As a tax preparer, you may have noticed that some professional tax software products support bank products. Should this feature affect your decision of which tax software subscription to get? How important are bank products? What are bank products?

To put it simply, bank products are pay-by-refund solutions that let clients get their taxes done and pay later, while tax preparers receive their fees without hassle.

Is it a good idea to offer bank products to your clients? Yes, it is! When a client signs up to use bank products, you can take your fee out of the client’s refund. You will not have to wait for the client to get around to paying you, which is a great convenience for you and your client.

Also you do not know the financial situation of a tax client. You might see that they have income, but you do not know their current ability to pay your invoice.

This article will explain bank products, show how they benefit tax preparers and their clients, and offer advice on selecting good tax software with bank products.

What Is a Bank Product?

A bank product is a refund disbursement option that provides the means for clients to settle their fees without making upfront payments. The fees are deducted from the client’s tax refund,. No need for the client to wait for their tax refund to arrive in their mail or bank account if they do an advance

Your fee as a tax preparer also comes out of the client’s refund. Your client will not have to pay out of pocket to settle their tax preparation bill! This is a great convenience to the client.

A bank product can also be known as a tax product, refund transfer or settlement solution. It is offered by a specially-authorized bank or financial company in partnership with a professional tax software application. Tax preparers using the appropriate tax software can easily offer bank products to their clients safely and securely.

The convenience of tax products does come at a price. There can be a few fees that make up the total fee, which is normal in any purchase transaction. The taxpayer will need to pay a bank fee, a service bureau fee and possibly other fees referred to as the bank fee. However, they do not have to pay out of pocket to settle these fees. All such payments are deducted from the taxpayer’s refund.

What Are the Benefits of Tax Products?

Customer satisfaction is a big concern for any tax preparation office. You are always looking for ways to make clients feel like you are looking out for their interests. One way to do that is to tell them about the benefits of a refund transfer or bank product.

While the client does incur a fee by using a bank product, the benefits easily outweigh the minor expense involved. Let’s take a look at what the taxpayer gets out of it:

- By choosing a direct deposit or advance they can get their refund quicker than a mailed IRS check.

- They can get an advance of their tax refund immediately if they opt to receive a refund advance. This is a type of loan based on the amount of the tax refund.

- They don’t have to pay tax preparation fees directly. Instead of making a payment to you, the client will have the owed fee deducted from their refund.

- They enjoy flexibility over the disbursement options to use in receiving their tax refund. Direct deposit, check and debit card are common options.

You can offer speed and convenience to your clients by giving them the option to use tax products. That is quite appealing from a customer’s viewpoint.

How Can Tax Products Benefit Tax Preparers?

Now that you’re aware of the benefits to taxpayers, you’ll want to know what are the benefits of bank products to you? Here is a quick rundown of their benefits to tax preparers:

- No-hassle payment settlement! You won’t have to wait for your client to get around to paying your tax preparer’s fee!

- Grow your tax business. Offering additional payment options will help you appeal to new clients. Your client may not always do a bank product but they might their first year.

- Boost client satisfaction! Offer them a number of appealing tax solutions obtainable via bank products, such as loan products, debit card and credit card balances.

- Generate additional revenue! You can offer clients loans based on the amount of the refund they are getting. That’s a good way to bring in extra revenue on top of your tax preparation services.

- Enjoy various bonuses and benefits! Tax product programs often offer attractive incentives for tax preparers.

Tax products and tax preparation services have good synergy with each other. As soon as you have prepared a return, you know the tax refund that your client is going to get, and then get the tax product process going.

Using Tax Software with Bank Products

Have you decided to offer tax products to your clients? How can you get started? It’s really very simple. You can subscribe to professional tax preparation software that supports tax products.

Many of the top professional tax software programs include bank products as a key feature. If you are researching what software to get, take a look at this helpful Professional Tax Software Comparison Chart. It includes information about which software programs offer tax product integration.

