Tax professionals running their own practices already know the law inside and out. You understand deductions, credits, and complex returns. But there’s an untapped way to grow your business—by adding new tax software skills to your toolkit.

Think about it: expanding your software expertise means never turning away good clients because of current system limitations. You open doors to new clients and revenue streams that might have previously been out of reach—plus, you can take on lucrative contract work during peak seasons.

Why Different Tax Software Exists—And Why It Matters for Your Practice

Many tax practice owners realize the importance of expanding their software skills to grow their businesses. But have you ever wondered why so many tax preparation platforms and versions are out there? Not all platforms are created equal, so understanding the differences can help you build a more versatile practice.

Meeting Different Practice Needs

Your clients bring diverse tax preparation needs to your practice. Some require simple 1040 processing, while others need complex corporate returns. By mastering a system, you can quickly determine what each client needs and can serve every client who walks through your door.

Finding the Right Fit for Your Workflow

Every top tax preparation software for professionals can help you get your job done, but each offers unique strengths for different business needs. Some versions of platforms excel at processing high volumes of returns quickly, while others provide detailed worksheets for complex corporate work. As your practice grows, having experience with multiple platform versions can help you choose the best tools for your changing needs.

The right platform should offer cost-effective options as you scale, reliable year-round support, and easy data conversion capabilities. Such flexibility means efficiently serving clients no matter what software they’ve used before while running your practice your way. This guide provides more details on evaluating new software for your business.

Adapting to Growth

As you expand your skills, you can take on more diverse work. Learning advanced professional tax software opens doors to corporate returns and multi-state clients. Each version or level of a system you master helps you serve more clients and grow your independent practice.

