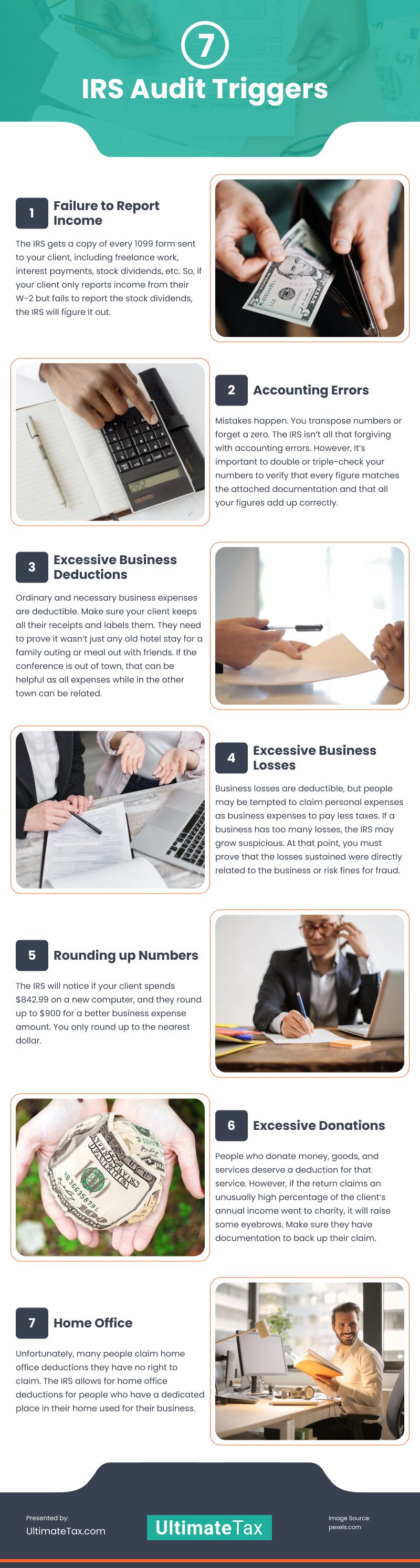

As a tax preparer, you want to be aware of the most common scenarios that trigger an IRS audit to avoid the pitfalls. An audit examines tax return data to verify it’s correct. As long as you have documentation to support the numbers and are honest in your report, you should be good, but some red flags get their attention like:

Failure to Report Income

The IRS gets a copy of every 1099 form sent to your client, including freelance work, interest payments, stock dividends, etc. So, if your client only reports income from their W-2 but fails to report the stock dividends, the IRS will figure it out. They take a dim view of people hiding income, and you and your client will face an audit.

It’s important to review all types of income so your client doesn’t forget to give you information. Of course, if they withhold that information from you in their efforts to deceive the IRS, you will need to prove you asked them the questions and what their response was to avoid difficulty. Never skip a question when using professional tax software for tax preparers; the software will help you tick off all the boxes.

Accounting Errors

Mistakes happen. You transpose numbers or forget a zero. The IRS isn’t all that forgiving with accounting errors. However, It’s important to double or triple-check your numbers to verify that every figure matches the attached documentation and that all your figures add up correctly.

The best tax professional software will calculate the numbers for you. As long as the numbers match the documentation, you shouldn’t have any problems. Proof everything before asking the client to review the information and sign the return. Two eyes are better than one.

Excessive Business Deductions

Ordinary and necessary business expenses are deductible. Let’s say your client is an author. You must be able to justify that any author would use the expense. Do they need a computer? Of course. Internet? Sure.

How about a writer’s conference? Yes, you can link the expenses directly to the client’s career, and many authors make connections that lead to book deals at these conferences or learn more about their craft. Make sure your client keeps all their receipts and labels them. They need to prove it wasn’t just any old hotel stay for a family outing or meal out with friends. If the conference is out of town, that can be helpful as all expenses while in the other town can be related.

A family ski trip because the author’s spouse is a member of the author’s LLC, on the other hand, does not qualify as the trip is not an ordinary author expense or necessary to their business.

Excessive Business Losses

Business losses are deductible, but people may be tempted to claim personal expenses as business expenses to pay less taxes. If a business has too many losses, the IRS may grow suspicious. At that point, you must prove that the losses sustained were directly related to the business or risk fines for fraud.

An audit may come months or years after the loss, however. The best way to handle this is to train your clients to note the purpose of the expense on the receipt or in their QuickBooks software so they don’t have to try and remember every detail. Twenty seconds at the time of purchase could save them hefty fines later.

Rounding up Numbers

The IRS will notice if your client spends $842.99 on a new computer, and they round up to $900 for a better business expense amount. You only round up to the nearest dollar.

Excessive Donations

Deductions for charitable donations are there to encourage people to step up. People who donate money, goods, and services deserve a deduction for that service. However, if the return claims an unusually high percentage of the client’s annual income went to charity, it will raise some eyebrows. Make sure they have documentation to back up their claim.

Home Office

Unfortunately, many people claim home office deductions they have no right to claim. The IRS allows for home office deductions for people who have a dedicated place in their home used for their business. Setting up your laptop on the kitchen table, which they mainly use for family meals, won’t cut it. Turning the second bedroom into an office, on the other hand, will work nicely.

You’ll need to ask for the room dimensions and decide the percentage of living space used for business purposes. Then, deduct that percentage of the utilities and rent (or mortgages and taxes). The laptop in the office qualifies as business equipment, but your client’s child’s laptop used for school assignments is not. Accounting tax software? Yes. Personal accounting software not used in a business? No. Remind your client that the risk of making false deductions isn’t worth the possible audit and fines if the IRS catches them.

It’s Mainly Common Sense

It’s fairly simple: Back everything up with documentation and be able to justify it if you get audited. You won’t need to worry if you have all your ducks in a row.

Infographic

Tax preparers should be aware of common scenarios that could trigger an IRS audit. It is crucial to provide documentation to support the numbers and be honest in reporting. Certain red flags may attract the IRS’s attention. Check out the infographic for more details.