Are you looking for a new side hustle or business venture? Regardless of your goals for increasing your income, starting a tax preparer business can be both lucrative and satisfying.

Why Choose A Tax Business?

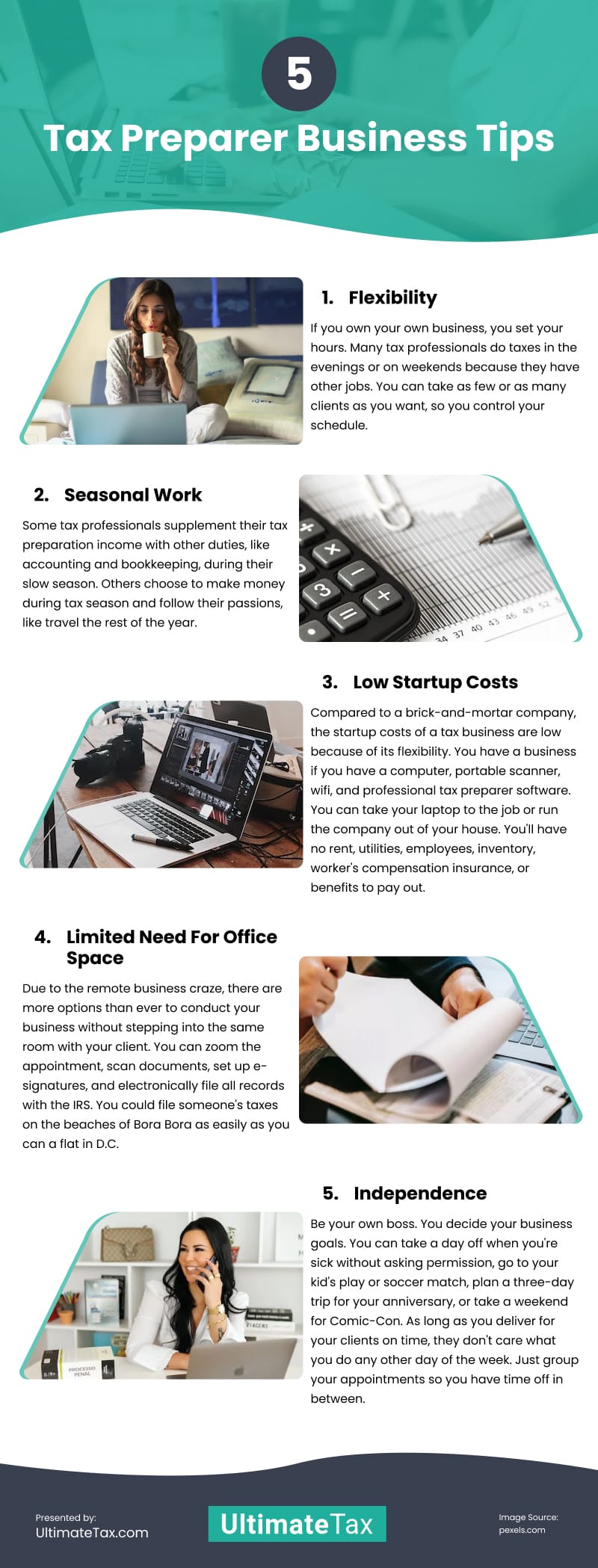

There are several reasons a tax business might be the best option for you:

Flexibility

If you own your own business, you set your hours. Many tax professionals do taxes in the evenings or on weekends because they have other jobs. You can take as few or as many clients as you want, so you control your schedule.

Seasonal Work

Some tax professionals supplement their tax preparation income with other duties, like accounting and bookkeeping, during their slow season. Others choose to make money during tax season and follow their passions, like travel the rest of the year.

Low Startup Costs

Compared to a brick-and-mortar company, the startup costs of a tax business are low because of its flexibility. You have a business if you have a computer, portable scanner, wifi, and professional tax preparer software. You can take your laptop to the job or run the company out of your house. You’ll have no rent, utilities, employees, inventory, worker’s compensation insurance, or benefits to pay out.

Limited Need For Office Space

Due to the remote business craze, there are more options than ever to conduct your business without stepping into the same room with your client. You can zoom the appointment, scan documents, set up e-signatures, and electronically file all records with the IRS. You could file someone’s taxes on the beaches of Bora Bora as easily as you can a flat in D.C.

Independence

Be your own boss. You decide your business goals. You can take a day off when you’re sick without asking permission, go to your kid’s play or soccer match, plan a three-day trip for your anniversary, or take a weekend for Comic-Con. As long as you deliver for your clients on time, they don’t care what you do any other day of the week. Just group your appointments so you have time off in between.

Remember, varying levels of education are needed depending on the authority you want to own regarding your business and how you serve your clients. You can be an uncredentialed preparer, an enrolled agent, a certified public accountant, or a lawyer specializing in tax law. The greater your knowledge base, the more you can charge for your expertise and services, so the more time off you can afford. If you need help starting your business, follow the steps below.

Seven Steps To Start Your Own Tax Preparation Business

- The first step is to get a business license, but the process varies from county to county. Check with your local officials on their requirements.

- Register your business with your secretary of state.

- Get your Employer Identification Number (EIN) saying you own the business. The EIN is the number you will use to file your taxes. It is also the necessary information to get the following two numbers. The application is simple, and you’ll have your EIN immediately after completing the application.

- Apply for a Preparer Tax Identification Number (PTIN), which identifies you as an individual who can prepare taxes for others. This application takes about 15 minutes and requires a small fee.

- Apply for an Electronic File Identification Number (EFIN) to submit tax forms through the IRS e-file system. This application can take 45 days or more to process, so start a few months before the tax season. You will need to pass the background check proving you have a good track record on your tax forms, your license (if you have one) is in good standing, and you aren’t a risk for fraudulent business practices.

- Compare tax preparation software to find the best platform for your business. Find one that is IRS-approved with excellent service, an intuitive layout, a comprehensive onboarding system to help you learn the software, and a free demonstration or trial period to play around with the program and get an overview of its features. You can get downloadable software if you work out of a stable office or the cloud-based tax software for tax preparers, which handles security and automatic updates. It also offers you the freedom to work from anywhere.

- Price other tax preparers in your area with similar education and backgrounds to find out what to charge for your services, then get your name out there.The way to profitability is to use tools that will make you more efficient, value your time, and charge accordingly. Not everyone will bring you a 1040EZ. The more complicated the form, the bigger the mess of unfiled receipts you have to plow through, and the more you should charge.Ensure you get paid for the time and effort you put in. If a client calls to ask you a question, if you have to put some time into it, you can send them a bill or add it to their fees for the next season. Many tax preparers are worried about charging additional fees for fear of losing a customer. However, all your clients visit the doctor or need a lawyer occasionally; they expect to pay them for their time and should expect to pay you too. Isn’t your time worth something?If you think you’ll struggle to collect fees for your time, consider looking into bank products, also called settlement solutions or refund transfers. These allow you to get paid directly from your clients’ refunds and get them their refunds sooner.

Tax preparation could be the solution you’ve been looking for to make some extra cash or to change careers. With endless benefits and quick, easy steps to start your business, you can be up and running in time for the next tax season.

Infographic

Considering a side hustle or entrepreneurial leap? A tax prep business offers flexible hours and low startup costs. Embrace remote operations and manage your time independently. Further education enhances expertise. Kickstart with licenses, registration, and IRS-approved software. Start a rewarding venture, ripe with opportunities for extra income or a new career.

Video