Chapter 1

How to Start a Tax Business

Chapter 2

The Fundamentals for Tax Preparers

Chapter 3

How to Setup Your Office

Chapter 4

Getting Your Office Tools

Chapter 5

Outsourced Suppliers

Chapter 6

Investing In Your Own Office Space

Chapter 7

Acquiring Your Clients

Chapter 8

Chapter 3: How to Setup Your Office

As a tax preparer, you face two choices. You can work for a large tax company or build your own tax business. A career in tax preparation can be lucrative. In 2019, big companies and self-employed businesses both contributed to the forecasted industry revenue of $11 billion.

There are benefits to working in a big company like H&R Block, Jackson Hewitt, or Liberty Tax. These include gaining valuable work experience, corporate connections, and employment stability. In addition, a company may provide additional employment benefits such as healthcare and bonuses.

Building your own business has many benefits as well. According to FranchiseHelp.com, the majority of tax offices are small businesses, with 37% owned by single proprietors and 53% with less than 10 employees.

One of the benefits would be more freedom; especially since most work is concentrated from January until April 15 annually. It’s a stable business as well since there will always be the need to pay taxes. For convenience, individuals and local businesses generally prefer to outsource tax return preparation to a professional.

If you decide to build your own business, here are some tips to get you started:

Assess your needs

Before starting any business, you should look into the requirements for setting it up. Make a detailed list of what you’ll need and have everything in place before you begin.

Get the necessary approvals

Obtain all necessary registrations for your new business. As a tax preparer, you’ll need to get your PTIN, EFIN, and business registrations. Be thorough in your research. Seek additional information from local government offices. Some states and cities have additional requirements.

Create a business goal for the year

Set a number of business milestones as goals. In the beginning, you can set your targets within a period of one year.

Create a calendar to identify when you need to work on specific milestone goals. You may already be aware that tax preparers are busiest during the first four months of the year. Outside this busy season, you can focus on growing your knowledge and expertise, and possibly work on expanding your business.

You can also create three-year, five-year, and ten-year plans. The clearer the business plans, the better for you.

Identify where you will work

One great advantage of being a tax preparer is its mobility. You can set up your tax preparation business at home or rent an office. Many tax preparers choose to work at home. Meetings with clients could be done in co-working spaces or quiet restaurants. For privacy, a home office can accommodate clients.

However, if your home is not suitable for receiving clients or doing your work, renting an office space may be a better option. You can rent a small office or find a good co-working space that you can rent for longer periods of time. As your business grows, you will want to find a designated space or tax office so you can have year-round hours.

Set a budget

Of course, this is a crucial step. Building a tax preparation business has minimal start-up costs. However, that doesn’t mean that you should splurge your entire budget in one go. Calculate how much you can invest and prioritize the essentials first.

Identify recurring expenses

The easiest to budget to make is the one for recurring expenses. This is the type of expense that you can easily estimate due to the schedule. Create a spreadsheet that tracks your daily, weekly, monthly, quarterly, and yearly expenses.

Here’s a list of the usual recurring expenses:

- Tax preparation software

- PC/Laptop software programs

- Continuing Education

- Office Supplies (i.e., paper, envelopes, toner, etc.)

- Equipment (especially those that were purchased with payment installments)

- Utilities (i.e., communications, electricity, water, etc.)

- Office rent

- Licenses and Permits

- Payroll / Employee Salary

- Insurance

- Tax deposits

- Marketing/Advertising costs

Estimate your initial budget by reflecting on your own monthly expenses. For items or services that you do not personally use, research the current prices in the market.

Knowing your expenses per month will help you determine how much to charge your clients. Your fees should be able to cover your expenses.

Classify the type of expense over a specific period of time

Once you’ve checked all your recurring expenses, classify them into fixed and variable. You can argue that there are no fixed costs because all expenses change over time. You can account for such change by budgeting in distinct timelines: have short-term and long-term budgets.

