Until recently, the IRS required wet-ink signatures on hard-copy documents for tax filing. They’ve relaxed their stance on hard copies in recent years, partly because they’re always looking for ways to improve their efficiency and partly because they need to keep up with the times.

As a tax professional, you can take clients from all over their state (and beyond, depending on your licensing.) You may even take US expatriates or military clients overseas. More people are working remotely than ever before, making it impossible for many clients to sign their tax documents in a face-to-face appointment. Electronic signatures provide flexibility and security to every transaction.

What Is An E-Signature?

An electronic signature is client approval and authorization for a tax preparer to file their taxes, just as the ink signature was. Instead of ink, it’s a digital identification. But what’s so special about them?

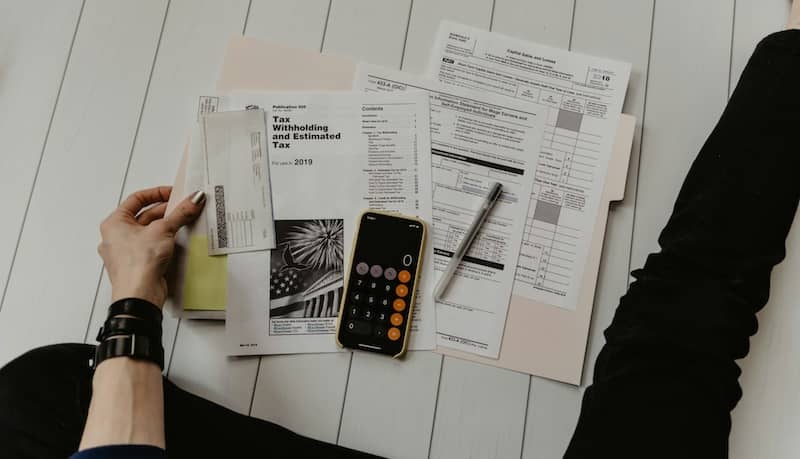

E-Signatures Mean A Paper-Free Office

For the first time, tax software for professional tax preparers can do all the heavy lifting. No more printing, mailing, faxing, or emailing documents to clients. No more walls of filing cabinets and stacks of file boxes cluttering your office and storage. You can meet with clients by video conference, upload documents using a scanner or cell phone, complete the taxes, offer bank products to help clients pay your fee, file their returns directly to the IRS online, and never print a single page.

Going paper-free means less money going to copier and fax paper, printer cartridges and toner, machine repairs, and postage, not to mention time wasted waiting for clients to sign and return the paperwork. More than 213 million returns were filed electronically with the IRS last year. If each return were a single-page document, the stack would be 13 miles high.

They Contribute To Efficient Workflows

Web-based professional tax software allows preparers to work at a client’s office, at their firm’s office, in their home, or while traveling. All templates and documents should be accessible through the site, including images of receipts, reports, and other client-provided paperwork or digital files. You can work anywhere there’s an internet connection.

Secure and immediate access to client documentation for you and your clients could shave days or weeks off the typical tax return process. More efficient workflows mean faster tax returns, improving your bottom line.

E-Signatures Improve The Client Experience

Clients have grown accustomed to having everything they need at their fingertips. They expect tax professionals to be tech-savvy and efficient. A paper-free, secure, quick process makes tax time less stressful for them.

E-Signatures Add Security

When clients sign a form in ink, they signify they have read and approved the tax return. An e-signature does the same thing. However, the signature locks the document in electronic form so no one can make additional changes. In 2021, there were 1.4 million reports of tax-related identity thefts. E-signatures prevent document manipulation or someone peeking into paper files for sensitive information.

Unfortunately, cybercrime is on the rise. Tax professionals are prime targets for hackers because of the types of information you keep on file. A single tax return allows a criminal to create fake identification cards, sign up for credit cards they max out and never pay, empty bank accounts, and ruin your client’s credit for years. Data security is a must in today’s digital world.

There is more than one kind of e-signature. The most secure form is a digital signature, which requires signer identity verification. There are two types:

- Knowledge-based authentication will require the signer to answer personal questions based on tax information submitted in other returns, like previous addresses.

- Email-based authentication requires the signer to click a link sent to their email address.

Digital signatures are tamper-proof and keep a log of dates and times of document creation, the signer’s IP address, who accessed the document, and more, which is helpful in case of an audit. Digital signatures must be kept on file for two years, though they can be kept in a digital format, saving office space.

Remember…

Tax time is hectic for everyone. Individuals and companies are trying to corral a year’s worth of financial data with varying levels of success. You may get organized reports or shoeboxes full of receipts. Small businesses are already counting their tax return as income to stay afloat, and families hope for a quick return to repair their cars, appliances, or other expensive necessities.

Tax return software for tax preparers streamlines a time-sensitive and complicated process, allowing tax professionals to work faster, make fewer errors, and spend less on postage and supplies. The efficiency and flexibility create customer satisfaction, while digital signatures give your clients a quicker tax return and peace of mind over the security of their private information.