Tips to Improve Client Experience This Year

Every customer counts for your business. Tax preparation is all about delivering a service. You have the tools and the knowledge to do so. But you’ve got to do more. You’ve got to set yourself apart from the competition.

How can you do that? By providing more than service. By delivering top-notch customer experience.

People generally don’t look forward to doing their taxes. That’s something about as popular as getting a tooth filled. Anything you can do to ease the process and make it painless will contribute to a better client experience.

Be Friendly and Professional

Customer experience can be influenced by how you present yourself. You don’t want to come off as aloof and unhelpful. Be friendly and welcoming to customers—and be pleasant to others as well. Some clients will take note of how you deal with other people aside from them.

But keep in mind that you are providing a tax preparation service. You need to exude authority and professionalism. Make your clients feel confident that they are in good hands. That they are being served by someone highly competent and knowledgeable.

Be a good listener and give the client your full attention. You don’t want to make the client feel like an afterthought. Instead, make them feel that you care about them (in the professional sense). That you care about giving them the quality of service that they expect… along with fast and accurate results, of course.

Make Resources Available to Customers

Keep in mind that every customer is different. Some will expect a personal touch to interactions. But these days, many customers prefer a less interactive approach. You want to appeal to those types of clients, too.

One good way is to provide information and resources for them to access. You should create a website for your tax business and populate the pages with helpful articles. Provide a FAQ for customers to consult when they have questions. Many people find it quicker to look up something on a FAQ instead of dealing with phone support. It can save them time—thus providing them with a better customer experience.

You should consider making video tutorials and orientations. Some people prefer watching a video over reading a FAQ or article. On the plus side, a video can allow you to market your brand while helping your customers. Create a YouTube channel for your tax practice and upload the videos there.

Prepare for Client Interviews

One of the key steps in the tax preparation process is the client interview. While you can rely on the tax and financial records provided by the client to do their tax return, you will find that a client interview can speed up the process quite a bit.

You can conduct a face-to-face interview in the office, or do it over the phone. You can even use an online meeting platform such as Zoom. Try to learn which approach best suits your client. Ask them about their preference and try to provide them what they want.

The UltimateTax software includes an interview mode to use in preparing a client tax return. You can use it while meeting with the client. Have the program open on a laptop and pull up the tax return to work on. Activate interview mode and use the prompts in conducting the client interview.

The UltimateTax interview mode will inform you of what client data is required. That way, you won’t miss anything! As you fill in the data fields, automatic calculations are made on the tax return. That will help you to promptly answer your client’s questions about their taxes.

Keep Your Clients Up to Date

After you have processed and submitted a client’s tax return, you don’t want to keep them in the dark. Let clients know what is happening with the tax return.

UltimateTax has a feature that can provide e-filing status updates on a return. After the tax form has been sent to the IRS, you can use the feature to check on whether the return has been received, accepted or rejected. Be sure to let the client know of the status of their filed return.

Provide Multiple Customer Support Options

Your tax practice has to be responsive to your customers’ needs. Someone should be available to respond when clients complain or ask for help. Basically, that means you should have a support team.

Customers often have many questions about taxation. Most of the time, you will want to answer their questions yourself. Try to do that in the initial meeting, or ask the client if they can come to your office to discuss what they want to know.

But clients can also have simple questions that can be answered quickly by a support team member. Train your team so that they can answer commonly asked questions.

You should consider offering multiple options for accessing customer support. Give clients the ability to request support via phone, email or online chat. If your tax business has a Facebook page, you can ask customers to message it when they have questions. Twitter is another possible channel for customer support interaction.

Get Immediate Tax Refunds for Your Clients

You can give the clients the option to receive their IRS refund right away! This is possible through the use of bank products.

What is a bank product? It is a name for a special service that a tax software company can offer in cooperation with a financial partner—a bank, in other words. If your client chooses to use a bank product, then they can collect a tax refund even before it is released by the IRS.

The client will receive an advance on their tax refund. Once their tax return has been accepted by the IRS, and their tax refund is confirmed, you can give them the advance. At the same time, you can collect payment for your tax preparation services via the bank product.