When you are starting your business, you’ll want to plan short-term budgets of three months and six months. Once the set amount of time has passed, review your expenses and make any necessary adjustments to your budget. After you’ve gotten a hang of short-term budgeting, you can plan your long-term budgets: one year, three years, and five years.

For fixed costs, you can create estimates for longer periods of time. However, for variable costs, you need to create estimates based on the trends you can see. In this case, reviewing your expenses every month, quarter, and year will help you improve in creating those estimates.

TIP: Find out what expenses you need to pay as a one-time outlay only. Create a separate spreadsheet for these to avoid recurring reminders.

Determine how much you will charge

Now that you’ve outlined how much your business will cost, it’s time to check how much you can charge your clients. Aside from the expenses, you also have to factor in non-variable factors such as your expertise, time, and the current market.

Most often, time and expertise are computed the same way. The idea is the higher your expertise, the faster you can get things done. However, in the tax business, it is not speed alone that clients demand, but also accuracy. Additionally, the more experience you have gives you more confidence. A confident tax preparer makes the client feel better about choosing you.

Another way to determine how much you’ll charge is by looking at the current market. You don’t want to be undercharging or overcharging due to a lack of information about standard rates in your area. Tax preparation rates will differ depending on whether you’re in New York or in Dallas.

Understanding the current market also means checking your competitors’ rates. You don’t want to be offering rates that are too low or too high compared to your competitors. If your rates are too high, you might lose business to other tax return preparers.

Review scenarios

Once you’ve made an estimate of expenses and potential profits, plan for contingencies. Envision “what if” scenarios to determine how you might make adjustments to your budget. Here are some questions to ask yourself:

What if sales go up to 10%?

What if expenses double in 3 months?

What if there are unforeseen expenses?

What if your clients triple in 3 months?

What if you need to pay a penalty?

Envisioning these scenarios and planning contingencies to address them will help you manage your budget well.

Combine all data and create your initial budget

When you have gathered your data, start creating your initial budget. Keep in mind that you need to review and analyze your expenses and profits every month. Learning how to manage your budget will lessen the pains of maintaining and expanding your business. As time passes, managing your budget won’t be as daunting as it was initially.

Essential Office Supplies

Technology has advanced and improved the way businesses are done. Even the tax industry has evolved with the emergence of tax programs and electronic filing. However, tax preparation is still an administrative type of business. So investing in essential office supplies can ensure productivity and efficiency in your practice.

Most tax forms are available to download on the IRS website. The IRS has detailed instructions for each one for easy reference. You can fill up forms using the Adobe Acrobat PDF Editor. Once ready, file the forms via the e-File application.

You may find that not all clients want to file their returns using the IRS e-File system. Clients who opt for paper filing their tax returns include those with concerns about the security of their financial data. Some clients may not be eligible for an e-filing option. In 2018, IRS still received 13,628,000 paper tax returns.

To handle paper filing,order available tax forms from the IRS for a limited quantity. Expect the forms to be mailed after ten business days. If you have regular clients who prefer paper filing, make sure to order forms as soon as you can. Tax forms for the calendar year filing are available for ordering as early as December 1 of the previous year. Paper filing is not as common as it used to be. You’ll want to allot additional time for preparing and mailing paper forms.

If you’ve exceeded the limit for ordering tax forms from the IRS, you may purchase IRS tax forms from Amazon and Staples.

TIP: Order red ink forms from the IRS, instead of printing these on your own. Red ink forms such as Form W-2 or 1099s are specialized. If your self-printed red ink form is rejected by the IRS scanner, you will be penalized.

