Bank products are client solutions that all tax offices should offer. This benefits the tax office so that you can get paid for your services. They benefit clients as well since you offer a solution for your clients to not pay when they have you do their tax returns. They can also be a way for the client to get an advance on their tax refund. As a tax preparer, you’ll want to seriously consider offering bank products to your clients. They can help increase customer satisfaction while doing away with the hassle of going after payments. This way you do not break the law by “holding” checks.

Bank products are also known as tax products, refund transfers, or refund settlement solutions.

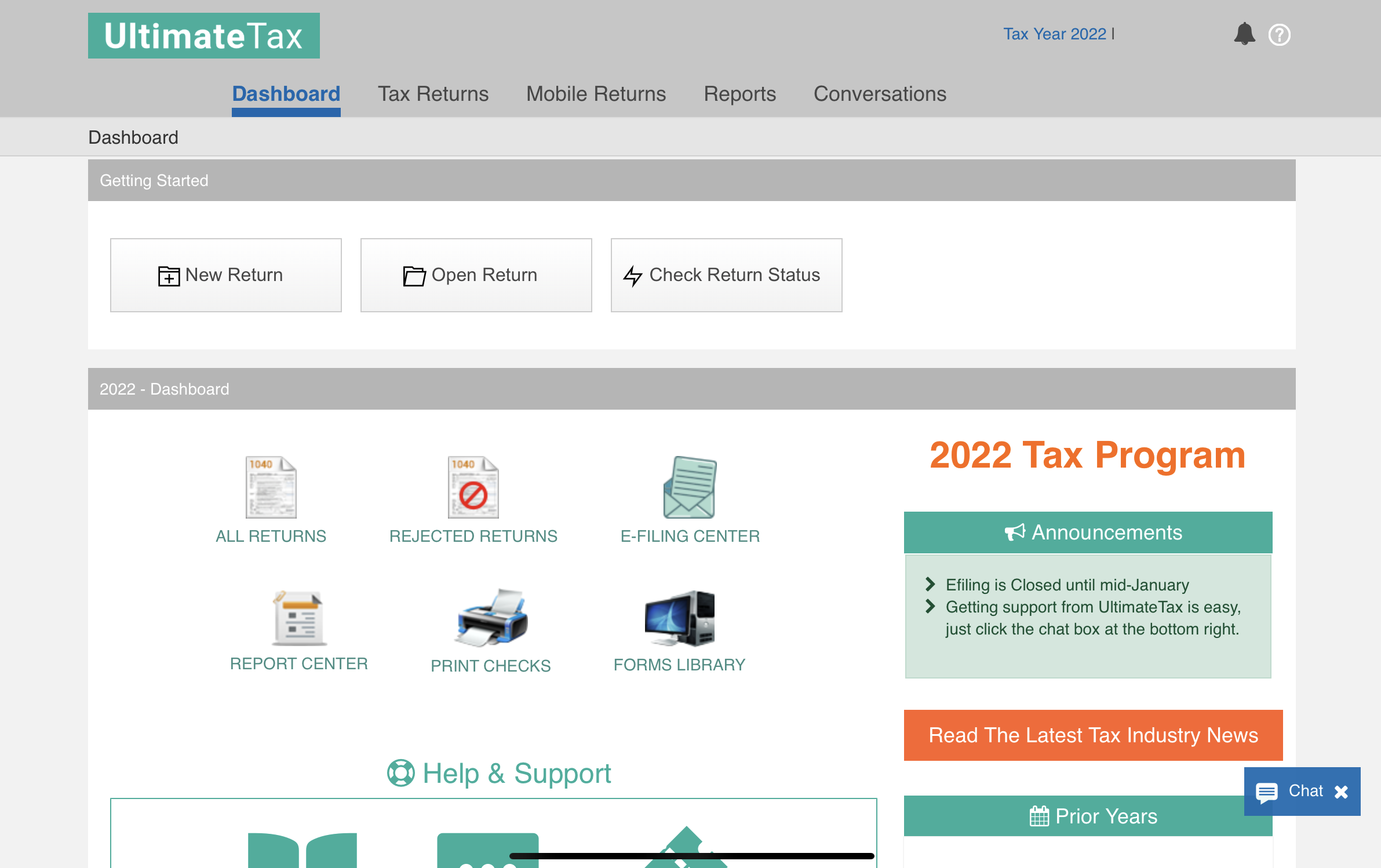

To get started, you will need professional tax preparation software that includes bank product support. It is the simplest way to get started with offering bank products. And it often comes with additional benefits to the tax preparer. For example, UltimateTax gives you a free subscription to their professional tax preparation software when you fund 30 bank products each season with TPG as a bank provider.

