How to Manage Your Tax Business Like a Boss with UltimateTax

The majority of tax preparers' ultimate goal is to start their own profitable business. You can set your own hours, delegate tasks to employees, and...

The Comprehensive Guide to Choosing the Most Efficient Professional Tax Software

In today's technologically advanced society, a plethora of software applications are used for day-to-day business operations. Working in accounting...

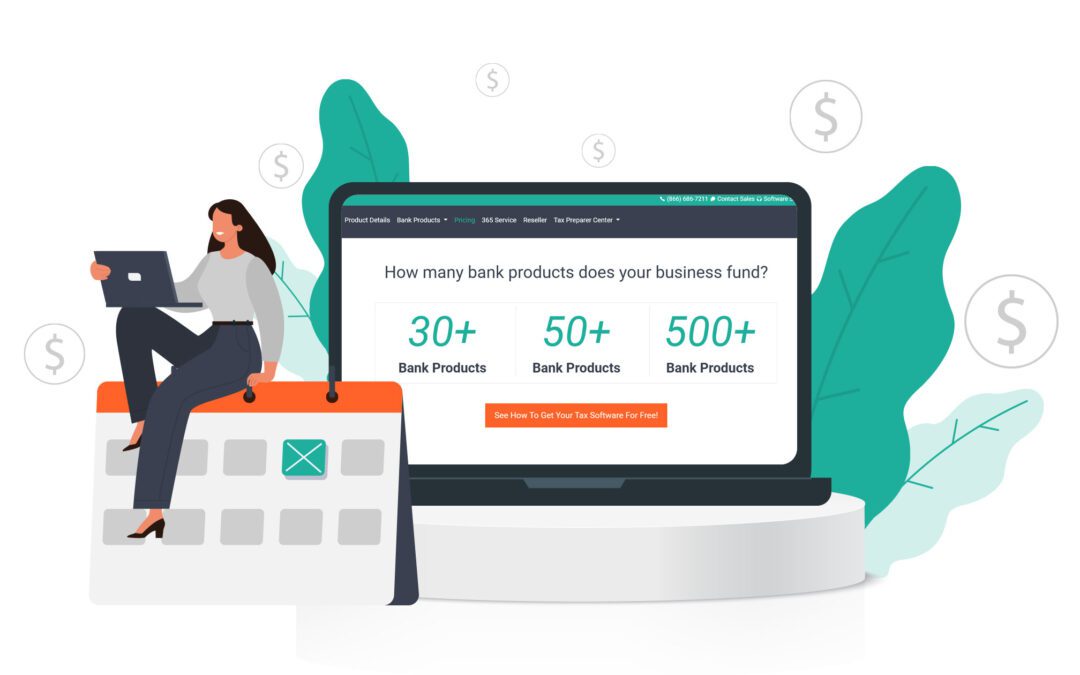

How Can TPG Aid You in Providing Superior Service? Ultimate Tax

TPG is a well-known banking product. It is also known as Santa Barbara Tax Products Group. It enables tax professionals to better serve their...

Best Corporate Tax Software for 2022

Are you looking for the best accounting and tax software? We frequently have too many options now that there are numerous tax preparation tools on...

Why Is Tax Preparation Software Such as UltimateTax Required?

Use top-tier professional tax software whether you own a large tax firm or work for yourself as a tax preparer. There are numerous tax preparation...

Why Is Software Like UltimateTax Necessary for Tax Preparation?

Use the best professional tax software available, whether you run a small practice or a large corporation. There are a variety of tax preparation...

