Start a Tax Preparation Business Now

The 2022 tax season will begin less than a month from now. If you are going to set up your own tax practice, now is the time to do it! But how do you start a tax preparation business? You’ve done your research, you’ve made a plan… what more do you need to...

Pre Ack Loans Available Now

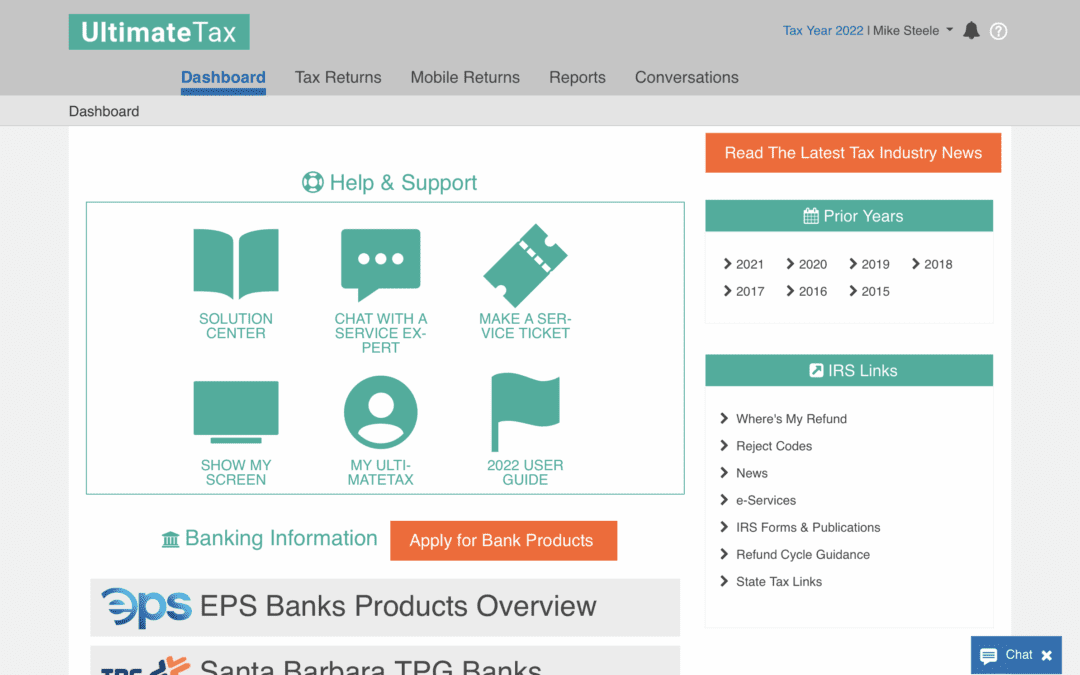

If you have applied for bank products and pre ack loans, they are available now. In our online program, the forms are now available. No updates are required. If you have our desktop program you will have to update your program and get module updates. Program Update:...

IRS Child Tax Credit Payments – Letter 6419

The IRS will be sending taxpayers who received Advanced Child Tax credit payment/s in 2021, the letter will be sent out January 2022, Notice 6419. This letter will show the total amount of payments received. The client can also see their payments in their CTCUp...

EFC Shut Down

IRS has announced its MeF (e-file) shutdown and cutover for Tax Year 2021. To ensure that all business tax returns e-filed through the MeF system are processed in a timely manner, submissions must occur before IRS shuts down the system on Sunday, December 26, 2021, at...

Tips to Improve Client Experience This Year

Tips to Improve Client Experience This Year Every customer counts for your business. Tax preparation is all about delivering a service. You have the tools and the knowledge to do so. But you’ve got to do more. You’ve got to set yourself apart from the...

Prepare for Disaster: Important Tips for Your Financial Safety

Prepare for Disaster: Important Tips for Your Financial Safety One of the most important things you need to discuss with your clients is financial safety. Clients will need to be aware of the possibility of the loss of personal records and the damage that can wreak on...

How to Prep Clients Using Handy Resources from the IRS

One of your responsibilities as a tax professional involves prepping tax clients for the coming tax season. While you are being paid to handle their tax matters so they don’t have to do it themselves, you can provide a more effective service if both of you are...

Learn the Best Practices for Keeping Client Data Safe

Professional tax software is designed to be secure. Sensitive customer data is protected behind a private account. Only an authorized user can access the information in the system. That doesn’t mean you don’t have to think about security. If an account...