Unhappy tax clients are a reality every tax preparer faces (even the best ones). When things go south with customer service or details get missed, clients can express their frustration to you. Or worse, in negative reviews.

The good news? There are ways to handle challenging clients and turn these situations into opportunities for growth. Here are some tips to head off potential unhappy clients and then some tips to navigate those nervy moments gracefully and maintain your good reputation.

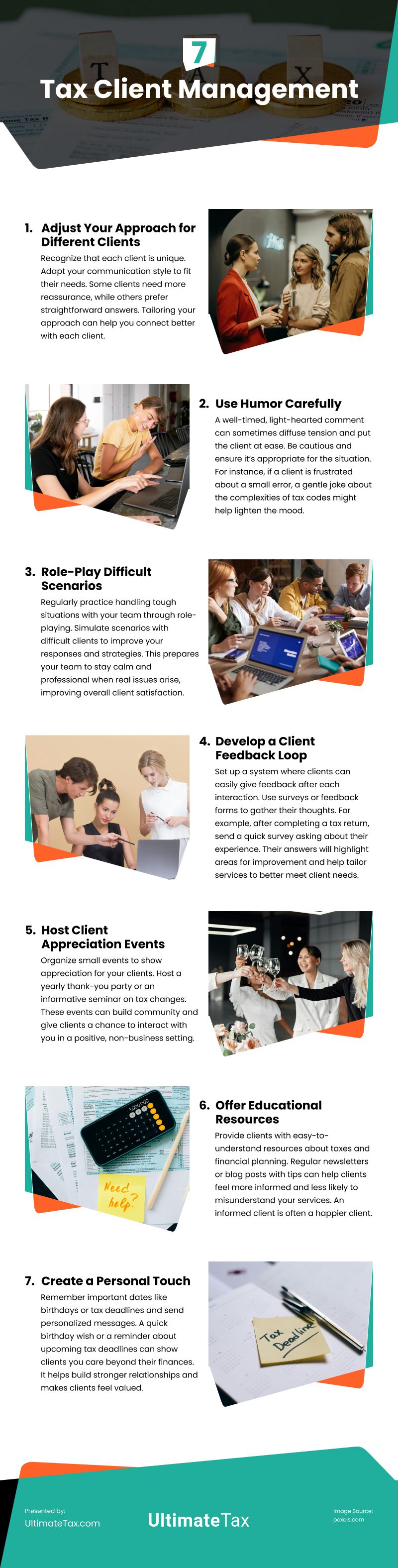

7 Tips to Head Off Challenging Clients

1. Adjust Your Approach for Different Clients

Recognize that each client is unique. Adapt your communication style to fit their needs. Some clients need more reassurance, while others prefer straightforward answers. Tailoring your approach can help you connect better with each client.

2. Use Humor Carefully

A well-timed, light-hearted comment can sometimes diffuse tension and put the client at ease. Be cautious and ensure it’s appropriate for the situation. For instance, if a client is frustrated about a small error, a gentle joke about the complexities of tax codes might help lighten the mood.

3. Role-Play Difficult Scenarios

Regularly practice handling tough situations with your team through role-playing. Simulate scenarios with difficult clients to improve your responses and strategies. This prepares your team to stay calm and professional when real issues arise, improving overall client satisfaction.

4. Develop a Client Feedback Loop

Set up a system where clients can easily give feedback after each interaction. Use surveys or feedback forms to gather their thoughts. For example, after completing a tax return, send a quick survey asking about their experience. Their answers will highlight areas for improvement and help tailor services to better meet client needs.

5. Host Client Appreciation Events

Organize small events to show appreciation for your clients. Host a yearly thank-you party or an informative seminar on tax changes. These events can build community and give clients a chance to interact with you in a positive, non-business setting.

6. Offer Educational Resources

Provide clients with easy-to-understand resources about taxes and financial planning. Regular newsletters or blog posts with tips can help clients feel more informed and less likely to misunderstand your services. An informed client is often a happier client.

7. Create a Personal Touch

Remember important dates like birthdays or tax deadlines and send personalized messages. A quick birthday wish or a reminder about upcoming tax deadlines can show clients you care beyond their finances. It helps build stronger relationships and makes clients feel valued.

Bonus Tip: Switch to Cloud-Based Tax Software

At a minimum, you should use tax pro software to help streamline your tax business. Consider switching to cloud-based tax software for better transparency. Clients can access their information anytime, so they feel more in control. It also helps reduce their anxiety and potential complaints.

7 Conflict Communication Tips

Even with the above advice, you should understand that you can’t win them all. Tax professionals have a tough job when it comes to dealing with clients. They can be demanding and tough to please, and some clients will never be happy, no matter what you do. Do your best, but know you can’t please everyone.

For example, a client might be frustrated with tax laws themselves. You know you can’t change the tax law for your disgruntled client, but you can use these tips below to help navigate the conflict smoothly.

1. Avoid Cowering from Conflict

Don’t dodge the issue. Hiding from complaints just makes things worse. Face them head-on and be open to feedback. If a client is upset about a missed deduction, listen and calmly explain the situation, then work on a solution together.

2. Move from Text to Verbal Communication

When things are going smoothly, emails and texts are great. But when you have an unhappy client, tone can be misinterpreted, and more miscommunications can happen. Move things from text to verbal communication–face to face is best. If you can’t make that happen quick enough, pick up the phone. A call is personal and shows you’re committed to resolving the issue. It will always help clear up misunderstandings faster.

3. Stay Calm and Communicate Clearly

Most importantly, stay calm and composed even if your client isn’t. If a client yells about a tax return error, keep your cool and reassure them that you’re there to fix it. Clients often get upset due to miscommunication or lack of updates. Listen to their concerns without interrupting. Restate what you heard and propose solutions. Address unrealistic expectations by clarifying the services agreed upon.

4. Show Empathy

Remember, clients may have personal issues affecting their behavior. Ask if everything is okay. Sometimes, they just need someone to listen. A few minutes of empathy can build stronger, more trusting relationships.

5. Offer Solutions and Engage Them in Problem-Solving

Sometimes, difficult clients want to feel involved. Invite them to be part of the solution. Ask for their input on how you can improve your service. This approach can turn a negative situation into a collaborative one.

If possible, give them options to make things right. Maybe a discount on next year’s service or a free consultation. If a client is unhappy with the service, offer what you can, like a free additional service, to show you value their business.

6. Reassure Them You’ll Improve

Let them know you’re taking their complaint seriously. Promise to do better and follow through. For instance, if a client points out a recurring issue, assure them you’ll change your process to avoid it in the future.

7. Document Everything

Keep detailed records of all client interactions, including complaints and how they were resolved. This helps in identifying patterns and prevents issues from recurring. If a client is unhappy about a past mistake, you can show them the steps you’ve taken to ensure it doesn’t happen again.

Remember that challenging clients can teach you valuable lessons. Each difficult interaction helps you improve your communication and problem-solving skills. Embrace these challenges as opportunities for growth. This mindset can make handling tough clients less stressful and improve how you handle your business.

Video

Infographic

Unhappy tax clients are a common challenge for tax preparers. When customer service issues or overlooked details arise, clients may express frustration. This infographic offers tips to prevent client dissatisfaction and handle tense situations gracefully.