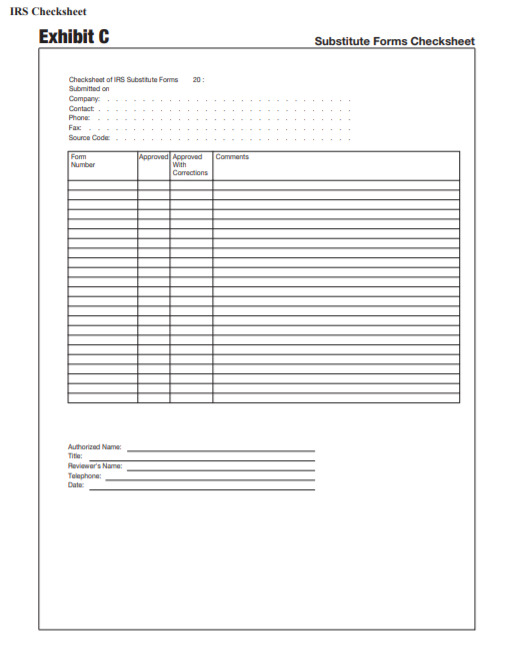

Printing your own tax forms means that you are applying for substitute forms. The IRS must pre-approve how you print these forms. Printing mistakes could damage the IRS’s scanning machine and could cause delays. To get approval, you must submit an application for review via email.

Steps to applying for substitute forms approval:

Getting Tax Forms

Most tax forms are available to download on the IRS website. The IRS has detailed instructions for each one for easy reference. You can fill up forms using the Adobe Acrobat PDF Editor. Once ready, file the forms via the e-File application.

You may find that not all clients want to file their returns using the IRS e-File system. Clients who opt for paper filing their tax returns include those with concerns about the security of their financial data. Some clients may not be eligible for an e-filing option. In 2018, IRS still received 13,628,000 paper tax returns.

To handle paper filing, order available tax forms from the IRS for a limited quantity. Expect the forms to be mailed after ten business days. If you have regular clients who prefer paper filing, make sure to order forms as soon as you can. Tax forms for the calendar year filing are available for ordering as early as December 1 of the previous year. Paper filing is not as common as it used to be. You’ll want to allot additional time for preparing and mailing paper forms.

If you’ve exceeded the limit for ordering tax forms from the IRS, you may purchase IRS tax forms from Amazon and Staples.

Printing your own tax forms means that you are applying for substitute forms. The IRS must pre-approve how you print these forms. Printing mistakes could damage the IRS’s scanning machine and could cause delays. To get approval, you must submit an application for review via email.

Steps to applying for substitute forms approval:

(Not something many individuals do, but it is a solution)

- Create one single PDF file of all the forms with a dummy account.

- Do not use your client or employee’s details

- All the forms that you would need should be in one continuous PDF

- You can only submit a total of 15 forms per submission

- Create a cover letter or statement that details your request to print substitute forms.

- Create a check sheet of all the forms you included

- Email the 3 PDFs (i.e. tax forms PDF, cover letter, and check sheet) to substituteforms@irs.go

- Email subject should be “PDF Submissions”

- Make sure that all attachments do not exceed 2.5 MB. You may zip your PDF to decrease the size of the files.

If there are problems submitting via email, you can mail the forms to the address below:

Internal Revenue ServiceAttn: Substitute Forms Program

SE:W:CAR:MP:P:TP

1111 Constitution Ave. NW, Room 6554

Washington, DC 20224

For your reference, you can learn more at Publication 1167: Guidelines related to Substitute Forms.

Using the Right Paper

Tax forms can be purchased from suppliers aside from the IRS. When dealing with a tax form supplier, you must ensure that the forms comply with the guidelines. Official IRS tax forms are printed in either an 18-pound ANSI C paper size or a 50-pound offset book paper.

If you were approved to print out substitute tax forms, you don’t have to use the IRS’ official paper standards. Substitute tax forms can be printed on standard letter size (8 ½” x 11″). However, make sure that the thickness of your paper is not less than 0.003 inches. If the paper is too thin, it will be rejected by the scanning machine.

Whether you do a paper filing for your client or give them a copy, you would need a reliable paper supplier.

Where can I get paper?