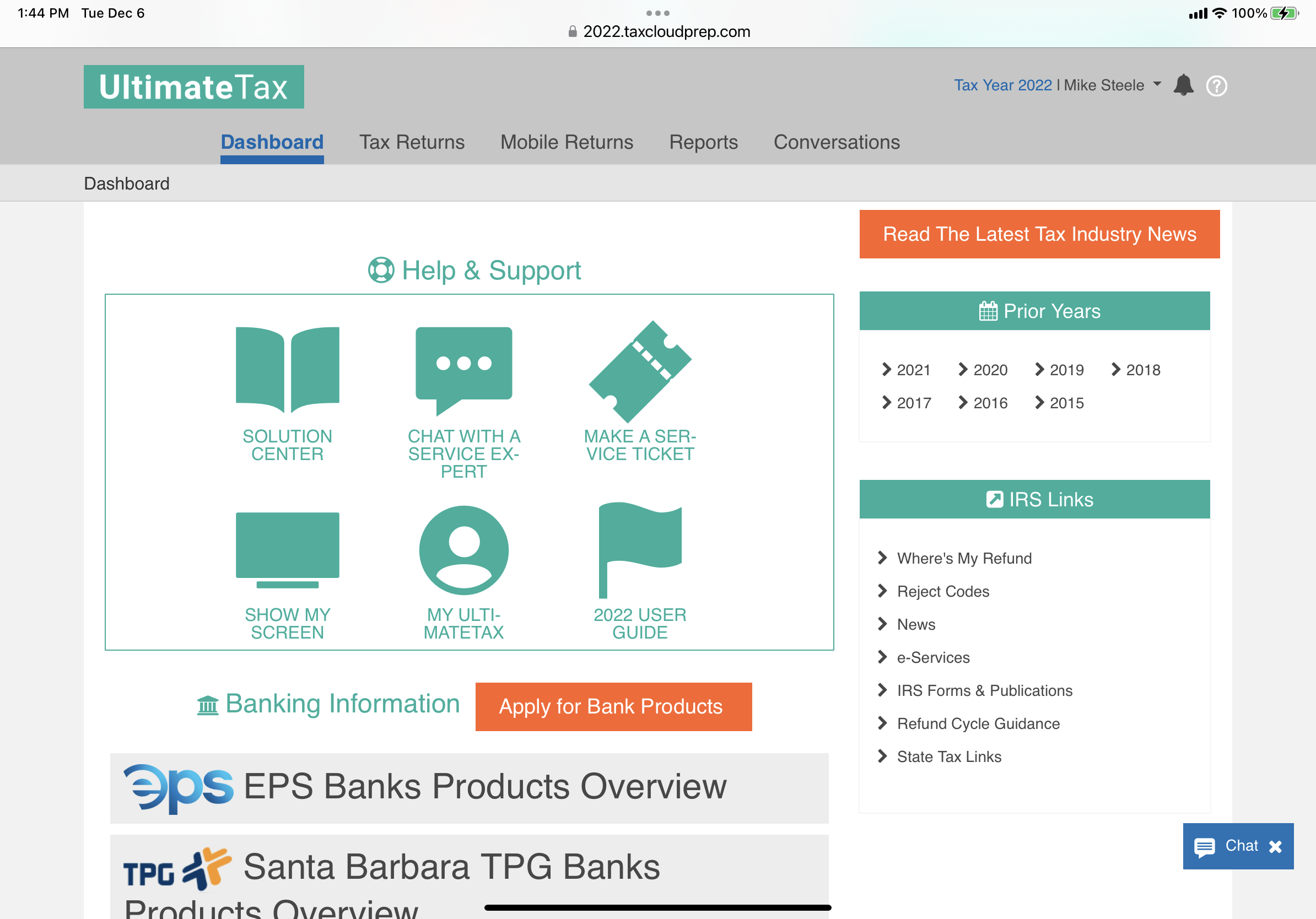

UltimateTax makes it easy for your office to offer this service to your customers. When you become an UltimateTax subscriber, you also become eligible to apply for our partners’ bank products—if State law allows it, of course. UltimateTax facilitates bank product services through our partners, EPS Financial and the Santa Barbara Tax Products Group (TPG).

For your client’s convenience, UltimateTax provides multiple options for sending the tax refund to your client. They can receive it via check, debit card or direct deposit into their account. Additionally, the client may be eligible for loan products depending on the size of the refund.

By helping your clients get their refunds faster, you can deliver higher customer satisfaction. The client won’t need to wait a long time to collect their refund! That’s providing excellent customer experience.

Let UltimateTax help you serve your customers better. Get UltimateTax professional tax software today! Or click here to access a free demo of UltimateTax.