Tax Tools for Your Clients

Here are a few tools that your clients may or may not fully comprehend. If you can help them understand the possible benefits then they may be able...

Clarification from IRS on Mass Transit Passes

The Internal Revenue Service has released a new revenue ruling on mass transit passes provided as fringe benefits to employees, how they are paid...

IRS 1040 E-File Shutdown/Cutover Schedule

The shutdown is coming earlier this year in order to make preparations for reprogramming the 2015 tax season. Note that acknowledgments may be...

Possible Delay to Tax Season Looms

Oh no, not another possible delay coming for the 2015 tax year. The IRS commissioner John Koskinen has warned congress that if they don’t make...

It’s PTIN Time!

The IRS has announced that you can now renew and apply for your 2015 Preparer Tax Identification Number (PTIN)! You may login to the IRS Online...

Tax Preparers Ain?t Got Time For That!

Remember the phrase “Ain’t nobody got time for that?” Well, once tax season starts, one thing tax preparers really don’t have time for is getting...

Excitement Stirs Over Green Dot ? TPG Binding

Due to the Green Dot merger TPG will now be able to give it’s clients industry leading financial products. The feedback from both existing and new...

The IRS Annual Filing Season Program (AFSP)

The IRS designed this program to allow tax preparers to voluntarily take this program which will give them knowledge and skills that will be...

Direct Deposit Limits

It is no secret (we hope) that there have been so many victims of fraud the past year that something needs to be done. The IRS has come up with a...

Green Dot Buys Santa Barbara Tax Products Group

Green Dot to purchase Santa Barbara Tax Products Group (TPG) in a 320 million dollar deal. The sale will be funded with $55 million cash, $150...

Recent Posts

UltimateTax’s Step-by-Step Process for Professional Tax Preparation

Are you considering working as a tax preparer for a living? Maybe you're just curious about how things work in the real world. In any case, you've come to the right place! Advanced tax professionals are in high demand in the accounting and tax industries. This...

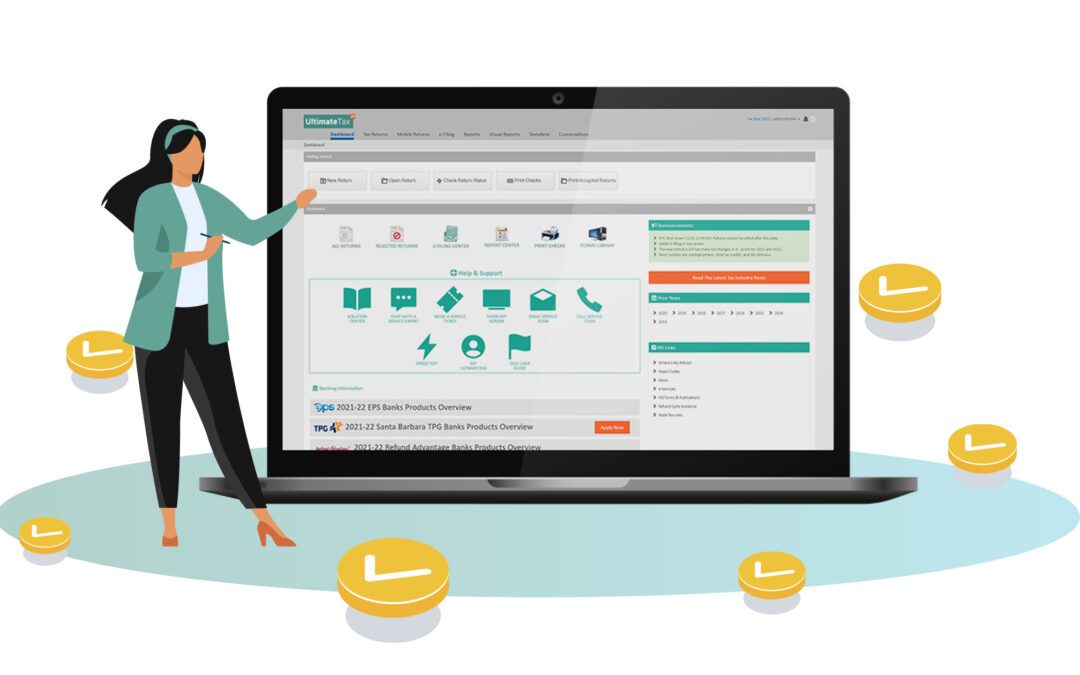

How to Manage Your Tax Business Like a Boss with UltimateTax

The majority of tax preparers' ultimate goal is to start their own profitable business. You can set your own hours, delegate tasks to employees, and collaborate with whomever you want when you own your own tax practice. Being your own boss also gives you a boost in...

The Comprehensive Guide to Choosing the Most Efficient Professional Tax Software

In today's technologically advanced society, a plethora of software applications are used for day-to-day business operations. Working in accounting or taxes is also dangerous! Accounting firms now consider sophisticated professional tax software to be a necessity, not...