When starting a business, it’s better to scout for paper suppliers available in your area. Get your mail and shipping supplies from your paper suppliers, too. Shop around for your business’ envelopes, mailing labels, and stationery.

The easiest way to get suppliers is through referrals. Ask your friends and family for recommendations. You can also check out Paper Index’s directory of paper suppliers and find one near you. But for your information, here are the top paper suppliers in the US:

- Horizon Paper

The Horizon Paper company has been in the business for more than 40 years. It operates in 13 service locations and has partnered with 37 paper mills across the nation. Horizon Paper prides themselves on good customer service. Customers can open an account on their Customer Portal for easy ordering and monitoring. Horizon Paper is certified with the Forest Stewardship Council® Chain of Custody and Sustainable Forestry Initiative!® Chain of Custody. - Kelly Paper

The Kelly Paper company has dealt in printing papers from world-class manufacturers around the globe for more than 80 years. It offers a wide array of paper products including envelopes and specialty papers. It has 42 stores nationwide; mostly near the West Coast. Similar to Horizon Paper, Kelly Paper also has a customer’s webpage for faster transactions and monitoring orders. - International Paper

The International Paper company is one of the world’s leading paper suppliers. They operate in more than 24 countries. In the US, they have over 200 facilities. They provide various paper products for different types of businesses. - Staples

For office supplies, you can count on Staples. They stock different brands of paper products and other office supplies that fit everybody’s needs. They have available customer programs that give rewards and discounts. You can either order supplies online or go to any of the hundreds of stores nationwide. - Amazon

Everything anyone needs is now online, especially on Amazon. Check out their office products section. Amazon makes ordering supplies online convenient and easy. If you’re on Amazon Prime, you’ll have the advantage of one-day shipping as well. - Costco or Sam’s Club

Being a member of a big box store enables you to buy paper at discounted prices. That’s an appealing benefit. In the early days, you can order paper on your own whenever you have the need. As your business grows, you’ll find it more convenient to ask customer service to set up a recurring order for you.

Invest in a Reliable Printer

Aside from printing tax forms, you’ll be printing memos, contracts, and invoices in your business. As a tax preparer, you’ll be printing possibly thousands of tax forms every year. A basic tax return with multiple schedules would be printed on a minimum of 12 pages. A bank product could easily go for over 40 pages. If you are mailing any returns, you can expect to print many more pages.

You’d be wise to invest in a quality printer that’s up to all these tasks. Additionally, no matter what printer you settle on, be sure to stock up on backup toner cartridges.

What printer should I get?

If you are buying a printer for your business, it’s best that you choose a laser printer instead of an inkjet. Laser printers can handle heavy-duty printing tasks. Inkjet printers are more appropriate for home use where printing is only done on occasion.

Another advantage of a laser printer is its superior printing rate. When you’re working with high-volume printing, speed matters

As for drawbacks, you may find that some laser printers do not excel in printing images such as photos. However, this should not be an issue since the nature of your business revolves around text-based documents without photographic imagery.

Another feature to consider is the level of noise produced by the machine. If you work in a small room, you might find a noisy printer rather disruptive.

You may also want to consider whether you will buy print-only or multi-function printers. Print-only printers can improve output efficiency as the whole device is dedicated to a single task. On the other hand, multi-function printers provide versatility, handling various office needs such as printing, copying, and scanning. Choose which type best suits your needs.

Here are our recommendations for printers that can offer high-quality output at a high volume.

The HP LaserJet Enterprise Printer is a printer that can deliver good results in as fast as 5.3 seconds. In a month, it can handle a total of 250,000 papers per month. This means you can print an average of 12,500 papers per day. As per speed, it can print 55 pages per minute. This printer is only available for printing in black ink. However, it produces high-quality resolution with 1200 x 1200 dpi. Although this printer is a little pricey, it’s a good investment because HP is known for its durability.

