitable year ever.

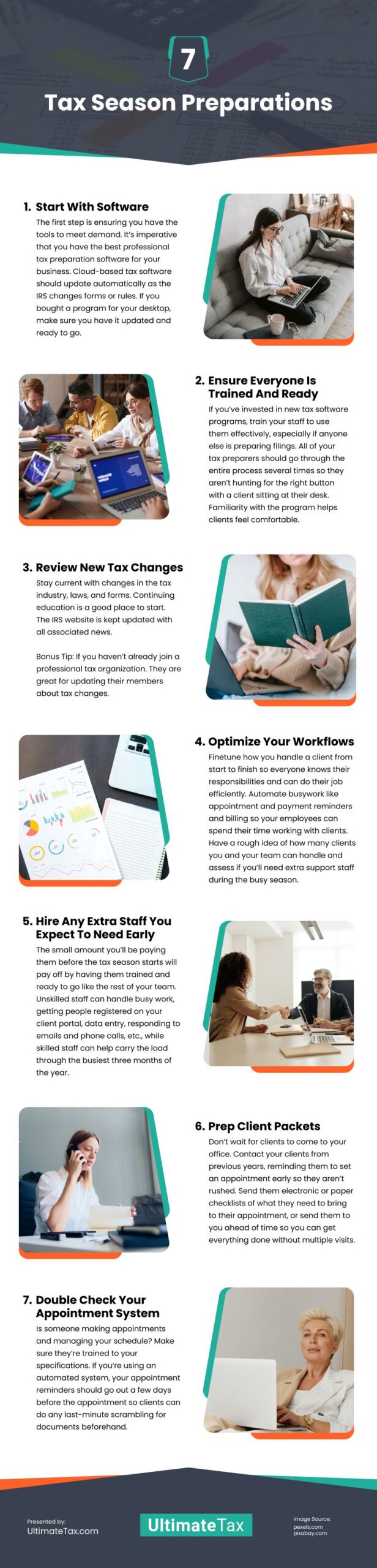

1. Start With Software

The first step is ensuring you have the tools to meet demand. It’s imperative that you have the best professional tax preparation software for your business. Cloud-based tax software should update automatically as the IRS changes forms or rules. If you bought a program for your desktop, make sure you have it updated and ready to go. Verify you can scale it up if you have more clients than last year and get all the bugs and kinks out now before people file their returns.

If you’re using a business management platform, set your returning clients up in the client portal ahead of time. You may need to wait for a few of the less tech-savvy clients who need a little coaching to set them up during their appointments. This is so they can upload documents, sign forms, send messages, and manage their payment information.

2. Ensure Everyone Is Trained And Ready

If you’ve invested in new tax software programs, train your staff to use them effectively, especially if anyone else is preparing filings. All of your tax preparers should go through the entire process several times so they aren’t hunting for the right button with a client sitting at their desk. Familiarity with the program helps clients feel comfortable. Fumbling with the software won’t give new clients confidence in your business and can cause old clients to lose trust. You want to come across as capable and professional as they are handing over sensitive and private financial information.

3. Review New Tax Changes

Stay current with changes in the tax industry, laws, and forms. Continuing education is a good place to start. The IRS website is kept updated with all associated news.

Bonus Tip: If you haven’t already join a professional tax organization. They are great for updating their members about tax changes. Additionally, you’ll be able to get to know others in your field. Depending on the organization, you might meet professionals in tax-related fields, like tax lawyers. If you have a question, you have extra resources.

4. Optimize Your Workflows

Finetune how you handle a client from start to finish so everyone knows their responsibilities and can do their job efficiently.

- A shared calendar lets schedulers and tax preparers stay on the same page so timeslots aren’t double booked.

- A secure client portal with document management, messaging, video call capability, payment gateway, and e-signature capability lets you schedule appointments with people anywhere in your state.

- High-speed internet with sufficient bandwidth to handle everyone working online at once.

- Automate busywork like appointment and payment reminders and billing so your employees can spend their time working with clients.

Have a rough idea of how many clients you and your team can handle and assess if you’ll need extra support staff during the busy season.

5. Hire Any Extra Staff You Expect To Need Early

The small amount you’ll be paying them before the tax season starts will pay off by having them trained and ready to go like the rest of your team. Unskilled staff can handle busy work, getting people registered on your client portal, data entry, responding to emails and phone calls, etc., while skilled staff can help carry the load through the busiest three months of the year.

6. Prep Client Packets

Don’t wait for clients to come to your office. Contact your clients from previous years, reminding them to set an appointment early so they aren’t rushed. Send them electronic or paper checklists of what they need to bring to their appointment, or send them to you ahead of time so you can get everything done without multiple visits. You can make the checklists by filing type: business, personal, renter, homeowner, etc. Your clients will appreciate you being proactive and your efforts to help them get organized.

Don’t forget to update your website with information your clients might find helpful, any changes to your process, and a copy of your generic client packet so prospective clients can know what to expect.

7. Double Check Your Appointment System

Is someone making appointments and managing your schedule? Make sure they’re trained to your specifications. If you’re using an automated system, your appointment reminders should go out a few days before the appointment so clients can do any last-minute scrambling for documents beforehand.

Send a personal email, message, or phone call confirming the appointment the day before and any reminders for documents that may not have been on the list. The checklist is a general guideline. If something in last year’s taxes raises a red flag, be sure you request the proper documentation now.

After appointments, don’t forget to follow up. Stay connected to your clients by asking for feedback. Did the appointment run smoothly? Are there any lasting concerns? Were they satisfied with their tax preparer’s professionalism and performance? Is there anything you could do to improve things? You might learn a few things to improve your process or clients’ experience.

Don’t forget you can always delegate some of these responsibilities to your staff so you aren’t trying to do everything on your own. Set deadlines so projects get done before tax time. It may be hectic, but some prep work can make things run more efficiently so you can get more done in your most profitable three months of the year.

Video

Infographic

As tax season is rapidly approaching, it’s essential to start preparing for what is likely to be the busiest time of the year for your office. Check out this infographic to learn how to make this year your most profitable one.