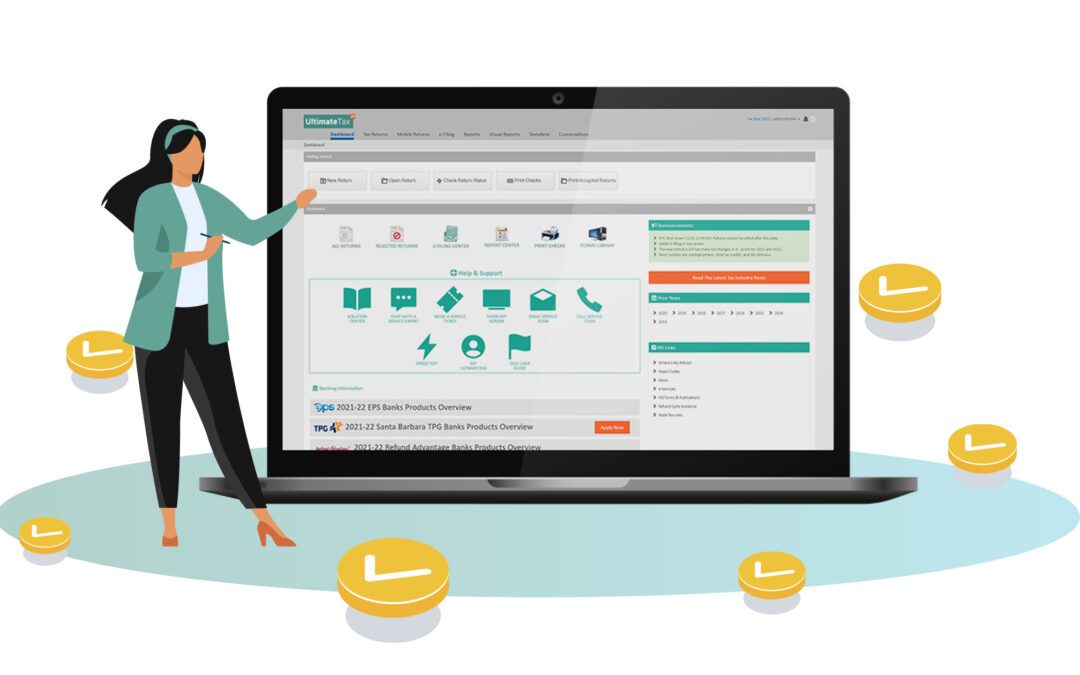

Ultimatetax Software’s Advantages for Tax Preparers

If you own a tax preparation company, you're probably used to wearing multiple hats, including tax preparer and financial analyst. Tax preparation...

The Comprehensive Tax Guide for Starting a Tax Preparation Business – Ultimate Tax

Individual tax preparers who want to start their own tax preparation businesses should read this guide. You may be passionate about providing your...

Ultimatetax Software from Eps What Advantages Will It Offer Your Tax Preparation?

UltimateTax is used by the majority of paid tax preparers because it makes their jobs easier. Among the incredible features of the software are its...

UltimateTax or ProSeries as the Best Corporate Tax Software in 2022

Looking for the best accounting tax software? There are numerous tax preparation software options on the market today. Each of these tools has...

Recent Posts

A Beginner’s Guide to Filing Taxes: Tips and Tricks for First-Time Filers

Filing taxes for the first time can seem like a daunting task. However, anyone can successfully navigate the tax filing process with the right knowledge and guidance. In this beginner's guide, we will provide valuable tips and tricks to help you file your taxes...

Filing an Amended Tax Return: Adding Deductions and Credits for a Better Refund

Filing an amended tax return can be a valuable opportunity to maximize your tax refund by adding overlooked deductions and credits. In this article, we will explore the importance of correctly filing an amended tax return to avoid penalties and future issues with the...

Tax Preparation Resources for Small Business

Tax preparation can be a complex and time-consuming process, especially for small businesses. Understanding the intricacies of tax regulations and properly managing financial records are crucial for maintaining compliance and optimizing financial health. In this...

How Much Does Tax Software Cost? A Detailed Cost-Benefit Analysis for Businesses

Managing finances and ensuring compliance with tax regulations are vital aspects of running a successful business. As tax-filing becomes increasingly complex, businesses face the challenge of efficiently managing their taxes. This article explores the costs...

How to Get a PTIN: Requirements for Tax Return Preparers

As a tax preparer, obtaining a Preparer Tax Identification Number (PTIN) is a crucial step in establishing your credibility and compliance with the Internal Revenue Service (IRS). In this article, we will delve into the details of what a PTIN is, why it is necessary,...