The Best Bank Products for Tax Professionals

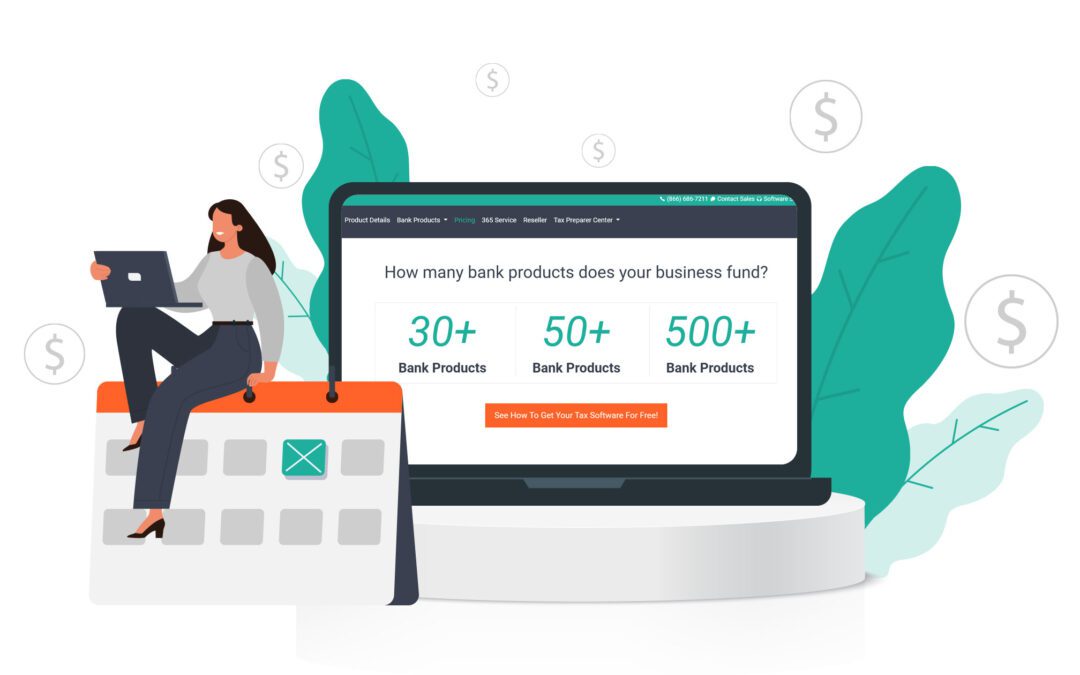

Bank products are client solutions that all tax offices should offer. This benefits the tax office so that you can get paid for your services. They benefit clients as well since you offer a solution for your clients to not pay when they have you do their tax returns....

What Is a Refund Transfer?

The refund transfer is a deposit product that allows clients to settle their preparation fees or accounting fees without making an upfront payment. Instead of paying you directly for services, the clients agree to have your fee deducted from their tax refund. A refund...

8839 Qualified Adoption Expenses

We are aware of an issue with the IRS schema concerning the maximum adoption credit allowed on Form 8839 Qualified Adoption Expenses. Per the form and instructions, the maximum allowable credit is $14,440; however, the IRS schema has this value set as $14,400. Any...