Tax Software for Easy At-Home Preparation & Filing

Tax preparation can be a challenging and expensive task, particularly for professional tax preparers. The financial aspect of tax preparation, including hiring personnel, purchasing resources, or subscribing to costly software, can significantly impact profitability....

Small Business Tax Preparation Checklist: Simplifying Your Tax Management

Effective tax preparation is essential for small businesses, offering long-term benefits and ensuring compliance with tax laws. In this comprehensive guide, we will discuss the key steps involved in small business tax preparation. From understanding your tax...

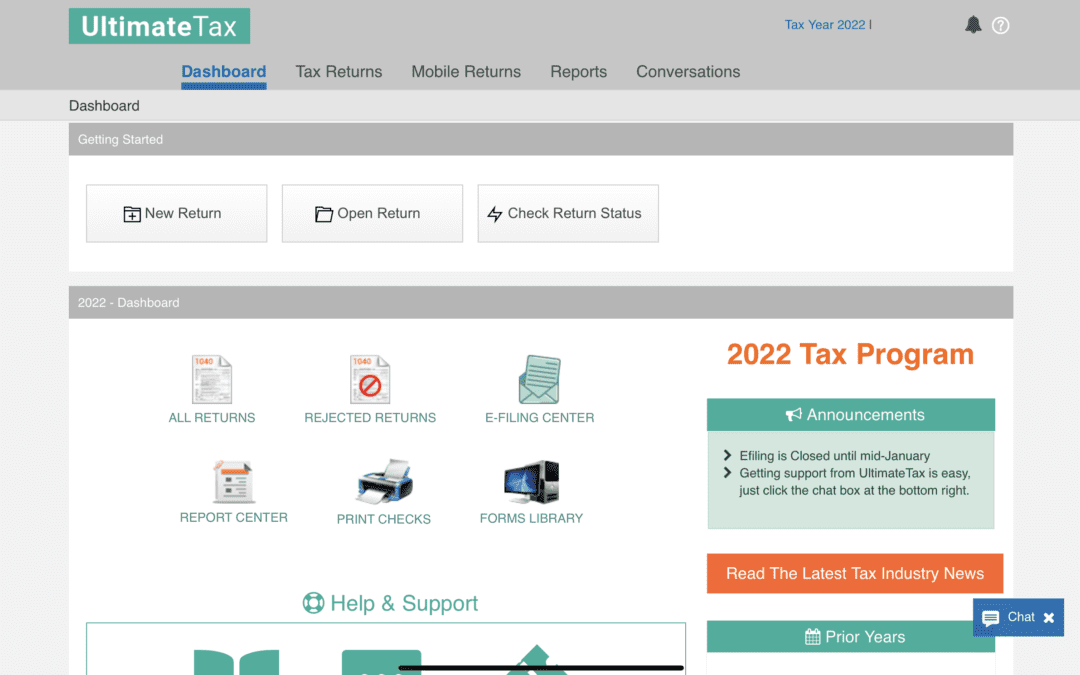

Best Tax Software for Accountants in 2023

As we usher in yet another tax season, tax software has become an indispensable tool for accountants in facilitating efficient and accurate tax preparations. In today’s fast-paced world, where clients demand quick and reliable financial solutions, a good tax...