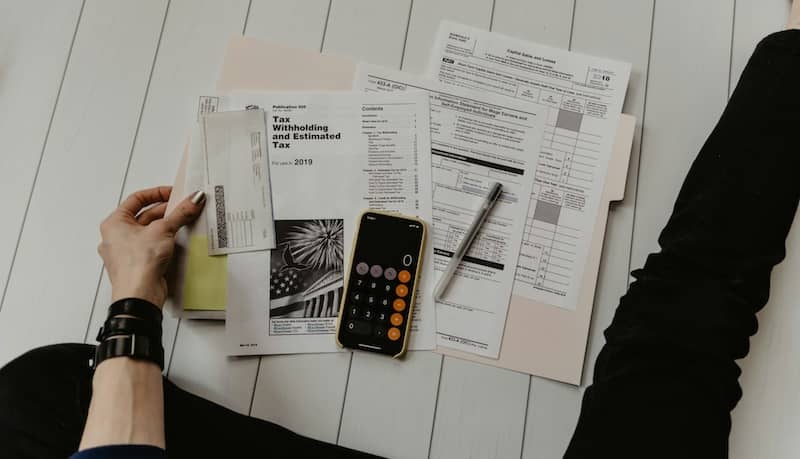

Tax Preparation: The Ultimate Work From Home Opportunity

Have you ever wondered if working at home is the right move for you and your family? Never in our history has it been easier to run a business...

Making Ends Meet Between Tax Seasons

When considering a job as a tax preparer, you may wonder what tax professionals do when it's not tax season. How do they keep the money rolling in?...

Why Professional Tax Preparer May Be the Job for You

Choosing a career can be stressful. What one person might find fulfilling, another may find annoying. Some people like working indoors in controlled...

Educating Your Clients: How To Detect Fraudulent Tax Preparers

Searching for the right tax preparer can be hazardous. Many scam artists prey on taxpayers’ inexperience and need for expedience. They submit bad...

Explaining Tax Refund Delays to Your Clients

The question every tax preparer hears is, "How long till I get my tax return?" Families have plans for that money to go on vacation, make household...

From Tax Preparer To Business Owner

So, you're ready to strike out on your own. Maybe you just graduated with your accounting degree. Perhaps you've worked for years for another...

What Are the Biggest Challenges That You Face as a Tax Professional?

Every job comes with its challenges, but tax professionals seem to have a difficult time when the entire nation has the same deadline for completing...

Growing Your Accounting Business In 2024

Is owning your own business living up to your expectations? Like many accountants, you may have understood the demand for accountants better than...

What are The Necessary Qualifications and Steps to Become a Tax Preparer?

Working as a tax preparer could be a full-time or seasonal job and is in high demand during tax season. Are you good with numbers, find taxes...

Will Software Replace Professional Tax Preparers?

There are several options for individuals and families looking to DIY their taxes. The IRS has a Free File program with the Free File Alliance, a...

Recent Posts

Dispelling Myths Around Cloud-Based Tax Preparation Software

Remember the days of crashed computers during tax season, lost files, and that constant worry about backing up your data? If you're still wrestling with traditional tax software, you're probably all too familiar with these headaches. Yet something holds you back from...

The Benefits of Getting Tax Software Early in the Season

Is now the right time to buy your tax software for the 2025 season? This question might be on your mind as you plan for the future of your tax preparation business. The truth is, investing in business tax software early can make your upcoming tax season smoother and...

Using Tax Software When You Don’t Have an EFIN

Starting a tax preparation business? Maybe you're exploring software options while your EFIN application processes, or perhaps you haven't started the application yet. Either way, you need to understand how your software experience changes without this vital IRS...

Expanding Horizons With Diverse Tax Software Skills

Tax professionals running their own practices already know the law inside and out. You understand deductions, credits, and complex returns. But there's an untapped way to grow your business—by adding new tax software skills to your toolkit. Think about it: expanding...

Tips For Managing Client Concerns About Tax Data Leaks

The recent IRS data leaks sent shockwaves through the tax world. Over 70,000 taxpayers had their sensitive information exposed by a rogue contractor. The incident left many feeling vulnerable and anxious about their financial privacy. Clients have been flooding tax...