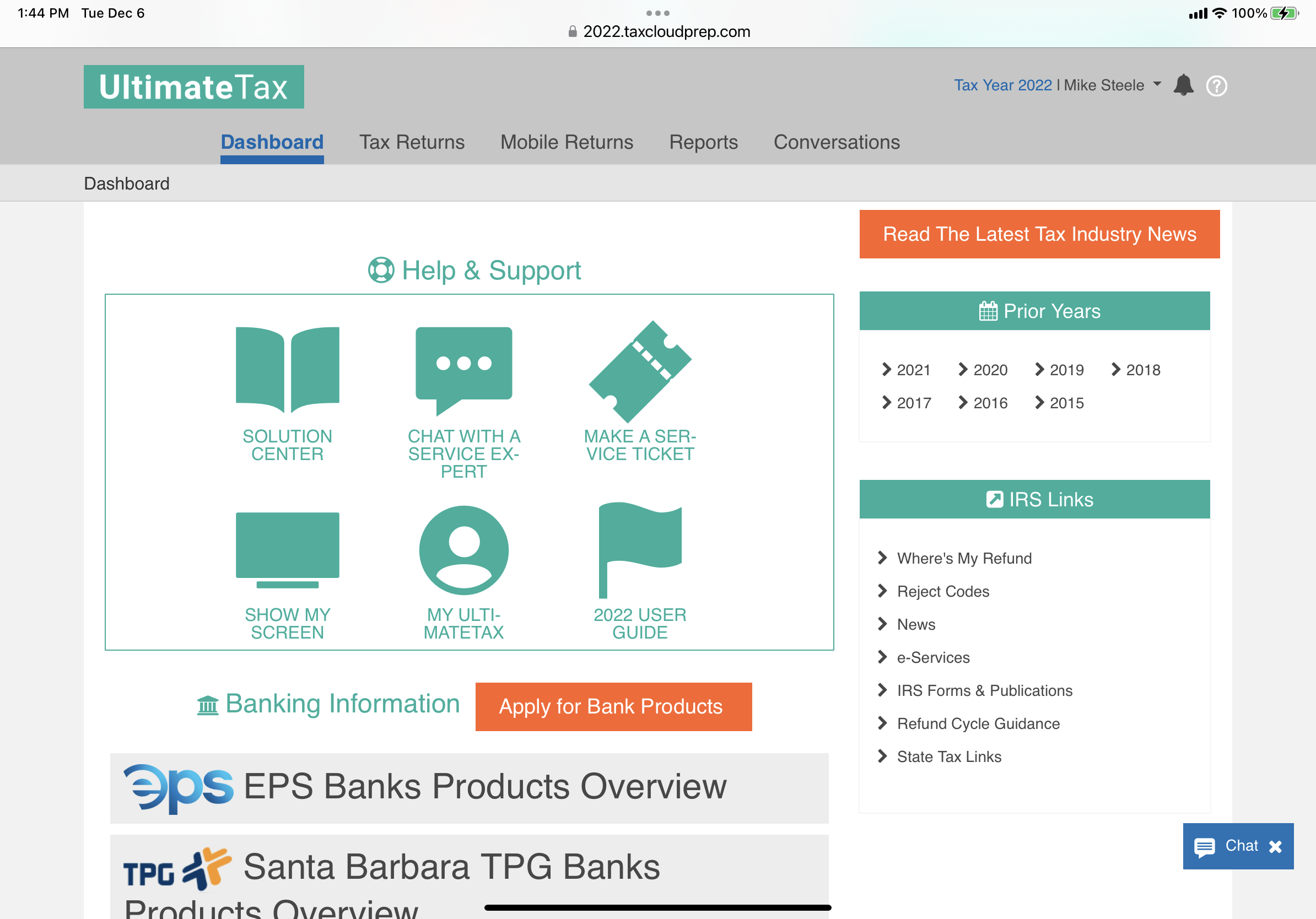

Tax software programs may support several different bank providers. The most well-known providers include Santa Barbara TPG, EPS Financial, Republic Bank and Refund Advantage. Which provider should you go for? To get some pointers, read this article: The Best Bank Products for Tax Professionals

CrossLink, Intuit ProSeries, TaxWise and UltimateTax are among the professional tax preparation software that offer tax products. CrossLink supports Santa Barbara TPG. Intuit ProSeries supports Santa Barbara TPG and Refund Advantage. TaxWise supports Santa Barbara TPG, Refund Advantage and EPS Financial.

Like TaxWise, UltimateTax supports Santa Barbara TPG, Refund Advantage and EPS Financial. UltimateTax also provides a great bonus incentive for the software’s subscribers. They can get UltimateTax software for FREE if they are able to fund 30 bank products or more each season with TPG as a bank provider.

That’s quite a deal! A free subscription to professional tax preparation software is definitely worth checking out. Try a free demo of UltimateTax Professional Tax Software today!