More DIY Taxpayers This Year?

As reported by CPA Trendlines , as of February 27, 2015 total tax refunds are down 1.8%, which is 882,000 fewer refunds than this time last year. Tax professionals have submitted 4.4% fewer e-files year over year with just 28,733,000 e-file receipts versus...

Snow and Professional Tax Software

We are taking a quick break from professional tax software to tell you about the most popular topic here in Iowa today – SNOW! Here are 10 Fun Facts that you probably didn’t know about snow: An average snowflake is made up of 180 billion molecules of water. Around 12%...

Marketplace Tax Statement Mishap Could Benefit 50,000

Did you prepare returns for clients that had bad Obamacare subsidy data (Read our 800,000 Incorrect Tax Statements article) If so, you are about to have some great news for them! Out of the 800,000 incorrect tax statements, the 50,000 taxpayers who already filed are...

ACA Special Enrollment Period

As Tax preparers, your clients may expect you to be their go-to-person for everything ACA (Affordable Care Act) related. You are the only live person they can physically sit with face to face and ask questions to, otherwise everything is done online. Especially now...

Scam Targets Tax Preparers

The IRS has issued a warning to alert tax preparers about fraudulent emails that are being sent to target tax preparers specifically. The email asks you to update your e-Services information and the links included are to a phishing scam which will capture your...

800,000 Incorrect Tax Statements

The 1095-A is the tax statement in question and anyone who purchased a health care plan through the Marketplace will receive one. Included in this tax statement is the amount paid in monthly premiums, which is where the mistake was made. Some of the premiums figured...

Quick Reference For Tax Professionals ? Can Clients Use Divorce Decree To Claim Child?

As a Tax Professional, you will have to ask your clients a few questions when dealing with this situation. Is your client the custodial or noncustodial parent? When is the final divorce decree dated? If the divorce decree or separation agreement went into effect after...

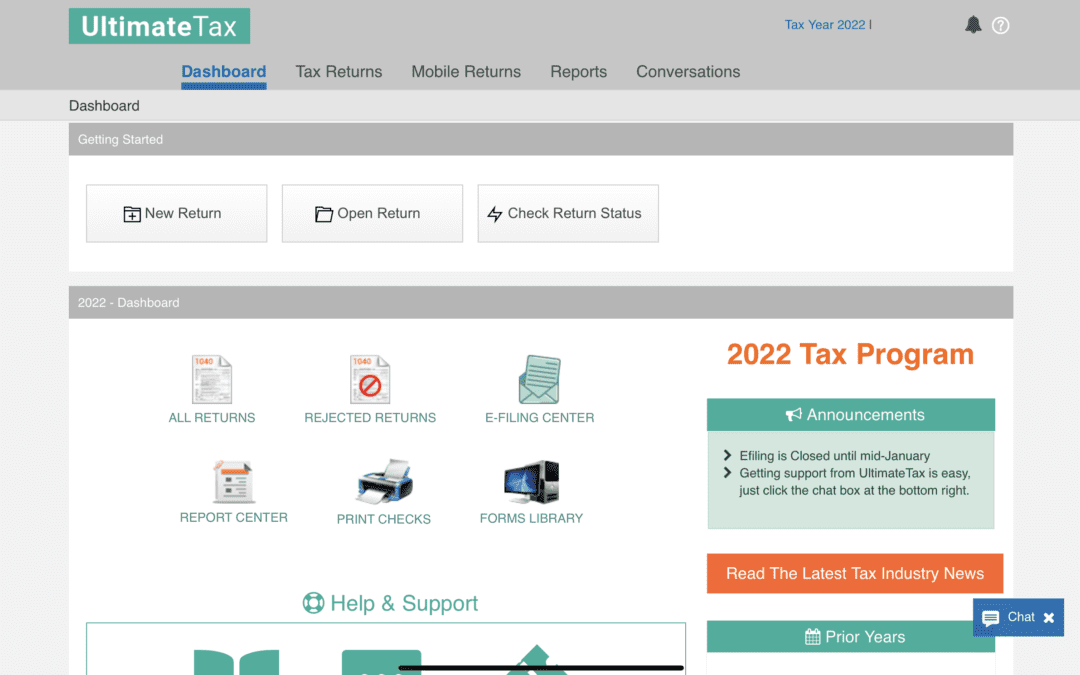

Using The Return Query For Up To Date Return Info

Checking the status of any return is very easy to accomplish. Below are the steps in the program to ensure your statuses are up to date and correct. Inside the program – please go to Communications >> Get Acks & Updates or Click the “Get Acks & Updates”...