Remember your first tax season? The endless stacks of paper, racing between client meetings, and hoping your office printer wouldn’t break down at the worst possible moment. Now imagine handling all that from anywhere, with everything you need at your fingertips.

The virtual tax office isn’t just for big firms anymore. Small practices and solo preparers are discovering they can serve clients better, work more efficiently, and grow their businesses—all without the traditional office overhead.

What Is a Virtual Tax Office and Why Should You Care?

A virtual tax office is a remote setup where you prepare taxes and serve clients without a physical office space. You get professional tax software that lets you work from anywhere, a secure client portal for document sharing, and video conferencing tools for client meetings.

Compared to traditional tax offices, you’re replacing paper files with secure digital storage, in-person meetings with video calls, and physical signatures with electronic ones. The work is the same—you’re still preparing returns, advising clients, and handling tax matters. The difference is how you deliver these services: digitally, securely, and more conveniently for both you and your clients.

5 Benefits of Running a Virtual Tax Office

Running a virtual tax office improves how you serve clients and grow your business. The switch to virtual brings benefits that solve many common headaches tax preparers face every season. Here’s what makes it worth considering:

1. Cut Overhead Costs Without Sacrificing Quality

Say goodbye to monthly rent, utility bills, and office maintenance costs. When you go virtual, your biggest expense is your tax software subscription. That means more of your revenue stays in your pocket. Many tax preparers find they can reduce operating costs significantly without cutting any services or quality for their clients.

2. Freedom to Work from Anywhere

Your office is wherever you open your laptop. Whether you’re at home, traveling, or just want to work from a coffee shop for a change of scenery, you can securely access all your client files and tax software. This flexibility lets you balance work with personal life in ways a traditional office never could.

3. Serve More Clients, No Matter Their Location

Without the limitations of a physical office, you can work with clients anywhere (state regulations permitting). You’ll welcome referrals regardless of their location. Virtual meetings and secure document sharing mean you can serve clients across town or the country. Many tax preparers find they can handle more returns in less time.

4. Top-Tier Security

Professional tax preparation software protects client data better than physical offices. Secure data centers encrypt and backup all your client information automatically. You’ll never worry about office break-ins, computer crashes, or lost files again.

5. Meet Client Expectations with Ease

Today’s clients expect convenience. They want to upload documents from their phones, sign returns electronically, and meet virtually when it fits their schedule. Going virtual lets you meet these expectations while providing the same professional service they trust.

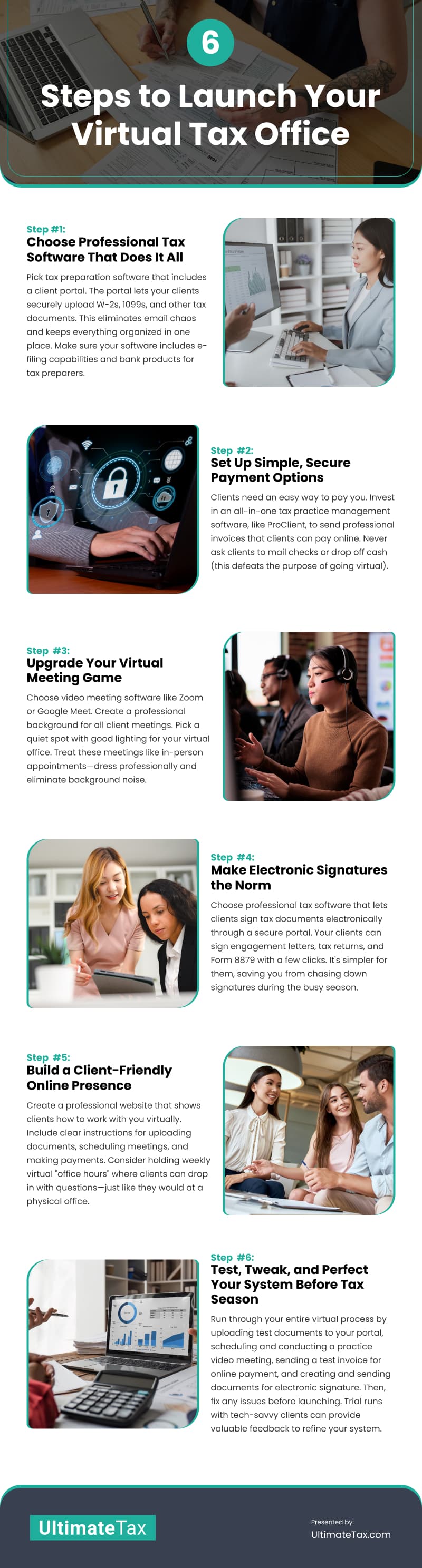

Your Guide to Starting a Virtual Tax Office

Running a virtual tax office takes the right tools and setup. Here’s what you need to get started:

Step 1: Choose Professional Tax Software That Does It All

Pick tax preparation software that includes a client portal. The portal lets your clients securely upload W-2s, 1099s, and other tax documents. This eliminates email chaos and keeps everything organized in one place. Make sure your software includes e-filing capabilities and bank products for tax preparers.

Step 2: Set Up Simple, Secure Payment Options

Clients need an easy way to pay you. Invest in an all-in-one tax practice management software, like ProClient, to send professional invoices that clients can pay online. Never ask clients to mail checks or drop off cash (this defeats the purpose of going virtual).

Step 3: Upgrade Your Virtual Meeting Game

Choose video meeting software like Zoom or Google Meet. Create a professional background for all client meetings. Pick a quiet spot with good lighting for your virtual office. Treat these meetings like in-person appointments—dress professionally and eliminate background noise.

Step 4: Make Electronic Signatures the Norm

Choose professional tax software that lets clients sign tax documents electronically through a secure portal. Your clients can sign engagement letters, tax returns, and Form 8879 with a few clicks. It’s simpler for them, saving you from chasing down signatures during the busy season.

Step 5: Build a Client-Friendly Online Presence

Create a professional website that shows clients how to work with you virtually. Include clear instructions for uploading documents, scheduling meetings, and making payments. Consider holding weekly virtual “office hours” where clients can drop in with questions—just like they would at a physical office.

Step 6: Test, Tweak, and Perfect Your System Before Tax Season

Run through your entire virtual process:

- Upload test documents to your portal

- Schedule and conduct a practice video meeting

- Send a test invoice for online payment

- Create and send documents for electronic signature

Fix any issues before your clients start using the system. Many tax preparers find it helpful to try the virtual setup first with a few tech-savvy clients. Their feedback perfects your system before rolling it out to everyone.

Start Small, Scale Smart, and Embrace the Future

Going virtual doesn’t mean losing the personal touch with your clients. With professional tax software and a straightforward process, you can deliver even better service while working from anywhere.

The best part? You can start small. Begin with a few tech-savvy clients, perfect your virtual process, and grow from there. Your practice can become more efficient, more profitable, and ready for the future of tax preparation.

Video

Infographic

Running a virtual tax office improves client service and drives business growth by tackling common challenges tax preparers face. To succeed, you need the right tools and setup. Learn in this infographic what’s required to get started.