Understanding Different Software Features to Expand Your Skills

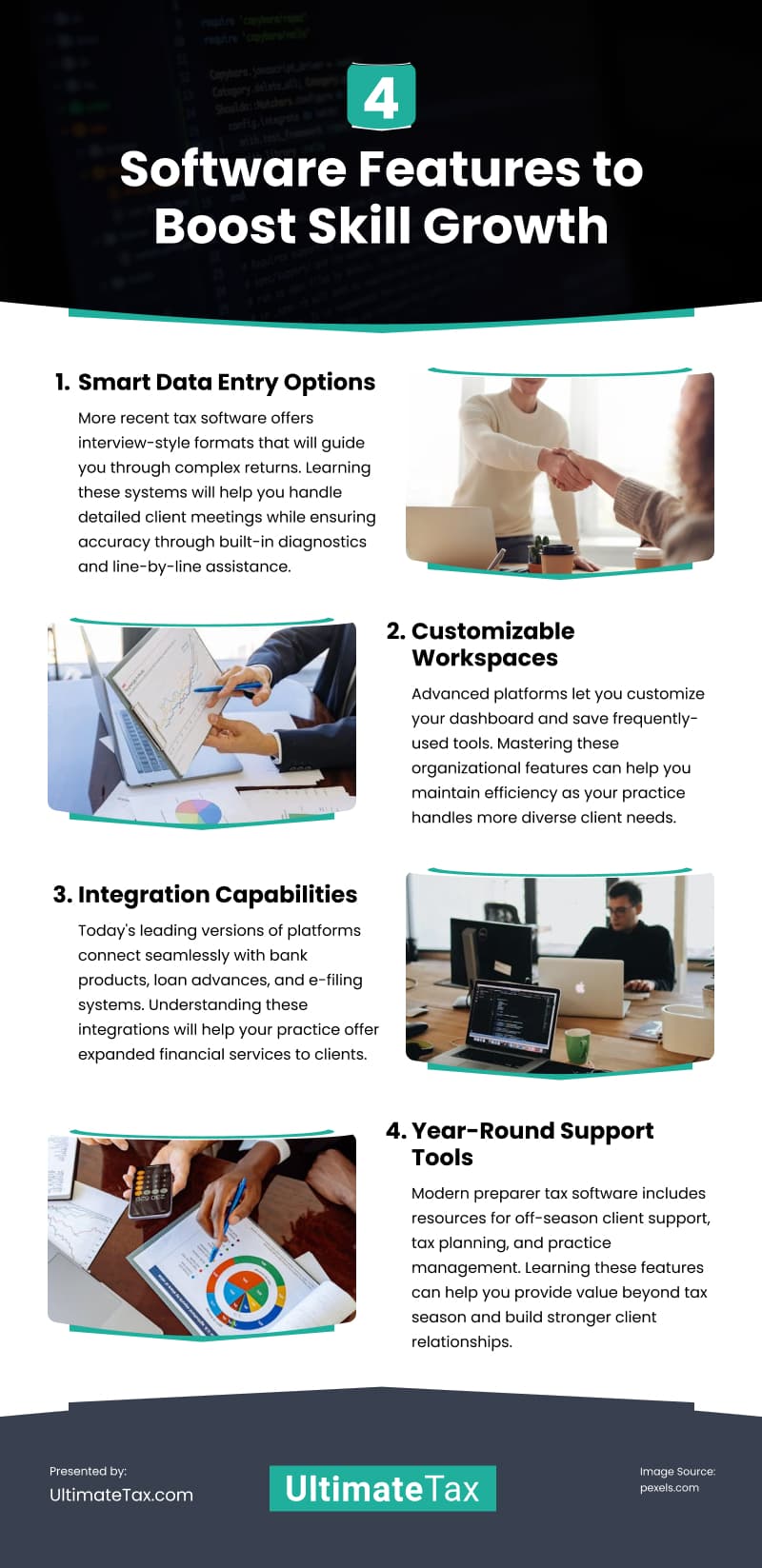

Now that you understand why different versions of platforms exist, let’s explore the key features you’ll encounter as you expand your software expertise:

Smart Data Entry Options

More recent tax software offers interview-style formats that will guide you through complex returns. Learning these systems will help you handle detailed client meetings while ensuring accuracy through built-in diagnostics and line-by-line assistance.

Customizable Workspaces

Advanced platforms let you customize your dashboard and save frequently-used tools. Mastering these organizational features can help you maintain efficiency as your practice handles more diverse client needs.

Integration Capabilities

Today’s leading versions of platforms connect seamlessly with bank products, loan advances, and e-filing systems. Understanding these integrations will help your practice offer expanded financial services to clients.

Year-Round Support Tools

Modern preparer tax software includes resources for off-season client support, tax planning, and practice management. Learning these features can help you provide value beyond tax season and build stronger client relationships.

How to Master Different Tax Software

Learning new tax software takes strategy. Here’s how successful tax professionals expand their software skills effectively:

Start With Core Functions First

Begin with the essential features you use daily—data entry, basic returns, and e-filing. Every tax software handles these differently, but they share common principles. Focus on mastering these fundamentals before moving to advanced features. Take advantage of built-in tutorials and practice returns to build confidence with basic workflows.

Use Off-Season Time Strategically

Summer and fall months offer the perfect opportunity to learn a new platform. Many software providers offer training programs during this period. Start with sample returns from your existing clients, recreating them in the new system to understand different approaches to familiar scenarios.

Pro Tip: Look for software that offers free onboarding and training with solid support that can help you as any issues arise. This shows that the company is willing to invest in your success on the platform rather than earning more money on multi-day training that is practically required to use the system.

Take Advantage of Free Conversions

When exploring new software, look for platforms that offer free data conversion from your current system. This lets you practice with real client data in a test environment. You’ll learn how different software handles various tax situations while ensuring your client information transfers accurately.

Build a Practice Case Library

Create a collection of practice returns that cover different tax scenarios—from basic 1040s to complex corporate returns. Use these same cases when trialing a new software platform. Comparing identical situations across different systems will help you understand their individual approaches and strengths.

Join User Communities and Training Groups

Connect with other tax professionals using the same software through online forums and local user groups. These communities often share tips, shortcuts, and real-world solutions that will give you a leg up.

Participating in these groups can accelerate your learning and help you discover features you might have missed. Many software providers also offer certification programs that can formally validate your expertise.

Top 3 Benefits of Mastering Tax Software Skills

1. Higher Earning Potential

Familiarizing with several tax software versions and platforms can help you build a more profitable practice. You can serve high-value corporate clients, take on multi-state returns, and even handle lucrative overflow work during peak season—all while maintaining your independent practice.

2. Client Flexibility

When you’re comfortable with multiple software versions, you never have to turn away good clients because of software limitations. Whether they bring in years of data from one system or need specific features from another, you can adapt to their needs.

3. A Competitive Edge

While most independent practices are familiar with their platform of choice, your diverse software skills let you serve any client who walks through your door. For example, you will already know that your platform can quickly convert data from other software and what version will best serve the client. This versatility helps you build a stable, year-round business and command premium rates for your comprehensive services.

Conclusion

Build a practice that never has to say “no” to good clients. Having more tax software skills means you can take on any return, serve any industry, and grow your business exactly how you want. The path to a more flexible, profitable practice starts with expanding your software expertise.

Video

Infographic

Expanding your software expertise enables you to attract more clients and access new revenue streams without being limited by your current system. Check out this infographic to explore the key features of enhancing your software skills.