You did everything right. You got your tax preparation certification, set up a professional office, and invested in what you thought was the right software. Yet here you are, staring at an empty calendar during what should be peak tax season.

Sound familiar? You’re not alone. Every year, talented tax preparers watch their dreams of a thriving practice fade—not because they’re bad at taxes, but because they missed some critical building blocks.

The good news? Most of these failures come down to a handful of fixable mistakes, from choosing the wrong tools to mishandling client relationships.

Let’s cut through the noise and talk about what really makes or breaks a tax business—and how you can avoid being another statistic.

1. Flying Without a Real Business Plan

I get it. You didn’t start a tax business because you love writing business plans—you started because you’re good with numbers and want to help people. But here’s what I keep seeing: really talented tax preparers struggling because they jumped in without a plan.

Many tax professionals find themselves watching their savings drain faster than expected simply because they didn’t anticipate all the hidden costs of running a business.

Pricing becomes another major hurdle—without proper planning, you may set your fees too low, leaving you struggling to cover expenses. And once tax season ends, you may find yourself scrambling for income, realizing too late that you never built a year-round revenue model.

Without a clear business focus, you might also try to serve everyone instead of establishing a niche, making it harder to stand out.

The Fix:

The solution starts with clarity.

- Choose who you really want to serve—small businesses? Real estate agents? Growing families? Specializing can help you differentiate yourself in a crowded market.

- Set pricing that not only attracts clients but also ensures your business remains profitable.

- Invest in the right tools before you’re overwhelmed with clients so you can work efficiently when the busy season hits.

- Plan how you’ll maintain a steady income throughout the year, whether through bookkeeping services, tax planning, or financial consulting.

You wouldn’t let your clients guess at their numbers. Don’t guess at yours.

2. Thinking Tax Season Alone Will Pay the Bills

Tax season feels like a gold rush—three months of non-stop work and healthy revenue. But what happens once April 15th passes? If your business goes quiet for the rest of the year, you’re missing out on both income and long-term client relationships.

Many tax preparers watch their hard-earned tax season earnings disappear by summer, leaving them scrambling to stay afloat. Competing for the same limited client base within a short tax season can also be exhausting, leading to burnout. It becomes even harder to retain quality employees when you can’t offer consistent, year-round work.

The Fix:

The key to a healthy, long-term business is diversifying your services, such as:

- Offering tax planning sessions throughout the year helps clients avoid tax surprises while keeping your business active.

- Adding bookkeeping services for small business clients creates a steady income stream outside tax season.

- Helping with payroll management and quarterly tax payment services allows you to stay engaged with business clients year-round.

- Guiding clients through IRS notices and audits, providing assistance when they need it most.

- Providing financial coaching—many individuals need help with budgeting and tax-efficient financial planning beyond tax day. Plus, it’s a relatively untapped market.

Your clients have tax and financial needs all year long. Position yourself as their trusted advisor, not just the person they see once a year.

3. Letting Good Work Go Unnoticed

Excellent tax knowledge doesn’t guarantee a full client list. In fact, some of the best tax preparers struggle to fill their schedule simply because potential clients don’t know they exist.

Many rely solely on referrals, hoping word-of-mouth will be enough, but this passive approach leaves gaps in business growth. A weak or nonexistent online presence means you’re missing out on potential clients searching for tax help.

Failing to stay in touch with clients after tax season can also make them more likely to switch to another preparer next year. And if a competitor markets themselves more effectively, even if they’re not as skilled as you, they’ll win over clients simply by being more visible.

The Fix:

- Build a professional online presence with a website and well-optimized Google Business Profile—Clients need to find you easily when they search online.

- Regular email newsletters and tax updates can help maintain connections with past clients, keeping you top of mind for next year.

- Create a simple referral program that can reward loyal clients and spread the word about your services.

- Don’t underestimate the power of social media—sharing tax tips, deadline reminders, and industry updates can position you as a knowledgeable and approachable expert.

Your existing clients are your best marketing asset—keep them engaged and give them reasons to refer others to you.

4. Choosing the Wrong Tools for Your Practice

Time is money in tax preparation, and every minute wasted on slow or outdated software is a lost opportunity.

If your tax software is inefficient, you’ll find yourself wrestling with sluggish performance at the worst possible times. Manually handling tasks that could be automated only adds to the workload, making the tax season even more overwhelming.

Lacking essential features in your software can also slow you down, forcing you to find workarounds during crunch time. And if your system isn’t cloud-based, you’re stuck in the office when clients increasingly expect remote flexibility.

The Fix:

The right business tax software makes all the difference.

- Invest in reliable, scalable tax software to ensure your practice runs smoothly.

- Choose cloud-based tax software for tax preparers that lets you work from anywhere, accommodating both remote clients and flexible work arrangements.

- Make sure your software includes modern features like e-filing, bank products for tax professionals, and automated document management to streamline processes, reducing time-consuming manual tasks.

- Most importantly, test new software before tax season—not during it.

The right tools should make your job easier, not harder, and a solid system will pay for itself in time saved and errors prevented.

5. Racing to the Bottom on Pricing

“I’ll charge less to get more clients.” It sounds logical, but this strategy usually backfires. While this strategy may initially bring in clients, it rarely leads to a healthy business.

