Why Is Tax Preparation Software Such as UltimateTax Required?

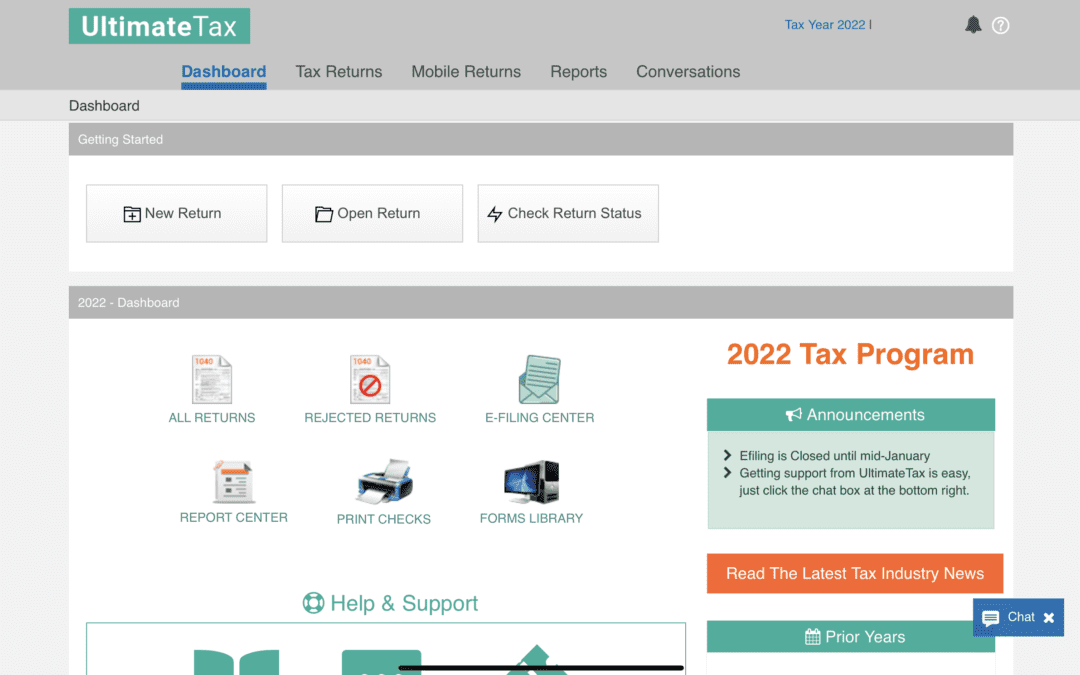

Use top-tier professional tax software whether you own a large tax firm or work for yourself as a tax preparer. There are numerous tax preparation resources available today; however, you should choose one that is tailored to the specific needs of your clientele. A...

