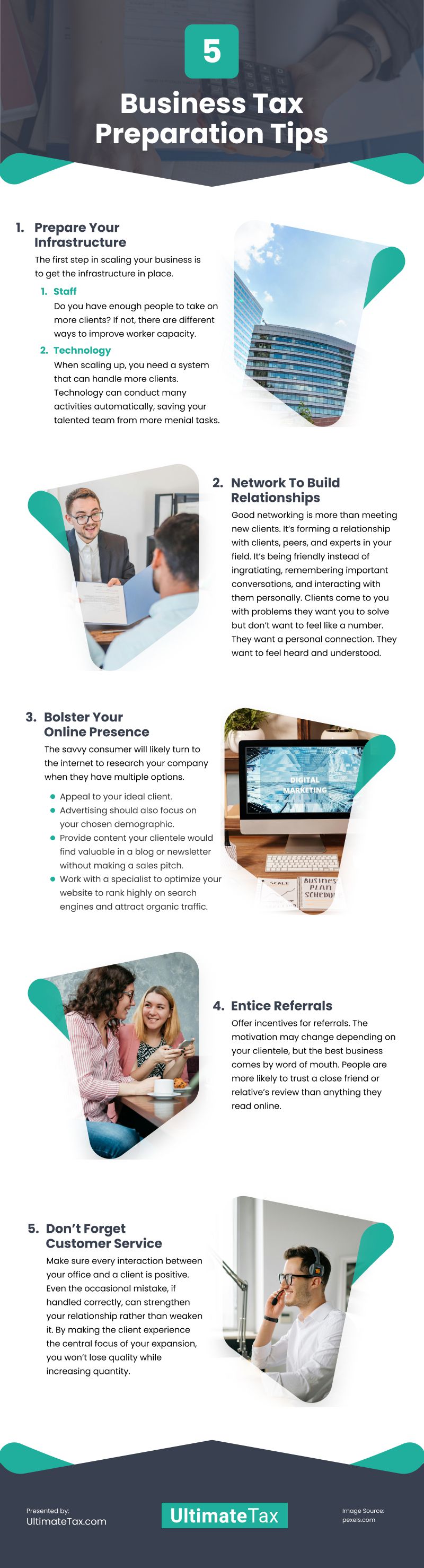

Growth is one of the primary business goals shared across markets. You’ve worked hard to set up your company, build a brand, and service clients. Let all that hard work pay off in a more significant market share by scaling up with these strategies.

Prepare Your Infrastructure

The first step in scaling your business is to get the infrastructure in place.

1. Staff

Do you have enough people to take on more clients? If not, there are different ways to improve worker capacity. You can hire new talent permanently, focusing on employees with a broader skill set. The more talented the tax professional, the greater the range of responsibilities they can tackle. You can hire temporary staff to help you when things get too busy. That way, you only pay for extra help when needed, and no one sits around twiddling their thumbs.

2. Technology

When scaling up, you need a system that can handle more clients. Technology can conduct many activities automatically, saving your talented team from more menial tasks. Examples of how technology could make your life easier include:

- Automate appointment reminders rather than pay staff to make phone calls.

- Automate payment systems. The system can send invoices, payment reminders, final bills, and past-due notices as soon as the job is complete.

- Automate appointment scheduling. The client can set appointments that fit their schedule, cancel if something comes up, and reschedule at their convenience.

But you can go beyond simple task automation. Think about your tax preparation software. Investing in IRS-recommended tax software will help you stay compliant while providing updated tax information and forms. Cloud-based tax preparation software also allows you to meet clients in other locations while maintaining the highest security standards. Ensure you can integrate multiple systems so you aren’t wasting time switching back and forth between platforms.

Speaking of integration, don’t forget about bank products. Integrate bank products for tax professionals and expand your clientele by offering small businesses and families affordable options, all while streamlining the process of collecting payment.

Network To Build Relationships

Good networking is more than meeting new clients. It’s forming a relationship with clients, peers, and experts in your field. It’s being friendly instead of ingratiating, remembering important conversations, and interacting with them personally. Clients come to you with problems they want you to solve but don’t want to feel like a number. They want a personal connection. They want to feel heard and understood. To help you do this, remember to:

- Ask questions about their financial goals, both professionally and personally.

- Ask about their pain points.

- Listen attentively and note when you discuss something important to them.

- Address their concerns.

- Put notes in their file so you can follow up and set an automated reminder to check in with that client several times throughout the year.

- Distribute a newsletter that has information they may need without pitching a product. Provide value.

Partnering with related businesses helps you meet your client’s needs by tailoring the product to suit them. If you do only business taxes but partner with a tax firm that serves individuals and families, you can create deals that make your clients likely to use both companies. You have a built-in referral system. Experts can answer questions when you have unusual cases and help you find solutions that may be new to you. Just make sure that you also provide value to them so the relationship isn’t one-sided.

Bolster Your Online Presence

The savvy consumer will likely turn to the internet to research your company when they have multiple options.

- Appeal to your ideal client. For example, if you serve the average homeowner, they may weigh cost versus benefit more heavily than other factors. If you serve an affluent clientele, they may need more specialized expertise to protect their assets. Determine what is most important to the clients you want to attract and tailor your business and website accordingly.

- Advertising should also focus on your chosen demographic. Know where your client is most likely to spend their internet time. Customize your ads to fit the platform and entice your ideal client rather than putting out a generic ad.

- Provide content your clientele would find valuable in a blog or newsletter without making a sales pitch.

- Work with a specialist to optimize your website to rank highly on search engines and attract organic traffic.

Entice Referrals

Offer incentives for referrals. The motivation may change depending on your clientele, but the best business comes by word of mouth. People are more likely to trust a close friend or relative’s review than anything they read online.

Don’t Forget Customer Service

Make sure every interaction between your office and a client is positive. Even the occasional mistake, if handled correctly, can strengthen your relationship rather than weaken it.

By making the client experience the central focus of your expansion, you won’t lose quality while increasing quantity.

Video

Infographic

Growth is a primary business goal shared across markets. You’ve worked hard to establish your company and build a brand. Let all that hard work pay off with a larger market share by scaling up using the strategies in this infographic.