When choosing your tax software, get informed about the bank product providers that the software supports. You want to be sure that your tax software offers the best bank products for tax preparers.

If you have questions such as: What is a bank transfer? What is a refund transfer? Be sure to check out this quick-read article explaining what refund transfers mean.

Santa Barbara TPG

The Santa Barbara Tax Products Group (TPG) is one of the leading financial companies that provides refund transfer solutions. It was founded in 1991, and in 2014 it merged into the Green Dot Corporation, a large bank holding company with a financial connection to the Walmart Company.

TPG charges a refund transfer fee for the processing of its tax products. The fee is deducted directly from the client’s refund. You as a tax preparer will not have to pay any part of the TPG fee at any point. (Unless you offer advances.)

TPG stands by the security of its refund transfer process. As soon as the bank receives the client’s refund from the IRS, your tax preparation fees will be securely deposited in your bank account.

TPG provides a number of disbursement options. The bank supports the creation of a cashier’s check that can be printed and issued directly by your practice. You can personally hand over this check to your clients.

Direct deposit is another option this has been the most popular option. TPG can deposit the refund straight into the client’s bank account. This is a highly convenient option for you and your client.

A third option is for TPG to deposit the refund into a GO2bank mobile bank account. These are accounts registered under the Green Dot Bank company. The refund can be disbursed to the client’s existing debit card on a GO2bank account.

EPS Financial

EPS Financial is a major financial company that has processed over $20 billion in tax products and other transactions since it was founded in 2009. Several years ago, EPS became a part of the MetaBank Company.

EPS is a solid competitor when it comes to bank products. They service most of the industry with their processing. EPS also offers a no-cost consumer loan option for taxpayers who sign on to their refund advance program. As a tax preparer, you can offer this option to your clients, a benefit to customer satisfaction.

The no-cost consumer loan applies to loan amounts of $250, $500, and $1,000. This includes a $0 marketing fee, which means that EPS does not collect a marketing fee from tax preparers that take part in this program. (Note that the $0 marketing fee applies to the prepaid card disbursement option, but not the printed check option.)

Whether a client enrolls in the basic refund transfer program or refund advance program, EPS provides a number of fund disbursement options. One is direct deposit into the taxpayer’s bank account, one of the fastest and most convenient methods.

You can also choose to have EPS support a printed check that can be issued by your tax practice. This is a good option for tax preparers looking to cultivate those client relationships.

A third option would be a prepaid card. EPS currently supports the FasterMoney® Discover® Prepaid Card. This disbursement method is recommended in the case of taxpayers who do not possess a regular bank account.

Refund Advantage

On an interesting note, Refund Advantage is also a division of MetaBank. As a service, Refund Advantage works with more than 30,000 tax preparation businesses. It has delivered over $1 billion in advance loans to taxpayers in a single year. The Refund Advantage program has been integrated into over a dozen tax software programs, making it readily available to most tax preparers.

A quick look at Refund Advantage’s programs suggests that they offer the same things as EPS Financial. The Refund Advantage loan offerings support the same loan tiers, including a no-cost consumer loan option for amounts of $250, $500, and $1,000.

Republic Bank

Republic Bank is one of the oldest players in the market, originally formed back in 1977. Their refund transfer program offers the same disbursement options as the others. Taxpayers can receive the refund via direct deposit. Republic Bank also supports a printed check issued by a tax office to hand over to the client.

Of course, Republic Bank offers a prepaid card disbursement option, which helps customers without bank accounts gain prompt access to their funds. Republic Bank specifically supports the Netspend Visa Prepaid Card for this option.

Best Tax Software for Bank Products

The easiest way to start offering tax products is to get a tax software program that supports them. Fortunately, the majority of professional tax preparation software programs do support bank products. Check out this Professional Tax Software Review & Comparison Chart to quickly learn about the available options.

UltimateTax is one of the best tax software options on the list. What makes it so appealing? Simply put, UltimateTax rewards you for offering tax products to your clients! You can subscribe to UltimateTax Professional Tax Software for FREE if you can fund at least 30 TPG or Refund Advantage bank products each season—that means TPG or Refund Advantageacts as the bank provider of the refund.

With UltimateTax, you may never have to pay for a professional tax software subscription again! And you also get to deliver higher customer satisfaction with convenient bank products and handy refund advance loans! It’s great for your clients—and great for your business.