How to Prep Clients Using Handy Resources from the IRS

One of your responsibilities as a tax professional involves prepping tax clients for the coming tax season. While you are being paid to handle their tax matters so they don’t have to do it themselves, you can provide a more effective service if both of you are...

Yes, You Can Start a Tax Business While Working Full-time!

Looking for a good way to supplement your regular income? You might see tax preparation as a viable option. And you’re right! It is a service profession that can easily be integrated with similar types of businesses, such as accounting, bookkeeping, financial...

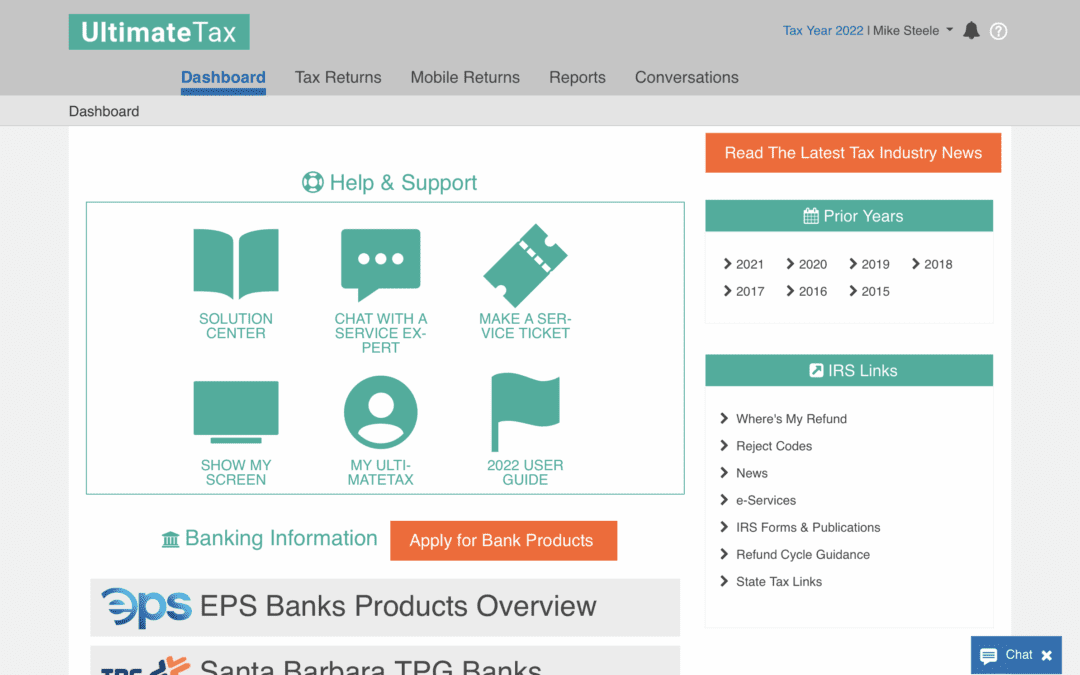

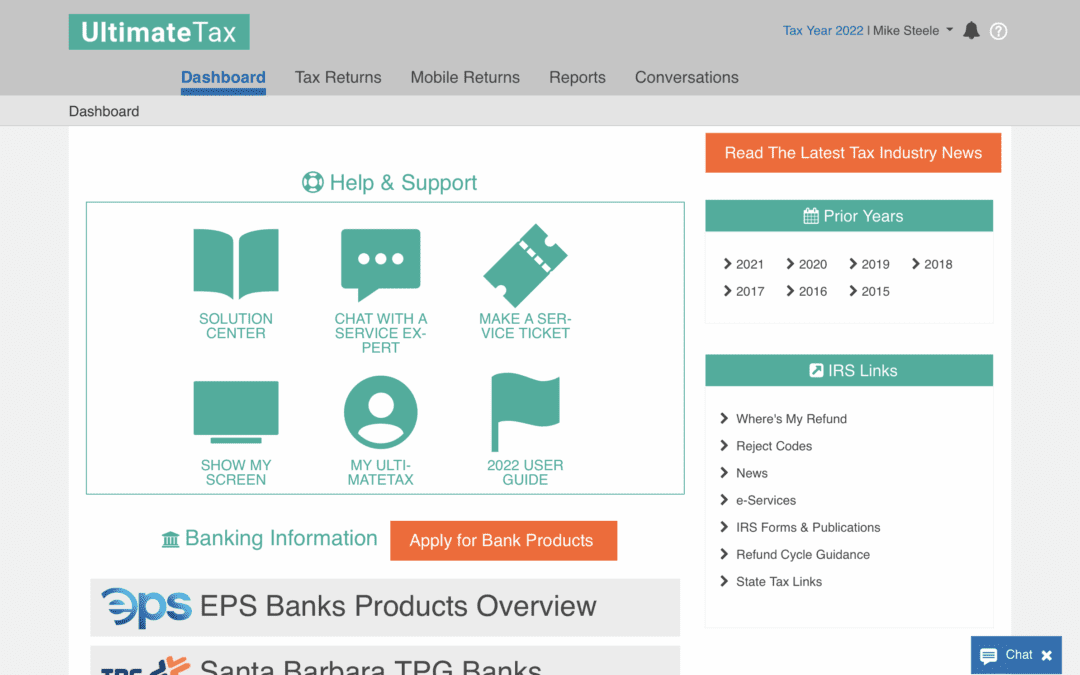

Program Update 3/18/21

Your Program should be updated to 35.04 Packages should be updated to the following: 1040 Indirect Ver 6 1120 “C” Corporation Ver 2 1120S “S” Corporation Ver 2 1065 Partnership Ver 2 1041 Fiduciary Ver 3 706 Estate Tax Ver 0 709 Gift Tax Ver 1...