The refund transfer is a deposit product that allows clients to settle their preparation fees or accounting fees without making an upfront payment. Instead of paying you directly for services, the clients agree to have your fee deducted from their tax refund. A refund transfer is also known as a bank product or settlement solution.

It is a win-win solution. The clients will receive their tax refund from federal and/or state agencies. They will not need to wait for the refund to arrive in their mail or bank account. In turn, your business enjoys hassle-free payment fulfillment. This allows you to have your fees withheld as the confidence to your client so you do not have to worry about payment.

The refund transfer provides tax preparers with an effective settlement solution that has benefits for both you and your clients. Let’s take a closer look at how they work.

How Does a Refund Transfer Work?

The refund transfer is a vehicle for withholding part of a client’s refund to pay for the fees they have incurred. The client gets to receive the tax refund quicker (compared to a mailed refund), minus the withheld amount. This also saves the client from facing any further out-of-pocket expenses related to the tax preparation services.

As a tax preparer, you can offer this bank product to clients who are eligible for this solution. A client can qualify after you have prepared their tax return and found that they are due for a refund.

Keep in mind that a refund transfer is optional. As the tax preparer, take time to discuss the idea with the client. Explain to them how a refund transfer works. Be transparent! Let your client know that they will incur an additional fee if they take advantage of the bank product as the confidence to not pay for your services upfront. These may include a refund transfer fee.

Despite the fees, the process offers so much convenience that it is easily worthwhile to do it. Let’s take a look at how tax products benefit the client—and the tax preparer, too!

What Are the Benefits of a Refund Transfer?

Client benefits:

- No further out-of-pocket expenses for tax preparation service

- Flexible refund options (i.e. check, debit card, direct deposit)

- Access to loans depending on the amount of expected tax refund

Tax preparer benefits:

- Receive payment for your tax preparation services

- Increase client satisfaction with a range of tax solutions: loan products, debit cards, secure checks printed in your tax office, and access to new products such as a mobile app.

- The more refund transfers your office offers, you can get free software and financial incentives based on volume.

- Offer additional tax services to ongoing and new clients

Both clients and tax preparers enjoy a number of benefits from utilizing bank products. Clients get to receive their tax refunds possibly quicker. Tax professionals get paid electronically and can earn additional income from offering the services.

Shortly after you finish preparing your clients’ taxes and confirm their tax refunds, you can offer a bank product that lets them have their fees taken out of the refund. You can also offer advances on their refund so they can get an advance before the IRS deposits their refund. That’s a great way to achieve high customer satisfaction!

If your client chooses a bank product, there’s no need to trouble them for the payment of your tax preparation services as well. Instead of asking your client to pay you, you can offer to withhold the payment for your services out of the refund they will be getting. Clients won’t have to pay you out-of-pocket! That’s yet another boost to customer satisfaction.

Steps in the Refund Transfer Process

Step 1: Gain your client’s approval

You must first complete a client’s tax return and determine if the client should be receiving a refund. Discuss the idea with the client. Help them understand what a refund transfer is and how it benefits them.

Always be transparent about the fees involved. Make sure that the client is fully on board before moving on to the next step. Highlight the convenience it offers them.

If your client chooses a bank product, your client must sign the Due Diligence forms and the bank product application documents.

Ask your client to choose whether to get their refund via check, direct deposit, or debit card. If you are approved as a preparer you can offer your clients an advance on their return.

Your clients must also know that a refund transfer is not faster than an IRS direct deposit but offers confidence of not going to their account and having the fees withheld.

Step 2: Offer a refund advance

Clients may seek easy application loans to answer their immediate needs. As a tax preparer, you can offer loans depending on the amount of your clients’ refund amount. Offering advances to your clients is confidence to your clients. If you do not offer advances many clients will find other ways and pay additional fees to get part of their refund early.

These types of loans are known as refund advances. They make it possible for a taxpayer to obtain their refund in hours to a couple of days, instead of waiting for a traditional refund disbursement.

Step 3: Client receives a tax refund

The refund transfer is arranged through a refund settlement bank. Such a bank will have special authorization to deduct fees from tax refunds provided by federal and state agencies. The bank is then tasked with redistributing the remaining amount of the tax refunds to the taxpayer.

As the tax preparer, you provide the client with the service of arranging the refund transfer. You also manage the disbursement of the tax refund. If you use UltimateTax, you can offer a range of refund options. Clients can receive the refund via check, debit card, or direct deposit.

If a client has arranged for a refund advance, the bank will send the loan amount to your client even before the IRS has confirmed and issued the refund.

Step 4: Collection of fees

As noted above, the refund settlement bank deducts a portion of the refund that the IRS is providing to the taxpayer. The amount deducted includes both the bank’s fees and your fee as the tax preparer.