Low prices often mean working harder just to break even, attracting clients who don’t see the real value in your services, and making it nearly impossible to raise rates in the future. Worse, potential clients may assume that lower prices indicate inexperience, leading them to seek out more expensive competitors.

The Fix:

Instead of underpricing, you should:

- Set rates that reflect your expertise and the value you provide, not your doubts.

- Create clear service tiers that cater to different types of clients—offering premium options for those who need more hands-on assistance.

- Know your worth and be prepared to communicate it confidently.

Researching competitor pricing can help, but your pricing should ultimately be based on the value you deliver—not on a race to be the cheapest option available.

6. Falling Behind on Tax Laws

Tax laws change constantly, and missing key updates can be costly—not just for your clients but for your reputation.

Errors due to outdated knowledge can lead to penalties, lost deductions, and financial setbacks for those who trust you with their taxes. Worse, finding out about new regulations from your clients instead of staying ahead of them can shake their confidence in your expertise.

The Fix:

Make it a priority to stay informed. You can:

- Set aside regular time to review IRS updates—even during the busiest times of the year.

- Join tax professional groups that share important regulatory changes so you’re always in the loop.

- Complete your training and continuing education requirements before tax season, ensuring you’re ready when clients start asking questions.

- Rely on trusted sources for tax news to filter through the noise and focus on the updates that matter most.

Staying ahead of tax law changes isn’t just about compliance—it’s about maintaining your credibility and delivering the best advice possible. And that advice needs current knowledge. Everything else is just guesswork.

7. Playing Loose with Security

Handling tax returns means managing sensitive personal and financial data. Yet, too many tax preparers treat security as an afterthought until a breach happens. Neglecting cybersecurity can lead to devastating consequences, including loss of client trust, financial penalties, and even the downfall of your practice.

The Fix:

To protect your business and your clients, take security seriously:

- Encrypt all client data and ensure that it’s stored securely.

- Set up two-factor authentication on everything (yes, everything) to prevent unauthorized access.

- Develop security policies that your entire team follows, and stay up to date with IRS and state security protocols.

- Regularly test your security measures—not just during tax season but year-round—to identify potential vulnerabilities before they become threats.

Your clients trust you with their most sensitive information—Don’t let convenience compromise their security.

Building a Tax Practice That Lasts

Look, running a tax business isn’t easy. If it were, everyone with a tax certification would have a thriving practice. But now you know what separates successful tax businesses from those that struggle.

The path forward is clear:

- Start with a real plan, not just a hope of winging it.

- Build revenue streams that keep money coming in year-round.

- Market your services consistently—not just when you need more clients.

- Set pricing for sustainability that reflects your value, not just what the competition charges.

- Stay on top of tax law changes so you’re always the expert your clients rely on.

Success in this business isn’t about being the cheapest, the biggest, or even the best at taxes. It’s about making smart business decisions, delivering reliable service, and staying ahead of industry changes.

Take one step today. Pick the biggest problem you saw in this list and fix it. Your future self will thank you.

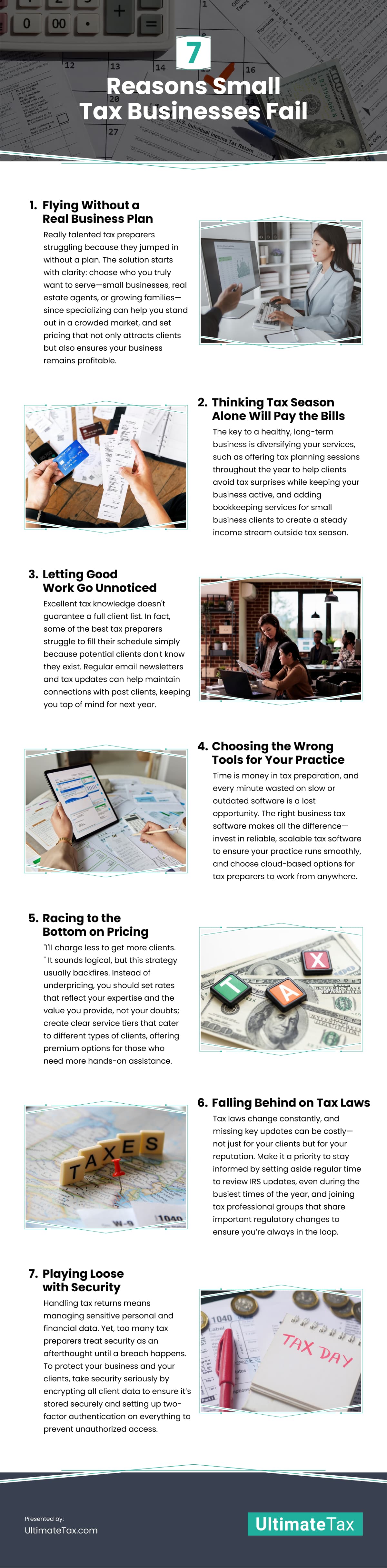

Infographic

You’ve tackled the hard work: earning your tax certification, setting up your office, and choosing the right software. Yet, during the busiest season, clients still aren’t lining up. Explore in this infographic the crucial factors that can drive or hold back your tax business.