This is Techradar’s top pick for best laser printer of 2020. It hits all the high marks, offering impressive speed, load capacity and monochrome print quality. Plus this a duplex printer, making it easy to print on both sides of the paper. The B600DN boasts a print rate of 55 pages per minute. Its main loading tray holds up to 550 sheets, and its fold-out multipurpose tray can hold 150 sheets, or alternatively, cards, envelopes or letter headed paper. Text documents come out in crisp, clear 1200×1200 resolution. The initial purchase cost may be a little high, but the B600DN is actually an economical choice due to its low running cost.

Another speedy output printer is the Lexmark XM5163. It can print up to 250,000 pages per month at a speed of 55 pages per minute. It supports print outputs in 17 paper sizes. It features a paper tray that accommodates 4,400 sheets of 20 lb paper. In terms of operating noise level, it emits only 56 decibels. This printer is built for heavy-duty use and durable to last for years.

Brother’s top-selling printer is the MFC-L8900CDW model. It has print, scan, copy, and wireless networking capabilities. It produces 2400 x 600 dpi print resolution at both black and color ink outputs. Its printing speed is a decent 33 pages per minute. In a month, this model can produce approximately 60,000 pages. The Brother MFC-L8900CDW also features a Toner Save mode that helps reduce toner consumption.

A sturdy workhorse of a printer with high-speed duplex printing capabilities. It’s fairly compact and a good fit for small offices or working from home. Plus it’s very affordable. The Brother HL-L5100DN can hold as many as 300 sheets of paper in its two loading trays. Its print rate of 40 pages per minute is nicely suited to small office needs. The image and photo printing quality leaves much to be desired, but that’s par for the course for printers at this price range. More to the point, its text printing quality shines. You’ll get nicely sharp and legible results at 1200 dpi resolution.

Getting a printer is a major investment. Take your time in purchasing one. Do your own research on the available printers in the market. Consider your budget and the specs you require in deciding which printer to buy.

Get a Reliable Laptop

Even if you have an office, it’s good to have the mobility afforded by a laptop. Most tax preparers will benefit from having one. A laptop comes in handy if ever you need to work outside the office. You can conduct various operations and transactions using the laptop: online communication, research, marketing. and purchasing equipment or supplies.

You will certainly need either a laptop or desktop to run your office. Your device will help you keep records of your clients, prepare their taxes, and file returns on the IRS e-File system.

What type of laptop should I get?

Not all laptops are created equal. It’s essential to know what specifications you need for your business. Budget is also a big factor. Getting the right laptop would mean finding one the fits your needs without overpaying for it.

The first consideration when buying a laptop or desktop for your tax preparation business is matching the required specifications of your tax preparation software. Preparing taxes will be more difficult if your laptop is not suited to your software.

The second consideration is the amount of software you need for your business. Maybe you need a laptop that matches your Point-of-Sale (POS) device. Maybe you need one that can store your client’s large financial data. Identify the programs and amount of storage you need so you can fit the laptop’s specifications to it.

Without other considerations, an ideal laptop or desktop should have at least an Intel i5 processor or equivalent. It should also have at least 4GB RAM and 256GB solid-state drive (SSD). These minimum specifications guarantee that your tax preparation software and other extra programs will run smoothly.

In the meantime, here are some of the recommended laptops and desktops for a start-up tax preparation business:

Asus has done the wonderful job of delivering an affordable business laptop that runs on the Intel quad-core i7-1165G7 (11th gen). Though if you’d like to save a few more bucks, you can opt for an i3-1115G4 or i5-1135G7 model instead. If you’re using it as a work laptop, you’ll probably be fine with an i5. This ZenBook has a pleasing lightness and a smart-looking metallic chassis. The keyboard is very comfortable to use. The laptop performance rates somewhere along the lines of an 8 out of 10, while avoiding any temperature issues. It is equipped with a 14-inch IPS matte screen—the FHD 1W option is recommended for its balance of quality video resolution and energy efficiency.

