Lawmakers Re-Introduce Bill to Credit Enrolled Agents

As it stands, not all states allow Enrolled Agents to use their credentials to encourage tax payers to use their services. This may not be the case...

Scam Targets Tax Preparers

The IRS has issued a warning to alert tax preparers about fraudulent emails that are being sent to target tax preparers specifically. The email asks...

800,000 Incorrect Tax Statements

The 1095-A is the tax statement in question and anyone who purchased a health care plan through the Marketplace will receive one. Included in this...

Quick Reference For Tax Professionals ? Can Clients Use Divorce Decree To Claim Child?

As a Tax Professional, you will have to ask your clients a few questions when dealing with this situation. Is your client the custodial or...

Using The Return Query For Up To Date Return Info

Checking the status of any return is very easy to accomplish. Below are the steps in the program to ensure your statuses are up to date and correct....

2015 ? American Opportunity Credits ? DELAYED

From our inside sources we are hearing that the IRS will be holding refunds with the American Opportunity Tax Credit. The word is that the IRS is...

IRS Bitter About Budget

It seems that IRS Commissioner John Koskinen is too busy steaming over the IRS budget cuts to worry about the Republicans and Democrats battling...

Obama Threatens to Veto Tax Extenders

As attempts to wrap up permanent tax-break extensions for corporations, college students and residents of states without income taxes were in...

Ebola Chartity and Expense Tax Breaks

President Obama finally addressed the public stating that the Ebola Virus outbreak in West Africa is a public health emergency,a humanitarian...

Tip Areas Hit By Scam Calls

Even if the caller ID shows the call is from the Internal Revenue Service, don’t believe it! These con artists that are targeting innocent taxpayers...

Recent Posts

EPS Program and How is it advantageous for your Tax Preparation Business

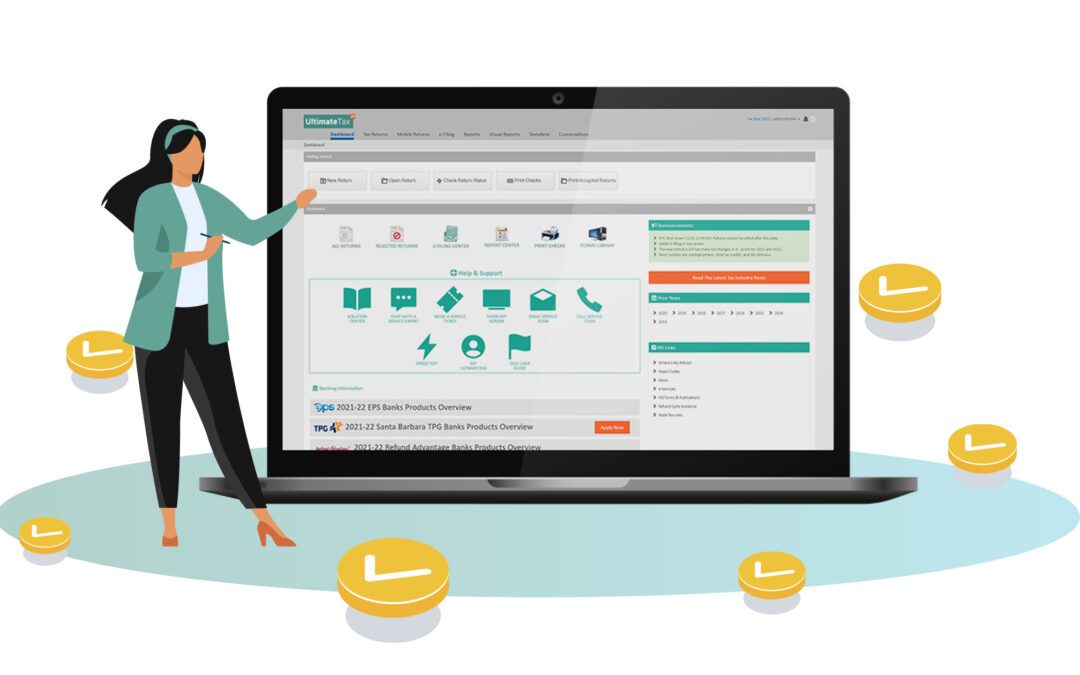

UltimateTax is the best professional tax software because it makes tax preparation easier. The software has excellent features, is online accessible, is compatible with all major devices, is user-friendly, and allows you to fill out e-forms as many times as you want....

The Benefits of Using the Right Tax Software

Tax season can be daunting, even for someone who files their taxes every year. The complexity of the tax code and the ever-changing tax laws make it difficult to keep everything straight. If you own your own business or plan on doing so in the coming year, you’ll need...

Running a Successful Tax Practice – What does it take?

The majority of tax preparers hope to one day own their own tax business. You can choose your clients and set your own schedule when you own your own tax practice. You can also hire people to help you with your work. Furthermore, there is no greater fulfillment than...

How to choose the Best professional Tax Software

The modern business world relies heavily on technology and various software packages to complete tasks. Similarly, in the accounting and taxation industries! Professional tax software that is both powerful and easy to use is now required for tax firms. Almost every...

How does Refund Advantage help tax professionals

UltimateTax offers a variety of services and banking products to its customers to help them stay competitive in their respective industries. Refund Advantage is one of these bank products that can be extremely beneficial to tax preparation businesses. It is a bank...