Professional Tax Software

Frequently Asked Questions

Why is it beneficial to purchase my software by June 30th vs. purchasing in December?

Is an EFIN required to purchase your program?

Will this program work on my MAC?

What kind of training do you have available?

Does your tax software ever go on sale?

We also offer an affordable option such as the UltimateTax PPR (Pay-Per-Return). You can get your professional tax software for only $288 per year at $15 per return. You’ll get the same software features and convenience as UltimateTax 1040 Online.

How can you offer better pricing than everyone else?

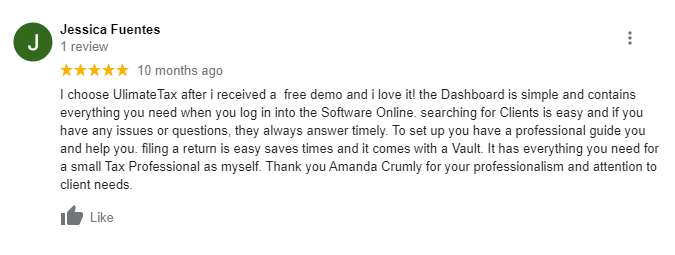

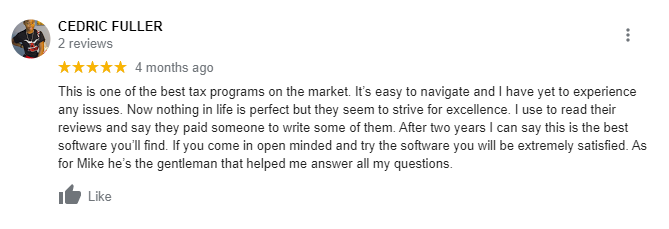

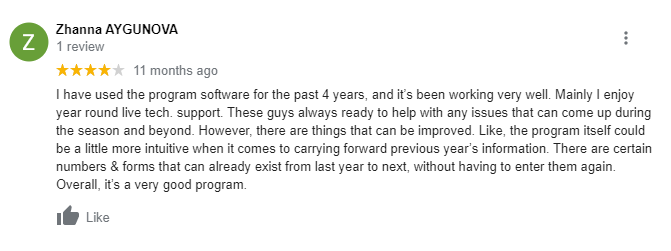

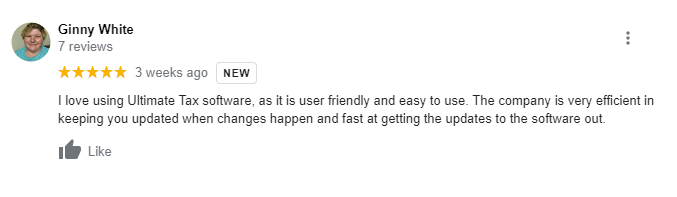

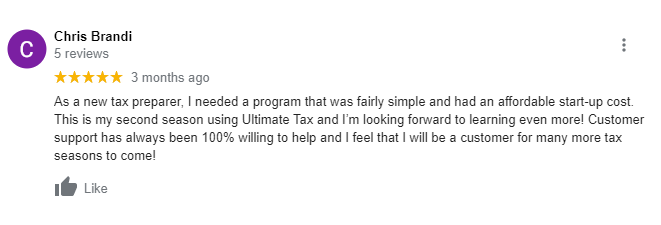

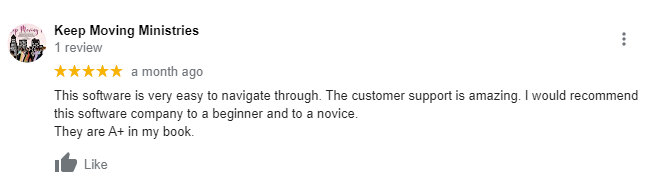

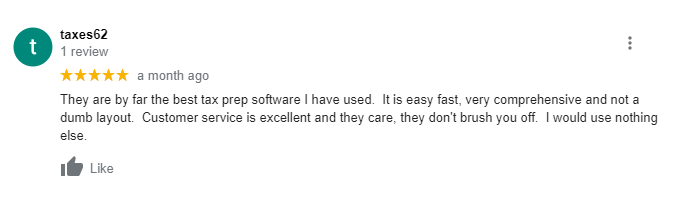

Is your Service after the sale any good?

We provide many solutions, phone, email, chat, and a first-class knowledgebase. We do not just provide software, we provide the support you need.

What support options do you have?

Are you a Tax Service Bureau?

A tax service bureau is a business that is able to make the best relationships in the tax industry. We have ties to the best partners and we are in the “know”. We are great at what we do, and we are proud to be offering our services.

We have had offices in every state. We continue to grow every year, because we are committed to this ever-changing industry.

How long have you been in business?

Do you offer a payment plan?

Do you have affordable tax software options?

What are all the state tax links?

- Alabama Department of Revenue

- Arizona Department of Revenue

- Arkansas Department of Revenue

- California Franchise Tax Board

- Colorado Department of Revenue

- Connecticut Department of Revenue Services

- Delaware Office of Tax and Revenue

- District of Columbia Office of the Chief Financial Officer

- Georgia Department of Revenue

- Hawaii Department of Taxation

- Idaho State Tax Commission

- Illinois Department of Revenue

- Indiana Department of Revenue

- Iowa Department of Revenue

- Kansas Department of Revenue

- Kentucky Department of Revenue

- Louisiana Department of Revenue

- Maine Revenue Services

- Maryland Comptroller of the Treasury

- Massachusetts Department of Revenue

- Michigan Department of the Treasury

- Minnesota Department of Revenue

- Mississippi State Tax Commission

- Missouri Department of Revenue

- Montana Department of Revenue

- Nebraska Department of Revenue

- New Hampshire Department of Revenue

- New Jersey Department of Treasury

- New Mexico Taxation and Revenue Department

- New York State Department of Taxation and Finance

- New York City Department of Finance

- North Carolina Department of Revenue

- North Dakota Office of State Commissioner

- Ohio Department of Taxation

- Oklahoma Tax Commission

- Oregon Department of Revenue

- Pennsylvania Department of Revenue

- Rhode Island Division of Taxation

- South Carolina Department of Revenue

- Tennessee Department of Revenue

- Texas Comptroller of Public Accounts

- Utah State Tax Commission

- Vermont Department of Taxes

- Virginia Department of Taxation

- West Virginia State Tax Department

- Wisconsin Department of Revenue