This great budget laptop retails in the $650 range. It packs power with its 8th generation i5 processor, 8GB RAM, and 256 GB SSD. The Dell Inspiron also has a full-size Ethernet port that helps you connect to business networks. It’s equipped with a touch screen, so you can convert this laptop into a tablet for your clients’ easy viewing. This is a great laptop to use when you have meetings with clients.

Mobility is Surface Pro 7’s main feature. It only weighs 1.70 pounds. Detaching the keyboard can convert your laptop into a tablet. Again, it’s a great way to display your client’s tax forms for their review. Beyond that, this laptop has a 10th-generation i5 processor, 8 GB RAM, and 256 SSD. You can also purchase a digital pen, which comes in handy when you need clients to log their e-Signatures.

The budget-friendly Google Pixelbook Go appears poised to overtake the similarly-named Google Pixelbook in popularity. For a budget laptop, it’s got top-notch performance specs, a great screen, and impressive battery life. Indeed, its battery can generally outlast the Pixelbook by approximately 2 hours. The keyboard is tactile and comfortable in the best way. A 1070p webcam offers sharp video quality—just what you need for your Zoom meetings. One of its best features is its supreme portability. You can use it pretty much anywhere. If you use online tax software and you’re a fan of Chrome OS, this laptop is for you.

A MacBook Pro can also be a great investment for your business. Brand new Macs can be a bit pricey, so you might want to look for renewed or refurbished units costing around $800-$1000. The 13″ MacBook Pro 2019 sports an i5 processor, 8GB RAM, and 256 GB SSD. Before you do purchase a Mac, first check whether it’s compatible with your chosen tax preparation software. Most programs can run only on Windows computers. Of course, if you’re using an online tax application, it should work on Mac, Windows or Chromebook.

If you prefer to invest in a desktop instead of a laptop, you can use the Lenovo ThinkCentre M910. An upgrade from its predecessor, it comes equipped with a 7th-gen Intel Core i7 processor and an Intel Optane SSD. It is even Oculus-certified, if that matters. The ThinkCentre M910 is encased in a slim metal tower that does not take up a lot of space. The advantage of getting a desktop is that you can easily support a double monitor setup. That allows you to display your client’s data on one monitor and your tax preparation software on the other.

Find the Best Tax Software

These days, you’ll need professional tax software if you wish to start a tax preparation business. You cannot offer the efficiency and security demanded by modern clients without proper software. If you want to compete in the current marketplace, you must have professional tax software to provide a high level of service.

What should you look for in professional tax software?

You’ll find that there are numerous professional tax software options available to you. All of them provide the same basic output: your client’s tax returns. Still, there are several factors to consider before purchasing professional tax software.

- Ease of Use

Accuracy is essential when you are inputting your client’s financial data. Ideally, professional tax software should be user-friendly. A clear and simple interface goes a long way in avoiding inaccuracies that may arise from a misclick or two. You might ask, what makes a tax program user-friendly? Basically, it should have an intuitive user interface (UI). Ideally, every essential software function should be readily available and visible upon launching the program. For example, a good UI would display a quick access menu of all of the system’s main features. In addition to having a good UI, user-friendly software should be easily accessible to you. Is the tax program only available as a desktop application? A preferable tax program would also offer a web-based application that you can easily access outside the office. A web-based application can be handy for any last-minute revisions to your client’s tax forms. Web-based applications have grown in popularity since they can be so secure and the updates happen without user intervention. - PC/Mac Compatibility

Ideally, your professional tax software should be compatible with different operating systems. That gives you more flexibility to accommodate a variety of scenarios. For example, you might use a PC in the office and a Mac at home. If your program works on both, then you’ll find it easier to manage days when you find it necessary to stay home yet still work. It’s also possible that you might decide to change your Windows PC to a Mac, or vice versa. Migrating data systems can be a pain. That’s less of an issue with multi-OS compatible software. Avoid delays or loss of crucial data by using professional tax software that runs on Mac and PC. But the majority of professional tax programs are Windows-only, unless you use an online platform. - Type of Data Entry