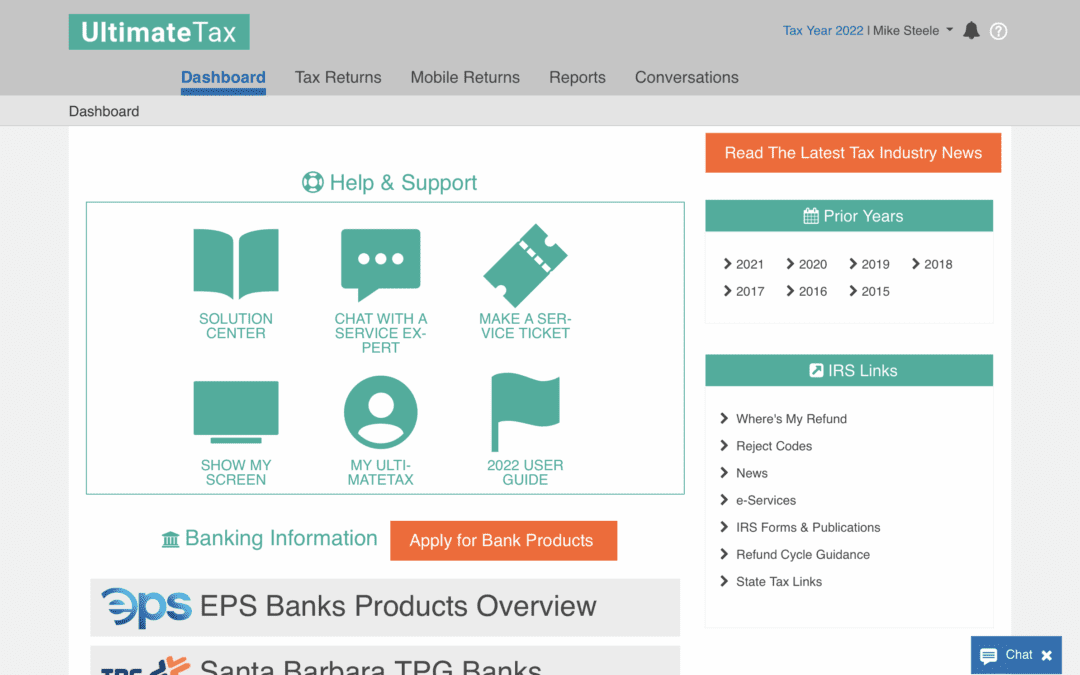

How Can TPG Aid You in Providing Superior Service? Ultimate Tax

TPG is a well-known banking product. It is also known as Santa Barbara Tax Products Group. It enables tax professionals to better serve their clients and achieve success. UltimateTax makes it easier for our clients to use TPG services. If you are a new tax...

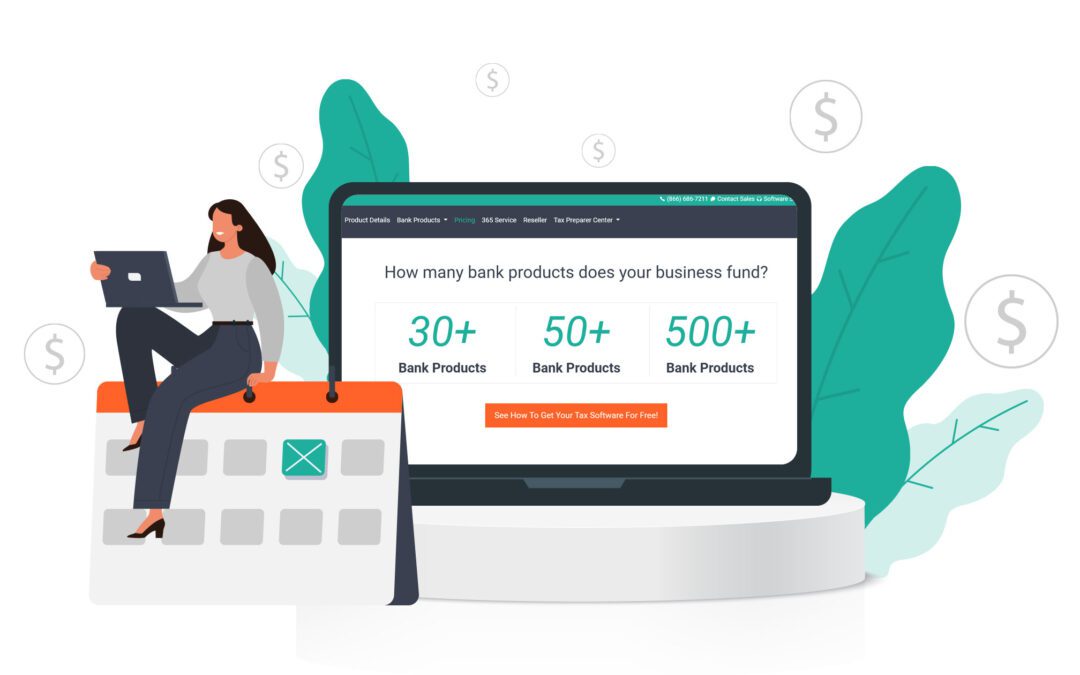

Best Corporate Tax Software for 2022

Are you looking for the best accounting and tax software? We frequently have too many options now that there are numerous tax preparation tools on the market. Each of these instruments has its own set of features and benefits that make it useful. So, how do you pick...