The amount may include other fees as well:

- Transmitter fees: paid to the company that develops the tax software program

- Technology fees: paid toward the costs of programming the tax software system

- Service bureau fees: paid to a third-party company providing related services

There are a few fees for this service they are normally explained as one additional fee for the refund settlement. As with any business, there are multiple fees that get combined into one fee. Take your electric bill, for example, it has multiple different fees just to provide you service to your business or home. For you, the fee that matters is the tax preparer’s fee. The bank will distribute this fee to you. This is usually done through direct deposit.

How a Refund Transfer Benefits Your Business

Want to know “what’s in it for me?” When you arrange a refund transfer with UltimateTax, here’s what you get:

- We allow you to add fees to be paid back to you.

- Offer your client’s proven services.

- Earn more with UltimateCash.

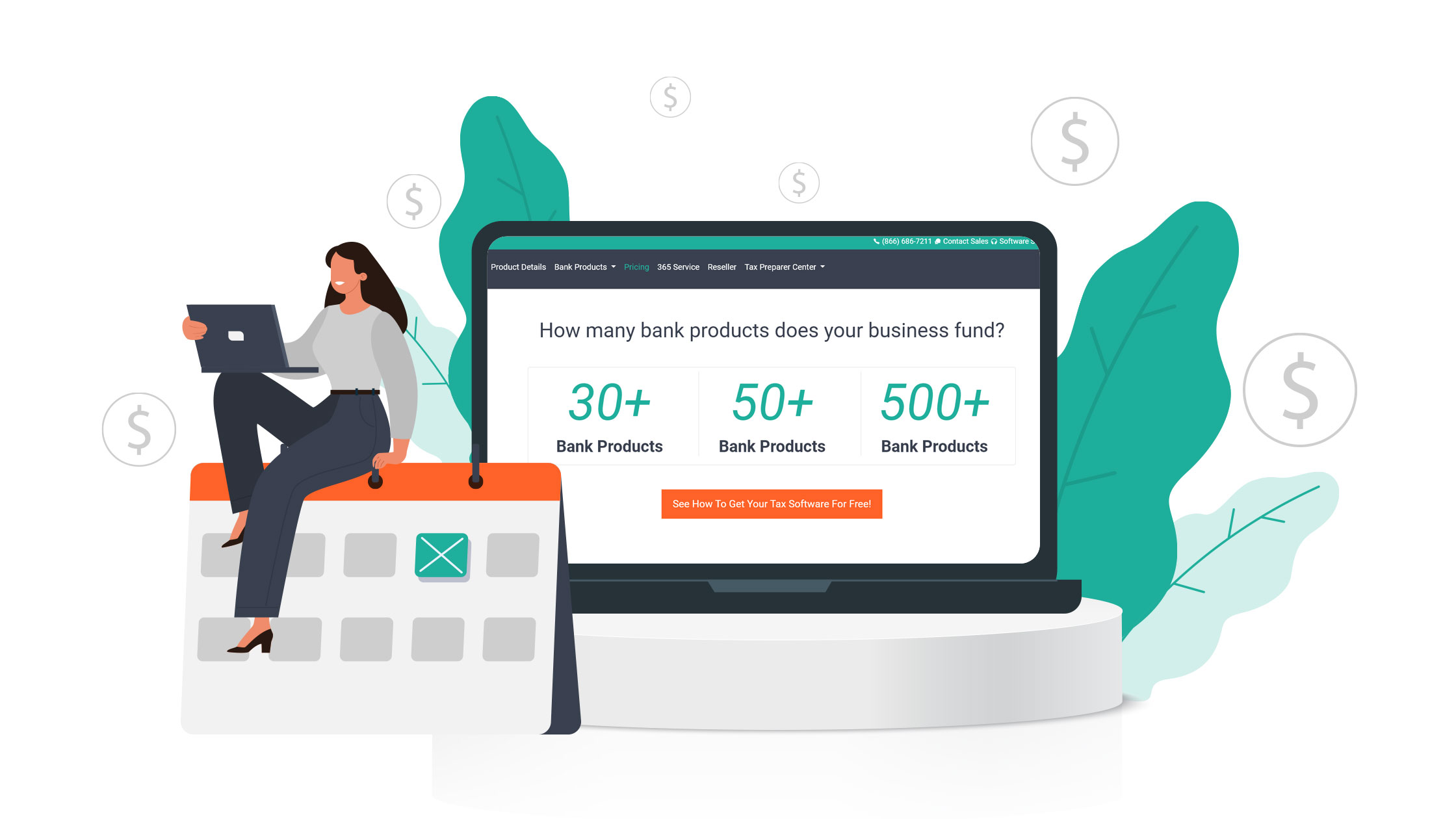

- Get UltimateTax Professional Tax Software for FREE when you fund 30 bank products or more each season with TPG or Refund Advantage as a bank provider.

This is a quick and easy guide to refund transfers. For a more complete guide to refund transfers, check out our article on integrated bank products designed for tax preparers.

The article provides a lot more information. It offers details about the preferred banks that offer refund settlement solutions. It provides a guide on how to start offering bank products.

The easiest way to start offering refund transfers is to subscribe to tax software with bank products. What are the best bank products for tax professionals?