Understanding Tax Garnishment: How to Check If Your Tax Return Will Be Affected

Tax garnishment is the process where a creditor can legally seize part of a taxpayer’s wages, bank accounts, or other assets to pay for an...

Top Tax Preparation Software for Accountants: Streamline Your Tax Season

It's no secret that taxes can be a difficult and time-consuming task to complete. Without the proper knowledge and expertise, it is easy to make...

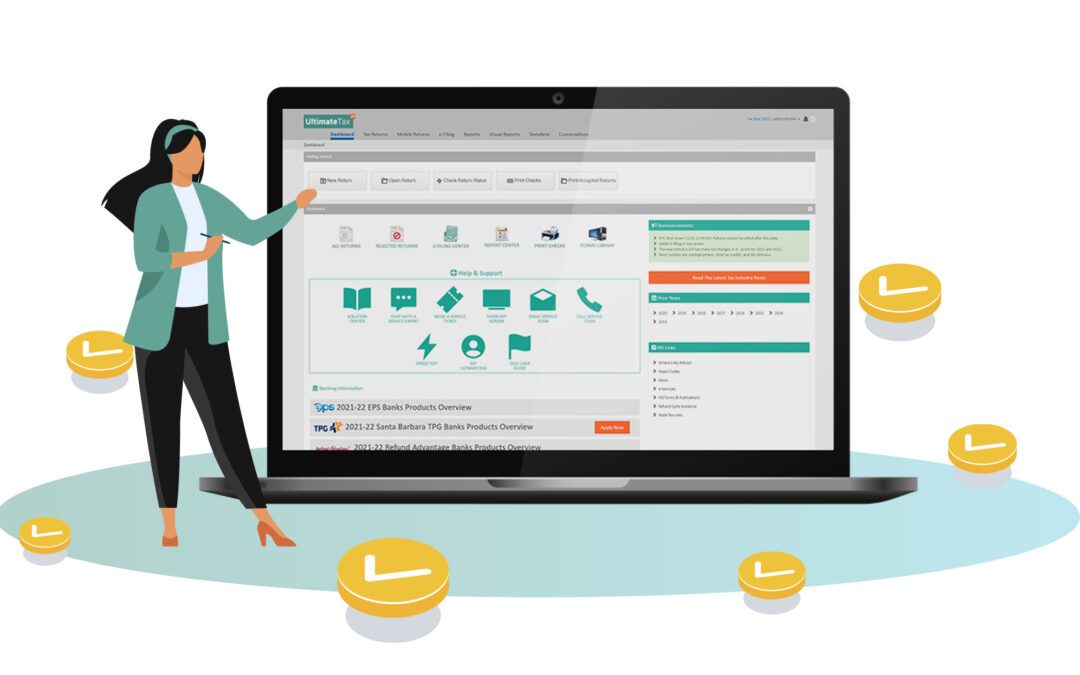

Cloud-Based Tax Preparation Software: The Future of Tax Filing

Tax software is an invaluable tool for anyone who needs to file their taxes each year. It helps users quickly and easily enter their financial...

Checking the Status of Your Amended Tax Return: A Step-by-Step Guide

Filing a tax return can be a tedious process, but it is necessary to ensure that individuals pay the correct amount of taxes owed and receive any...

IRS Hub Testing what is it?

Each year the IRS will shut down and do a switchover. Usually, at the end of the year, late November, the IRS will shut down its e-file systems....

2023 E-File to start January 23rd, 2023

The IRS has announced that it will start accepting 1040 returns for the 2022 tax season on January 23rd, 2023. They also announced April 18th is the...

