It’s tax season once again! For tax professionals, the next three to four months can be the busiest time of the year. Aside from meeting with both old and new clients, you need to gather your clients’ financial documents, start preparing income taxes and file prepared taxes.

All these tasks can be overwhelming, especially when you’re handling multiple clients at the same time. So, it’s very important to take note of the critical dates for this year’s tax filing!

For new tax preparers, being familiar with these dates can help you establish credibility. Clients look for reliable and trusted tax preparers. If you want to build your clients, you have to show off your credibility.

Not all the dates below need action from you as a tax preparer. However, forms and payments due on these dates can affect how you can assist your clients this tax season.

Here are the dates you need to mark on your calendar:

January 15, 2020: Deadline for the 2019 4Q Estimated tax payments

If you have clients who are self-employed individuals, sole proprietors, partnerships, and S corporation shareholders, then the first deadline for the year is their fourth-quarter Estimated Tax Payments (IRS Form 1040).

Estimated payments for the first to third quarters of 2019 were due last April 15, June 15, and Sept. 15, 2019. The final estimated payment is for the fourth quarter is due on January 15, 2020.

Make sure to prepare your clients’ taxes for payment before the 15th. Give enough time for your clients to deposit or transfer their payments to the IRS (if you’re not the one doing the payments). If your client does the payment, send a little reminder before the 15th to make sure they won’t incur any penalties.

