It’s 2024. It’s a time for family, friends, fireworks, and dazzling parties. The new year and the time-honored tradition of resolutions are opportunities to learn from old mistakes and let go, moving on with greater insight. Here are five resolutions you might include as a tax professional:

1. Balance Your Work And Home Life

Will you regret not spending enough time at work or with your family at the end of your life? If you’re like most people, you’ll look back and see missed opportunities with your family. It’s good to set some boundaries to live without that particular regret.

2. Set Boundaries

Since the global pandemic, many tax professionals haven’t returned to working in a separate office space. Working from home has perks, but balancing your efforts between the family and the job can be stressful when home and office lines blur. Kids and pets want your attention now, while your clients deserve your full attention. Set aside a designated business area; don’t work outside that zone.

Set reasonable work hours with breaks for meals, take the dog for a walk, and get in a few minutes of play with your kids. When you’re with your family, be with your family. If a client were calling when you were already with a client, they would have to leave a message. Treat your family as your best clients. Don’t answer your phone during breaks, or they aren’t really breaks.

Also, respect your team members’ boundaries. For example, don’t send emails at 3 AM because you can’t sleep. Business hours may be longer during tax season, but time off work should be honored to keep your people from burning out. Set a time delay on those middle-of-the-night emails so they get delivered during business hours. This will help your team avoid feeling like they’re falling behind.

If you’re working late regularly during your busiest months, allow them a day or two a week to take care of personal business, eat with their families, have a date night, etc. Tax season is stressful for everyone, including your family, as they make sacrifices, too.

3. Stay Ahead Of Your Continuing Education

Plan to take your CPE credits during your less busy months. Well before the deadline, so you’re not scrambling at the end of the year. Once you have an ideal timeframe, taking care of your CPE every year is easy.

4. Leverage Technology

Learn to use your technology more effectively to increase productivity and efficiency. For example, cloud-based professional tax software will allow you to access your files from home or when you meet clients out of your office. Are you taking advantage of that feature? Or does your current tech not meet your needs? Read more about the key features your tax business software should have here.

Make sure you’ve trained your office to use your software effectively. You have fewer training opportunities during busy times and when operating remotely. Set aside time to see what your team struggles with and fill in any gaps in their training.

Look for ways to automate simple tasks. Those few minutes add up over time, your staff can focus on income-producing activities, and it eliminates a bit of monotony.

5. Provide Value And Exceed Expectations

Provide more value to your clients. As the tax profession grows more competitive, you need to stand out from the crowd and create loyalty in your customer base. Make each interaction with your clients more personal and friendly. If clients feel like they’re just a number, they could easily switch to another company.

Here are some ideas to provide extra value and wow your clients:

- Customer loyalty programs: Giving clients incentives to stay with your company can be as simple as offering lower rates to long-time customers, sending them a gift card at the end of the year, or other small gestures to let them know you appreciate their business.

- Keep existing customers engaged: Send out a newsletter or post a blog that provides additional value to your customers, such as reminders of important deadlines, tips on making tax time more manageable for everyone involved, checklists so they can compile all documents ahead of their appointment, etc.

- Adopt a client referral program: The most effective advertising you will ever invest in is a referral program. People trust their friends and family over ads. A satisfied customer who brags about you going above and beyond could nab you multiple referrals every year.

- Ask for feedback: Sometimes, we don’t see where we need to improve. Asking for input before ending an appointment can help you make a better showing in your next meeting. It also gives a customer time to express any concerns they may have or to ask questions.

Final Thoughts

These are just a few ideas on how to take what you’ve learned from 2023 and make the new year even better for your business. Resolving to do one or more can make the year less stressful and more productive while supporting your clients and staff.

Video

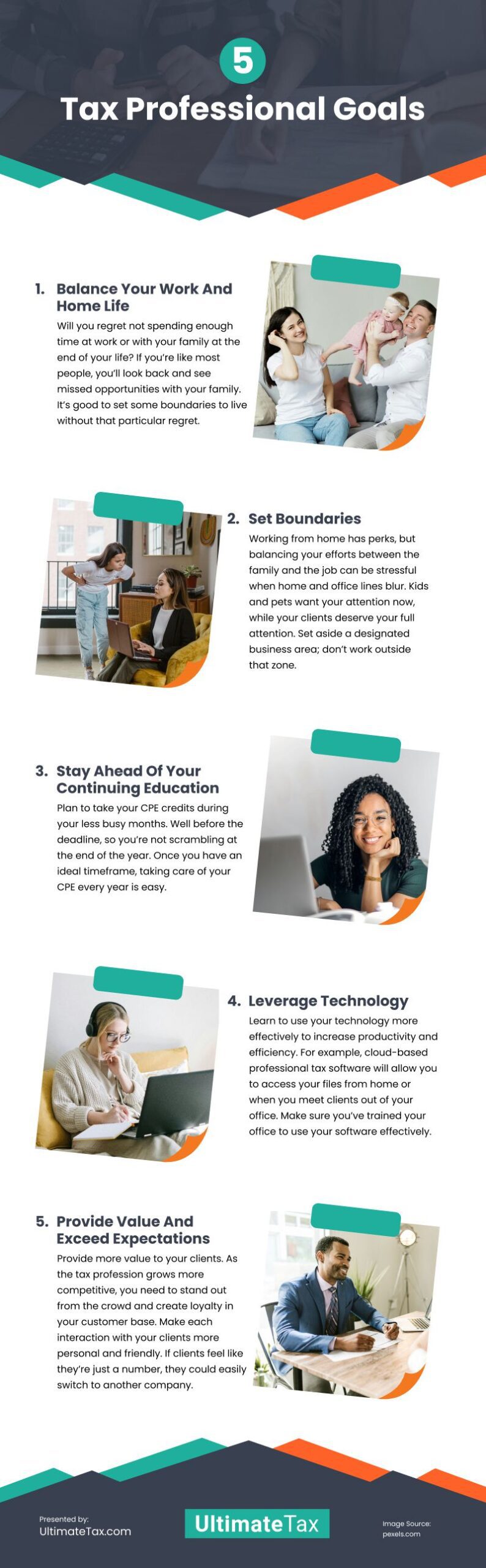

Infographic

It is now 2024, a year of celebration and festive gatherings with loved ones and acquaintances. As we welcome the new year, it is customary to reflect upon past experiences and determine what we can learn from our mistakes to improve ourselves going forward. As a tax professional, discover in this infographic the five resolutions you may want to consider.