How to File a Tax Extension for a Nonprofit: What You Need to Know

Nonprofits play an essential role in our society, offering services, support, and resources to communities in need. As a nonprofit organization, you are bound to meet a series of deadlines, including submitting tax returns each year. However, there may be times when...

Becoming a Tax Preparer in California: Requirements and Steps

As the tax season approaches, the importance of knowledgeable and skilled tax preparers cannot be overstated. The state of California, which boasts the fifth-largest economy in the world, has a unique tax code that can be intimidating for even the most experienced tax...

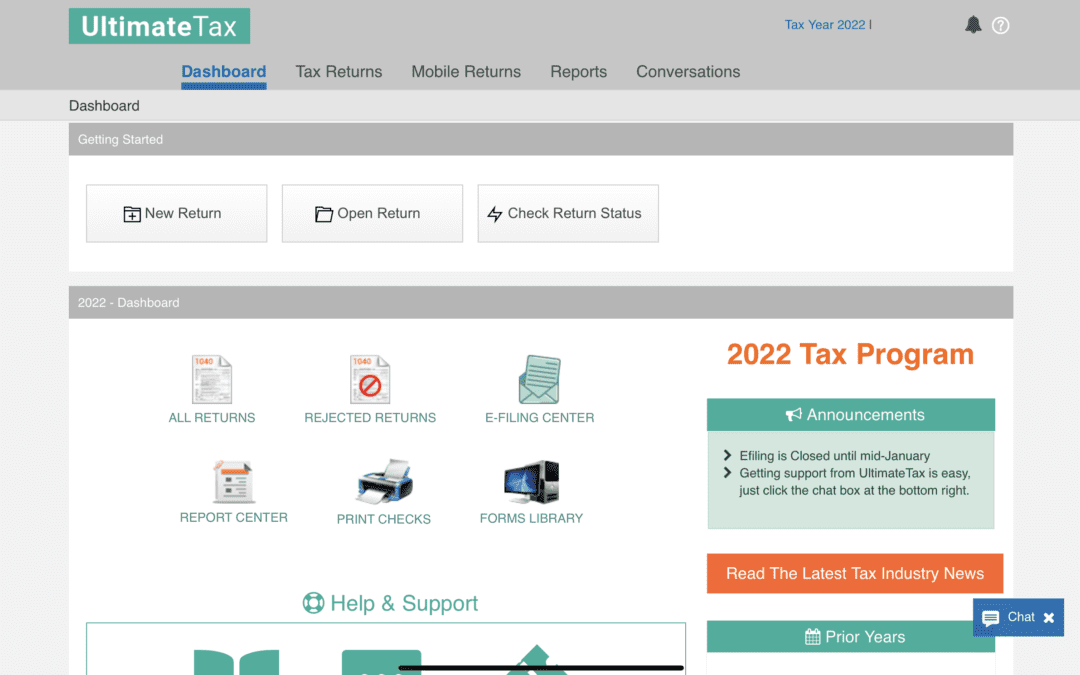

Tax Software 2023 Released

December 6, 2022 UltimateTax service has issued software to all customers who have already purchased for the 2023 season. This season we have seen many tax offices who are ready to get their office setup. Even though there have not been many changes to the desktop tax...

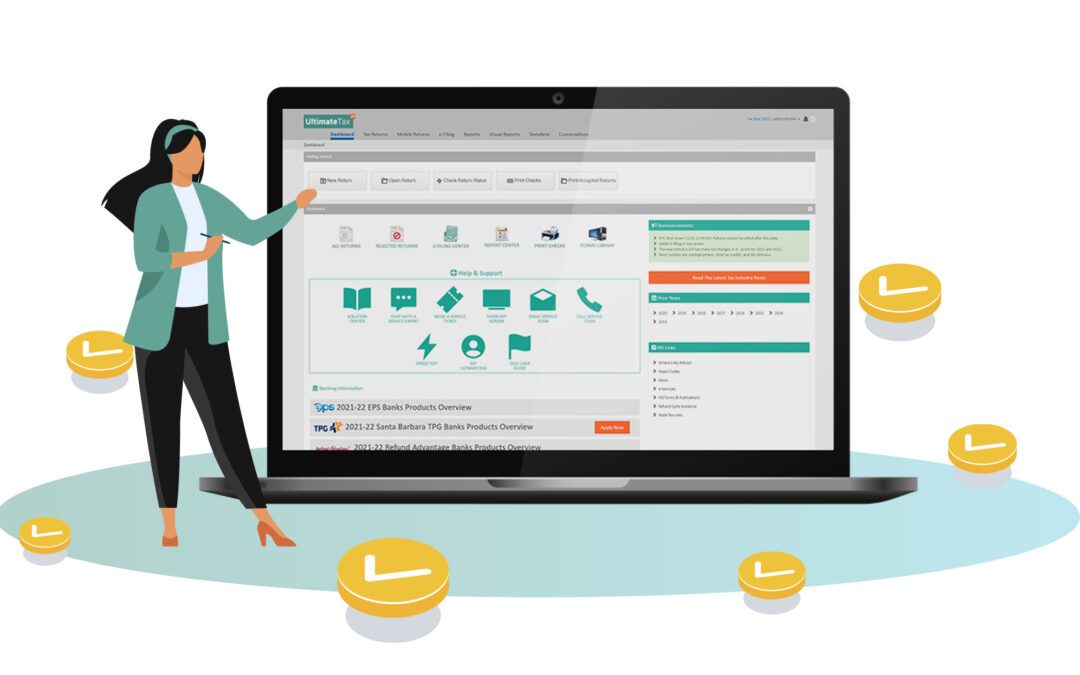

Advantages of a Tax Software for Tax Preparers

If you are a tax preparer and you are getting tired of manually recording all your transactions then it’s high time you get yourself tax software for tax preparers. Tax software is an online program that helps you manage and organize the data from your business,...

The Benefits of Using the Right Tax Software

Tax season can be daunting, even for someone who files their taxes every year. The complexity of the tax code and the ever-changing tax laws make it difficult to keep everything straight. If you own your own business or plan on doing so in the coming year, you’ll need...

How does Refund Advantage help tax professionals

UltimateTax offers a variety of services and banking products to its customers to help them stay competitive in their respective industries. Refund Advantage is one of these bank products that can be extremely beneficial to tax preparation businesses. It is a bank...

Ultimatetax Software from Eps What Advantages Will It Offer Your Tax Preparation?

UltimateTax is used by the majority of paid tax preparers because it makes their jobs easier. Among the incredible features of the software are its online availability, compatibility with all major devices, usability, and limitless e-filling. When banking services are...

Drake vs. Ultimatetax UltimateTax: In Search of the Best Professional Tax Software

Your company’s success is dependent on the use of reliable tax preparation software. You want tax software that won’t break the bank, won’t require a tax preparation expert to master, and will help you submit individual and business tax returns...