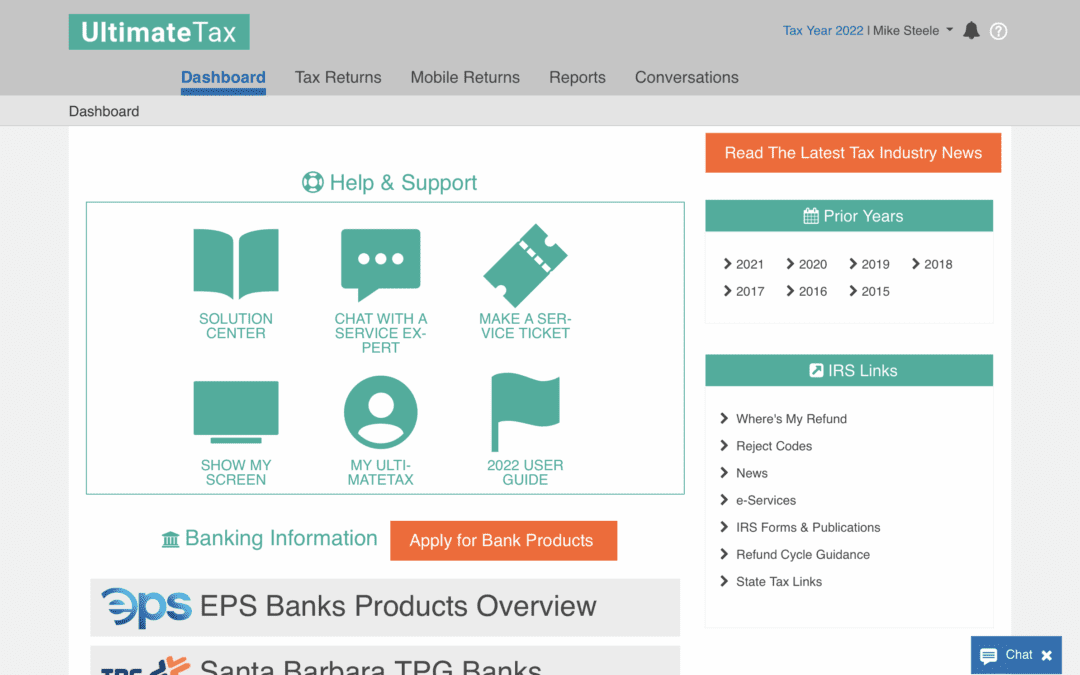

Ultimatetax Software’s Advantages for Tax Preparers

If you own a tax preparation company, you’re probably used to wearing multiple hats, including tax preparer and financial analyst. Tax preparation consists of numerous tedious, precise tasks. This process will become more laborious and time-consuming as your...

UltimateTax or ProSeries as the Best Corporate Tax Software in 2022

Looking for the best accounting tax software? There are numerous tax preparation software options on the market today. Each of these tools has unique features and benefits. How do you pick the best tax preparation software for your business? When deciding on the best...

E-file Shut down for 2022 for Years 2019-2021

Last Day to e-File – November 22, 2022 IRS has announced its MeF (e-file) shutdown and cutover for Tax Year 2021. To ensure that all Form 1040 tax returns e-filed through the MeF system are processed promptly, submissions must occur before IRS shuts down the...

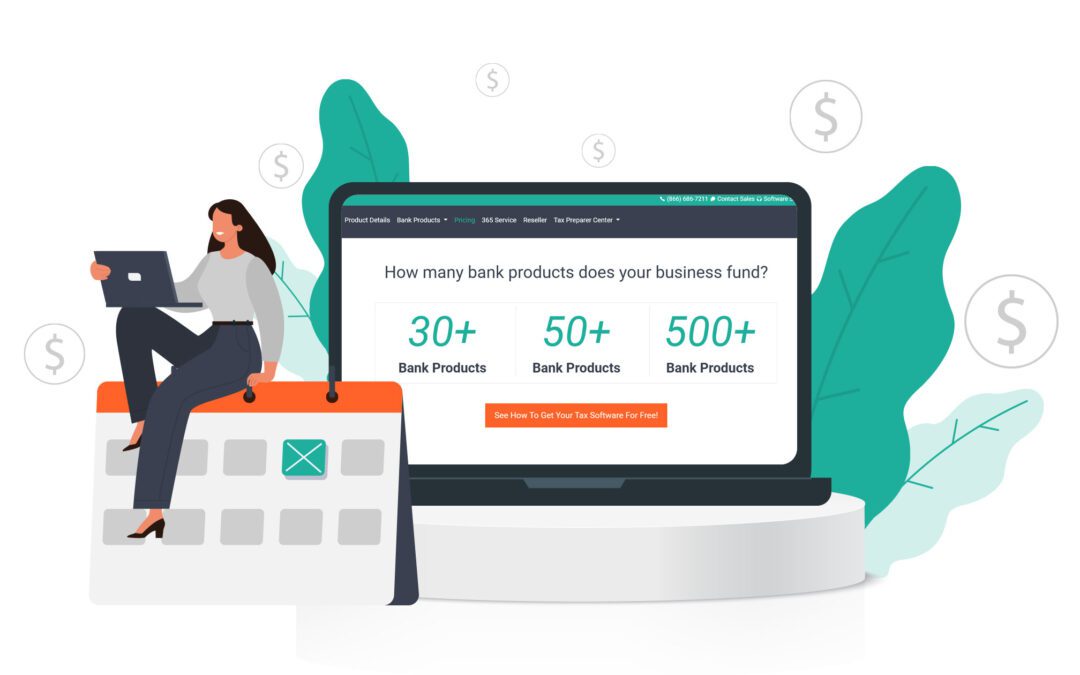

The Best Bank Products for Tax Professionals

Bank products are client solutions that all tax offices should offer. This benefits the tax office so that you can get paid for your services. They benefit clients as well since you offer a solution for your clients to not pay when they have you do their tax returns....

Understanding Tax Software with Bank Products

As a tax preparer, you may have noticed that some professional tax software products support bank products. Should this feature affect your decision of which tax software subscription to get? How important are bank products? What are bank products? To put it simply,...

Is It Time to Upgrade Your Tax Software Package?

When deciding to renew your tax software, you will want to ask yourself one important question. Should you upgrade your tax software package? As you consider this question, you will want to reflect on your needs for the coming tax season. Do you expect your business...

What Is a Refund Transfer?

The refund transfer is a deposit product that allows clients to settle their preparation fees or accounting fees without making an upfront payment. Instead of paying you directly for services, the clients agree to have your fee deducted from their tax refund. A refund...