When filing taxes, you would typically use your social security number to file your taxes as an individual. However, when preparing taxes for other people or business entities, you need a specific number to identify yourself as a tax preparer instead of a taxpayer. The IRS uses this number to safeguard your clients, track all the returns you’re preparing, and ensure compliance with applicable tax laws. This unique number is called an Electronic Filing Identification Number (EFIN), and here are answers to seven FAQs about them:

1. What Is An EFIN?

An EFIN is for tax preparers who prepare returns for clients. It proves you have completed the IRS e-file application with the intent to become an authorized IRS e-file provider. The EFIN is separate from an Employer Identification Number (EIN); many businesses will have both numbers.

An EFIN proves to your clients that you have passed the suitability check and comply with IRS filing requirements.

2. Why Would You Need Both An EFIN And EIN?

The EIN and EFIN normally belong to the business or owner of the company. EIN is used to identify the company, and if you have employees, you use your EIN. The IRS only requires EFINs for businesses that prepare and electronically file tax returns.

The business owns the EFIN number rather than the employee. All tax preparers for that business must pass the suitability requirements to keep the EFIN once it is issued and use IRS-recommended tax software.

3. Who Can Use The EFIN?

Only authorized users who have passed the suitability test should be allowed access to the EFIN. If the number is ever compromised, meaning an unauthorized provider has used it, it must be reported immediately.

You can check the number of filed returns listed by the IRS with your records to ensure the numbers match.

The IRS will contact the owner of the EFIN if they discover the discrepancy first. They will inactivate the compromised EFIN and issue you a new number.

4. Who Must You List On The E-file Application?

● The Responsible Official: The person in charge of the e-file operation who will communicate with the IRS, be authorized to make changes and updates to the application as the business hires or fires employees, and is ultimately responsible for all tax returns filed from that location.

● The Principals: Principals are those in a position to act for the business entity in legal matters, including a sole proprietor owner, business partners with 5% or more interest in the company, or the officers of a corporation.

● The Preparer: A preparer is applying for authorization to submit tax returns through the IRS e-file system.

5. Can Employees Keep Using The EFIN Indefinitely?

If an employee quits or is fired, they are no longer allowed to use the EFIN. If the principal passes away or dissolves the business, the EFIN is no longer usable. All employees will need to reapply with their new boss or company.

6. How Do I Apply For An EFIN?

First, applications for an EFIN are currently free. You should never need to pay for one. Also, remember that approval for an EFIN can take a couple of months; start the process well before the tax season.

There are two stages to the application process. This first stage is to make an e-services account with the IRS. This lets you interact and submit your EFIN application on their e-file system.

- To open the account, you must provide contact information, legal name, and social security number.

- Fill in your current or prior year’s gross annual income on the filed tax return.

- Select a login ID and password and security questions.

- You’ll get a confirmation code in your email and can log in to confirm your account within 28 days of the creation date.

The second stage is the EFIN application process:

- Identify the firm you will represent, including the EIN, mailing address, and contact information.

- Choose “electronic return originator” (ERO) as your e-file provider option. Do NOT choose Online Provider – this is a different service.

- Enter full details on every principal and responsible official involved in the electronic filing operation.

- All certified or licensed tax personnel, such as a CPA or attorney, must indicate their certificate or license status. Is it active and in good standing?

- Get non-licensed or certified staff fingerprinted. You can get the fingerprint card from the IRS or the person fingerprinting you. It must be done by a professional, such as a police department or live scan fingerprinting company.

- Live Scan fingerprints are sent electronically. For hard copy print cards, mail them to Attn: EFU Acceptance, Testing Stop 983, 310 Lowell Street, Andover, MA 01812.

7. What Does The IRS Look For In The EFIN Suitability Screening?

The IRS ensures you handle money responsibly through a credit check before giving you access to other people’s funds. They will also look for past filings to see if you comply with all rules and regulations so your future clients can rely on you to get the job done right. They will run a criminal background check before they give you access to people’s financial data, including bank account numbers, social security numbers, etc.

The IRS will check to see if the business and responsible parties file tax returns on time and are current.

Once the IRS approves you, you will get a letter with your unique EFIN, and you can begin filing electronic returns with paid tax preparer software.

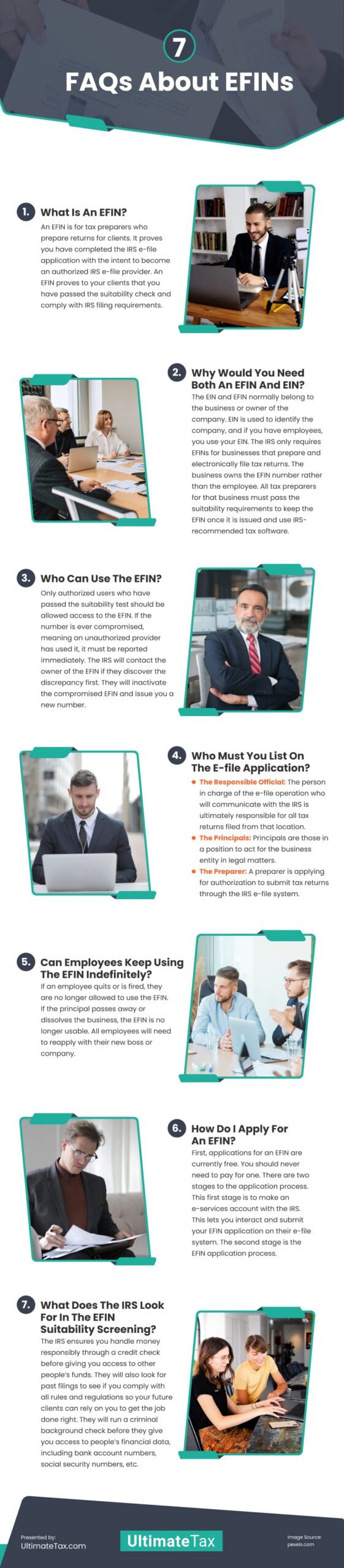

Infographic

Tax preparers need an Electronic Filing Identification Number (EFIN) from the IRS for business and other tax filings. EFINs ensure tax law compliance and client protection, differing from Employer Identification Numbers (EINs). They require passing suitability tests, with any compromise reported immediately to avoid deactivation. Acquiring an EFIN involves an application process that includes suitability screening.

Video