January 27, 2020: First filing day for Federal Tax Returns

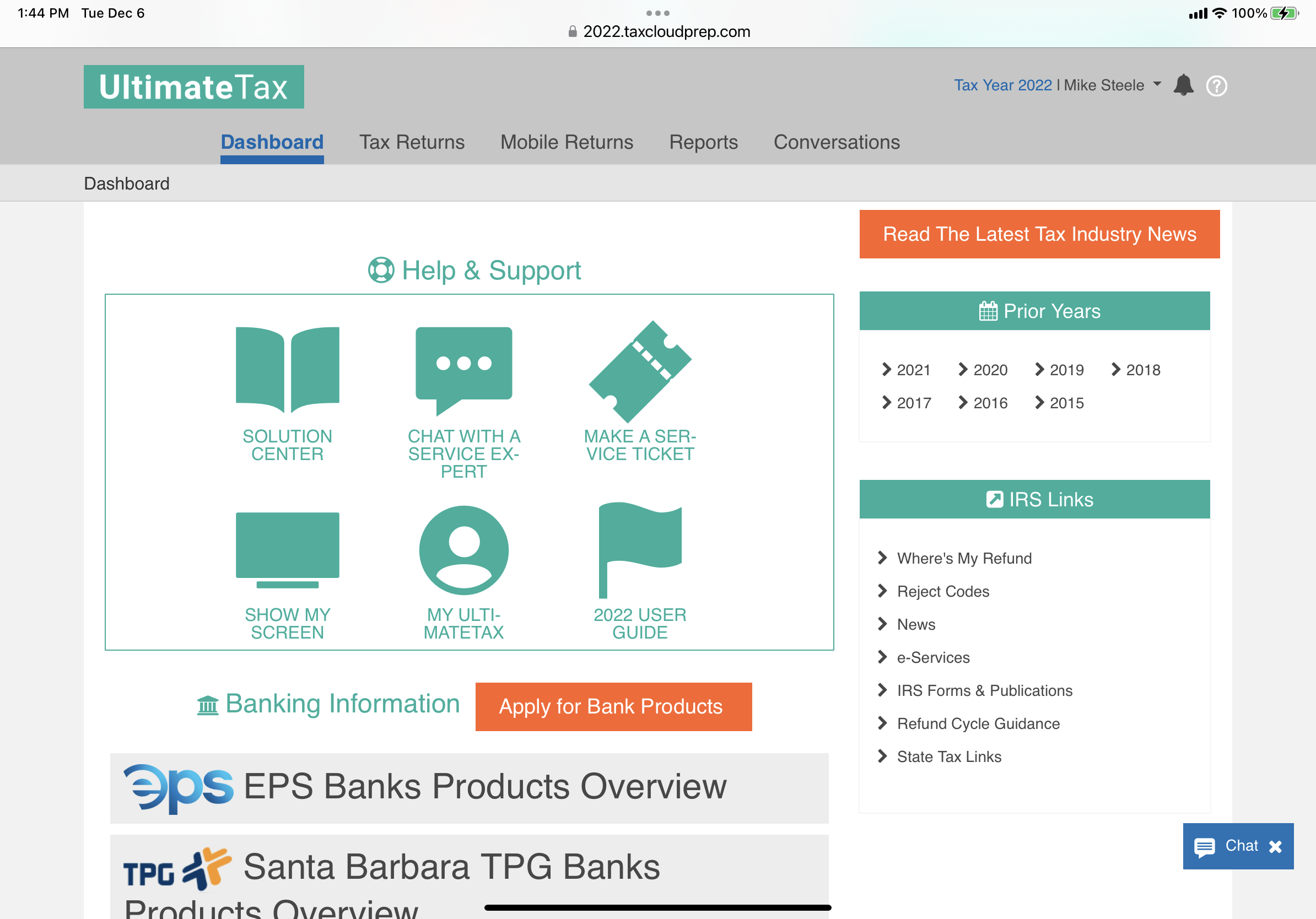

The IRS has announced that they will start reviewing federal tax returns on January 27, Monday. Tax preparers can e-file their client’s taxes ahead of time using professional tax software, such as UltimateTax.

January 31, 2020: Employers to mail W-2 forms, Businesses to complete 1099 Forms, and last chance to pay the 4Q Estimated Tax Payments

Employers must mail or hand-deliver each employee’s W-2 forms before January 31. If your clients are employees, remind them to check whether their employers have done this. You can also remind them to follow up with their employers if they haven’t received their W-2 forms by mid-February.

Businesses also need to start completing the 1099 forms. These forms can be tricky and need to be sent out before the end of February.

If your client misses the 4Q Estimated Tax Payments on January 15, your client can opt to file their income tax return and pay any remaining tax due on January 31. This is the only way to prevent incurring any penalties for the missed 4Q Estimated Tax Payments.

February 18, 2020: Financial Institutions to mail Form 1099-B, Form 1099-S, and Form 1099-MISC

Remind your clients that they should receive their Form 1099-B, Form 1099-S, and Form 1099-MISC (if applicable) during the next two weeks. If they are expecting any of these forms but did not receive any, they should reach out to their banks or financial institutions to confirm.

February 28, 2020: Deadline for Businesses to mail Forms 1099 and 1069 to the IRS

Businesses need to be able to mail out all 1099 forms by this date. Take note of this deadline if you are preparing corporate taxes for your clients.

March 16, 2020: Partnership returns (IRS Form 1065)

If you prepare business-related taxes for your clients, the deadline for partnership returns is on March 16. Make sure to complete all the Schedule forms related to Form 1065 such as Schedule K-1 and Schedule E (if needed).

If your client would like to file for an extension, file a Form 7004 before March 16. This will give a six-month extension. You can file your clients’ Form 1065 with Schedule K-1 (or Schedule E) until September 15, 2020.

April 15, 2020: Last day of Filing 2019 Taxes and Deadline for 2020 1Q Estimated Tax Payments

The April 15 deadline is the standard deadline for filing taxes. Some adjustments are made if the date falls on a weekend or on a holiday. For this year, April 15 falls on a Wednesday, so there won’t be any extensions.

All tax returns must be filed on or before April 15 to avoid incurring penalties. Your client can also file for an extension using Form 4868. Your client can get a six-month extension to file the necessary paperwork. However, payment for the taxes is still due on the 15th.

Aside from the 2019 tax returns, the first of the 2020 tax payments are due on April 15. So, it’s the start of another tax year and it’s going to be a hectic day. Advise all your clients to submit all necessary documents for their 2019 tax returns ahead of time, so there won’t be any unnecessary rush when this deadline comes.

June 15, 2020: Deadline for 2020 2Q Estimated Tax Payments

Send out reminders to all your clients, who do not pay through withholding tax, for their 2Q Estimated Tax Payments. Second-quarter is from April to June.

September 15, 2020: Deadline for 2020 3Q Estimated Tax Payments and Final Deadline for 2019 Partnership Returns

The third installment of the 2020 Estimated Tax Payments is due on September 15. This covers the third quarter of the year from July to September.

If your client applied for an extension to file their 2019 Partnership Returns, September 15 is the final deadline.

October 15, 2020: Final Deadline for 2019 Tax Returns

This is the final deadline for 2019 Tax Returns for any client who requested for an extension last April 15. Pay any tax, interests, or penalties that were incurred for the year 2019.

October 15 is also the last day the IRS will accept electronically filed 2019 returns. If your client still wants to file a 2019 return beyond October 15, the returns must be mailed to the IRS.

As a tax professional, it is your duty to provide the best advice to your clients on how to handle their tax returns. Keeping track of these deadlines can help you provide the best advice for each client based on their situation.

Remember, missing important deadlines from the IRS can incur penalties. Encourage your clients to complete all their requirements and file taxes ahead of time. Your clients won’t have to be stressed, and they’ll get any tax refund quicker!

If you’re a new tax preparer, don’t panic and don’t be overwhelmed by the multiple deadlines. Continue learning about the industry and build your knowledge base.

Don’t know where to start? Find out how to start your tax business with The Ultimate Guide for New Tax Preparers.