Good tax software provides convenient data entry modes. Professional tax software commonly offers “Form” data entry. In the program, you will be shown the editable tax form to fill out as you would manually. Although it is practical to go through each detail line per line, this entry mode can take a lot of time. Some software products also offer an “Interview” mode for data entry. Instead of filling out details directly on the tax forms, you input your client’s data on a separate page. Details are grouped into categories. This data entry mode has the benefit of facilitating a more natural Q&A conversation between you and your client. As an example, one of the Interview categories is Personal Info. During your interview with the client, the program will prompt you to ask them for relevant personal info. You’ll enter their answers as data in the appropriate fields. After you save the data, it will be reflected on any tax form you use for that client in your software. That saves you some time and effort when working on that client’s tax return. - Tax Forms and Tax Filing Availability

You expect professional tax software to include all the federal and state tax forms you will need. Your business relies on that! It would hardly be convenient to use separate tax programs for your federal and state filing operations.Screenshot from CCH Small Firm Services | TaxWise 2016: Interview

- E-filing capacity

Most professional tax software products have at least basic e-filing features. The amount of e-filing you can do will depend on your subscription. At the lowest tier, you may be limited to e-filing a small number of returns. Should you file returns above the limit, you’ll pay additional fees. Therefore you might want to get a tax program that will let you e-file as many tax returns as possible. If you’re just starting your business, you can make do with limited e-filing access. But as you expand your practice and acquire more clients, you’ll want to be able to file as many tax forms as you can. As noted, tax programs with limited e-filing access will require you to pay additional fees to go over the limit. In the long run, this will not be cost-efficient for your business. Find a professional tax software that has unlimited e-filing included in your subscription. Then you won’t lose any opportunities of gaining more clients. - Customer Service

Early in your career, learning all the tips and tricks of your new professional tax software may be difficult. Your software provider should have easy-to-understand manuals and guides available. Better yet, a friendly customer agent should be accessible to answer your questions and help you learn the software. When there’s a new program update or a new IRS form, you’ll want to discuss the change with someone to aid you in fully understanding it. Getting advice from your tax software service agents is a great benefit! You can be assured of getting enough support to help you serve your clients better. - Budget-friendly

Last but not least, you’ll want to purchase professional tax software at a budget-friendly price. Your budget may be the most crucial factor in starting your tax preparation business. Of course, this does not mean you will purchase the cheapest tax program you could find. Your goal is to find professional tax software that provides value that will justify its price. Ideally, your best choice of professional tax software would be one that has all the features you need at a price that fits your budget.

The Best Tax Software for a Tax Preparation Business

UltimateTax is the best professional tax software for both new and seasoned tax preparers. Its features and services meet all the requirements for high-quality professional tax software, including a budget-friendly price.

- Ease of Use

UltimateTax provides easy-to-use software. Its default screen offers a series of icons on its toolbar at the top of the application. These icons give you access to the most used functions. You can set frequently used links and shortcuts for better navigation. UltimateTax also populates tax forms easily from saved data on the program. You won’t have to keep requesting previous data from your clients. Whatever data you saved from your previous meetings, you can easily populate on different tax forms available on the program. Additionally, UltimateTax comes in both English and Spanish versions. Set the program to the language you are most comfortable with. UltimateTax also has an e-Signature feature. No need for your clients to travel all the way to your office to meet you to sign in. It delivers services with convenience in mind for you and your clients. Another great feature is its web-based application. You can access the UltimateTax professional tax software by installing on your desktop or accessing it over the internet. This is a great feature if you prepare taxes from multiple locations. If you need it, UltimateTax offers onboarding to assist you in your initial setup. - PC/Mac Compatibility