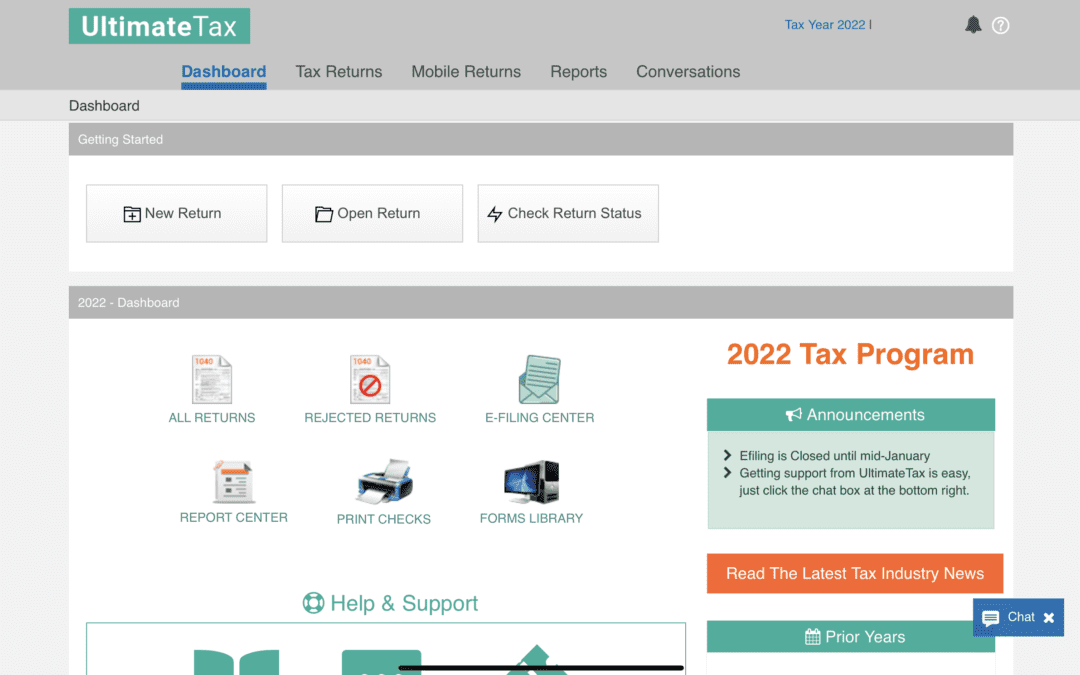

Tax Software 2023 Released

December 6, 2022 UltimateTax service has issued software to all customers who have already purchased for the 2023 season. This season we have seen...

Tips for Choosing the Right Professional Tax Software

Anyone who pays taxes knows they’re complicated. And with the ever-widening tax brackets, numerous deductions, and other nuances, it can be...

Advantages of a Tax Software for Tax Preparers

If you are a tax preparer and you are getting tired of manually recording all your transactions then it’s high time you get yourself tax software...

How to Start a Tax Preparation Business: Get Tips and Advice Here!

Tax season can be stressful. Between managing your tax return, the ever-changing tax laws, and preparing your taxes for each new year, it can be...

Recent Posts

Explaining Refund Advance Loans to Your Tax Clients

Tax season can be incredibly stressful for you to meet tax preparation demands, and taxpayers are either focused on what they owe or wondering about their refund. Businesses and individual taxpayers often have plans for their refund money weeks before they even file...

Debunking 7 Tax Myths For Your Clients

Let's be honest. The average taxpayer will never read the tax code. They will likely rely on a professional tax preparer like you, using good tax preparation software, to guide them. Otherwise, they're getting tax advice from family, friends, or worse, a social...

Essentials To Start Your Own Tax Preparer Business

Are you looking for a new side hustle or business venture? Regardless of your goals for increasing your income, starting a tax preparer business can be both lucrative and satisfying. Why Choose A Tax Business? There are several reasons a tax business might be the best...

How Do you Stay Up-to-Date on the Latest Tax Laws and Regulations?

When it comes to taxes, it can feel like you’re in a losing battle against minutiae. Each year, everyone from congressional legislators to IRS administrators seem to have something about the tax code they either want to update, add, or get rid of altogether. A tax...

5 Key Features You Want For Your Tax Business Software

Selecting tax preparation software for your business is critical in ensuring profitability and success. Quality software will help you deliver accurate returns on time, offer great support, and be easy to navigate. Anything less could cost you business. Here is a list...