For years, tax software was so complicated it took months to learn it. Few people wanted to switch, even if unhappy with their service because they’d have to learn a new system all over again. However, there are many user-friendly paid tax preparer software if you want to switch.

When searching for the right professional tax preparation software for your office, there are a few things you want to consider:

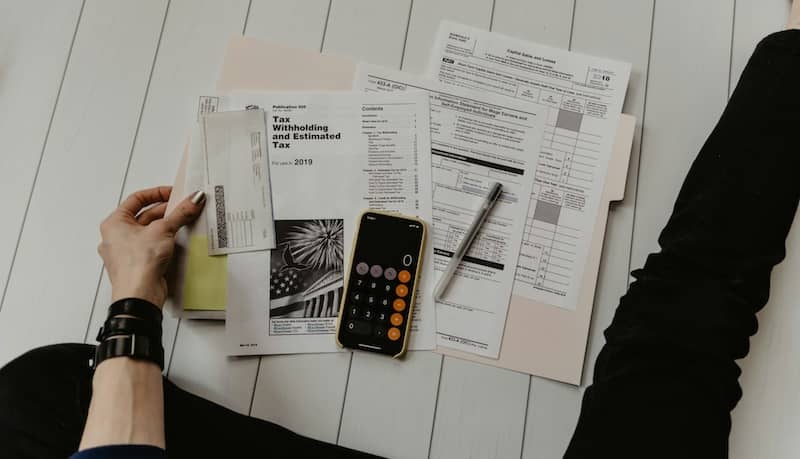

Data Transferability

One of the top concerns tax preparers have when switching software is whether they can safely transfer their files from one program to the next without losing critical documents. Some programs integrate well with professional tax prep software, others not so much. It’s essential to know how the programs you’re looking at buying interact with your current record-keeping program.

Data transfer is a process that takes time, but there are benefits to having your files in better digital programs.

- The level of encryption meets tax law standards, which means it’s better than what they use for emails, standard office programs, and social media, and certainly better than hard copy files.

- Quality software will have a document management system to find what you need quickly. Clients can upload documents directly into the system using a scanner or their phone, and you can organize them in whatever makes the most sense for your office.

Usability And Quality Support

Preparing taxes is complicated enough. You’re looking for professional tax software with a user-friendly, intuitive interface. You want to flow through your order of work naturally, be able to locate things you need easily, and have easy help options so you don’t have to switch back and forth between the tutorial section and the page you’re working on.

In addition to the intuitive interface and process, you want free onboarding training that won’t take you weeks or months to master, with customer support on standby to help you if you run into problems.

Note: Quality support doesn’t necessarily mean 24-hour support for everyone. If you call after standard business hours, you will talk to a call center outside the US. They have flip charts of answers to basic questions. But if you have a complicated problem, they’ll refer it upline to the parent company during their regular 9-to-5. Find out if support is always outsourced or if there are times you’ll get someone who knows the software’s ins and outs.

Desktop Vs. Cloud

There are definite benefits to cloud-based software over local desktop storage.

- There’s nothing so disheartening to turn on your computer and see the blue screen of death. If you only had files on a local system, your business could be in trouble. If your computer crashes, there’s a backup of all your files on the internet behind encrypted firewalls. If you want to go the desktop route, it would be best to have an external hard drive backup that updates regularly.

- Portability is vital for those who visit their clients rather than have their clients come to the office. You can access the software from multiple devices from any place with Wi-Fi.

- Updates on both tax code and functionality are uploaded automatically. It’s impossible to forget to download changes and submit incomplete or incorrect forms to the IRS.

- The client portal allows for secure logins from your staff and your clients. Everything is encrypted. They can securely upload documents, make payments, and schedule appointments independently.

Does The Software Support Bank Products?

Bank products allow people who could not otherwise pay for your services to get help with their taxes. You get paid out of the refund, they get help with no money upfront, and it’s convenient for you both.

Your software should partner with bank product services so the process is efficient. You’re already in the right program. You don’t have to have multiple passwords and switch back and forth between screens.

Is There A Free Trial?

If you’re reading this article, you could be happier with your tax filing software. Whether it was clunky with unneeded features, too slow, too complicated, or you need better customer service, you want to ensure you aren’t jumping out of the frying pan into the fire.

The only way to guarantee you aren’t getting the same problems at the new company is to try it out, not just for a half-hour demo. Take a few days or weeks poking around. Do a dry run with a made-up client. Make it complicated so you know how hard it will be to get answers. Call customer service and see how well they work with you. Make sure it does what they claim and what you need before you buy.

Final Thoughts

Whatever your reason for shopping, quality, user-friendly options are out there. They will help you satisfy your clients, be more productive, and meet your goals for the coming year.