No need to worry about your hardware and software compatibility. UltimateTax is compatible with both Microsoft and Apple OSes. You can use UltimateTax Desktop 1040 on your Windows computer. If you have a Mac or Chromebook, then use the UltimateTax Online 1040. UltimateTax’s desktop version can be installed on multiple workstations within the same network. At the start of your tax preparation practice, you may only need one desktop version. But as your practice grows, you may need to install more professional tax software on your employee’s workstations. UltimateTax does not require any additional fee for installing it. You can even save all tax returns you’ve prepared on your computer server for better data privacy and accessibility. Plus, for UltimateTax Online 1040, updates on the tax programs are automatically downloaded and synced to your devices — no need to spend any time manually downloading and installing updates. In terms of overall ease of use, UltimateTax provides great value. - Type of Data Entry

UltimateTax offers both “Form” and “Interview” data entry modes. Using the “Interview” data entry mode will make it a lot easier for you and your client to fill out all types of tax forms. Once you’ve saved the data, you can quickly populate all details in any electronic tax form you need. Building rapport with your client is highly recommended, as it can lead to repeat business. Using the “Interview” mode helps you with that. You’re interacting directly with the client, asking for details per category instead of per line in the tax form. Your questions will have a natural progression that feels convivial, rather than coldly professional. If you’re more familiar with the tax forms, you can choose the “Form” mode, instead. Either way, UltimateTax is flexible to make filling in data more convenient for you. - Tax Forms and Tax Filing Accessibility

UltimateTax is updated with all of the IRS’ new tax forms. You can feel assured that all tax forms prepared using the program are compliant with IRS standards. This goes for both federal and state tax forms. Yes, UltimateTax is compatible with e-filing in all states.**When using an UltimateTax Unlimited package - E-filing capacity

Another UltimateTax great feature is its unlimited e-filing capacity. If you choose UltimateTax, you can offer e-filing to all of your clients without limit. Expand your business and acquire more clients without incurring additional fees! UltimateTax’s unlimited e-filing feature even applies to your client’s back taxes. It also applies to any tax return extension your client might request. - Customer Service

UltimateTax prides itself on providing the best customer support for its customers. A knowledge base is set up so you can be updated with the latest trends in the industry. You also receive emails relevant to the tax industry. From November to December, UltimateTax offers one-on-one assistance to its users, as well. Training videos and FAQs are readily available to help anyone use the program. You can work on practice returns to get familiar with the program before dealing with any actual client work. For first-timers, a setup assistant is available to take you through the installation. You can seek help via a dedicated 365 Service Phone Number set up to handle inquiries. Get assistance over their toll-free phone support. During critical months, customer support is made available for extended hours. Not available for calls at the moment? Contact UltimateTax via email or chat. - Budget-friendly

UltimateTax has four products: the UltimateTax 1040 Online, UltimateTax 1040 Desktop , UltimateTax Online 1040+ Corporate, and UltimateTax PPR (Pay-Per-Return). Each product is valued at different prices to fit any tax preparer’s budget.Compared to other professional tax software, UltimateTax falls under the low-to-mid price range. However, based on price and features comparison, there’s no doubt that UltimateTax provides more value than the others. For any new tax preparer, investing in UltimateTax yields returns as you establish and expand your business. UltimateTax renews most of its customers from year to year.

Learn more about UltimateTax by getting the

first-hand experience.

Click on the links below for your free demo:

Compared to other professional tax software, UltimateTax falls under the low-to-mid price range. However, based on price and features comparison, there’s no doubt that UltimateTax provides more value than the others. For any new tax preparer, investing in UltimateTax yields returns as you establish and expand your business. UltimateTax renews most of its customers from year to year.

Compared to other professional tax software, UltimateTax falls under the low-to-mid price range. However, based on price and features comparison, there’s no doubt that UltimateTax provides more value than the others. For any new tax preparer, investing in UltimateTax yields returns as you establish and expand your business. UltimateTax renews most of its customers from year to year.