IRS Customer Service Angers Taxpayers

Part of our service of providing professional tax software is also providing you with information that will be helpful to your clients and...

Professional Tax Software ? Annual Filing Season Program

As it stands right now, the Annual Filing Season Program (AFSP) Certificate is not required. This could change based on what happens with the most...

Tax Loans Are Beneficial

The word is out that Tax Loans are back! We’ve seen some negative comments regarding them, and it’s time to clear the water. We are strong believers...

IRS Takes Another Swing At Regulating Tax Preparers

Regulating tax preparers has been a hot topic of controversy over the last few years. The IRS has really gone to bat to try and get some sort of...

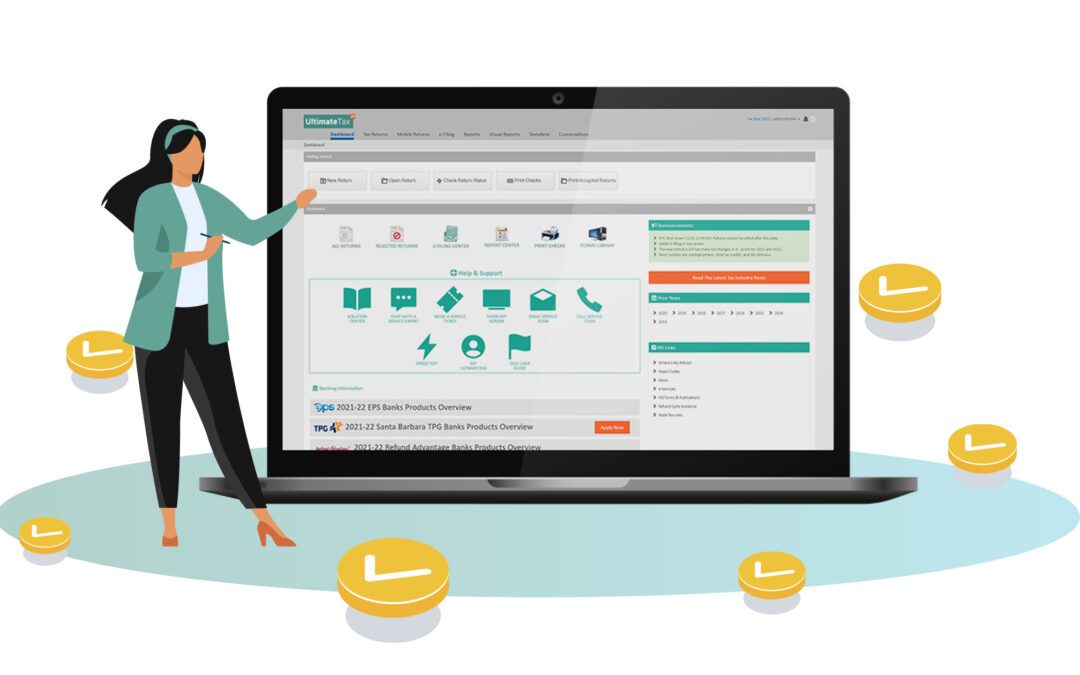

Tax Loans Are Back! And FREE!

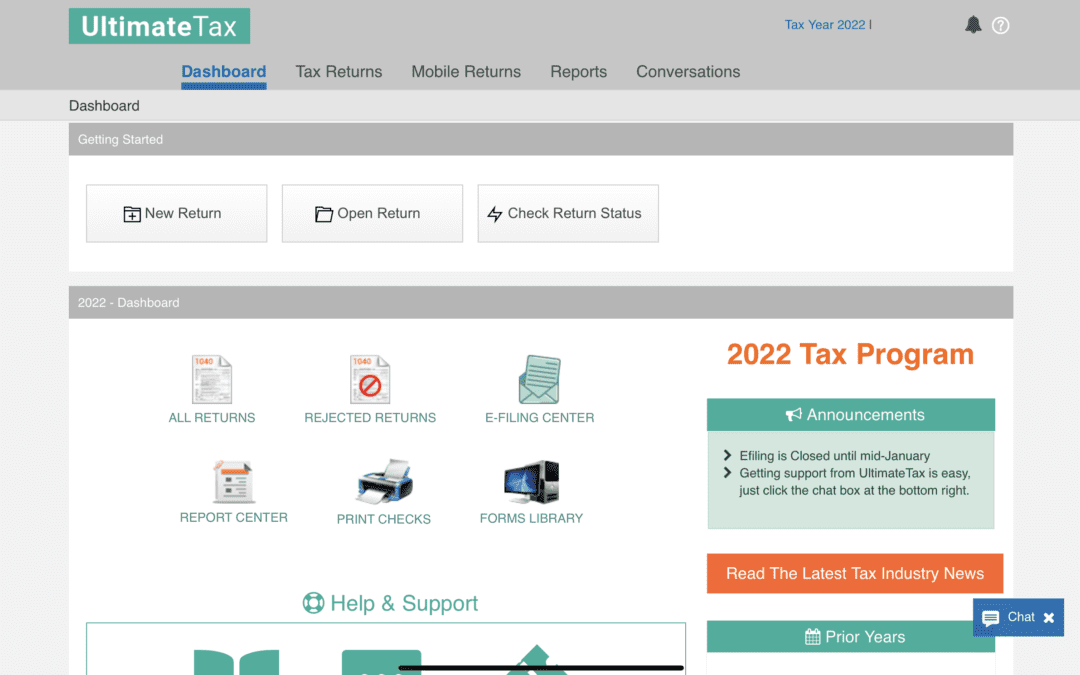

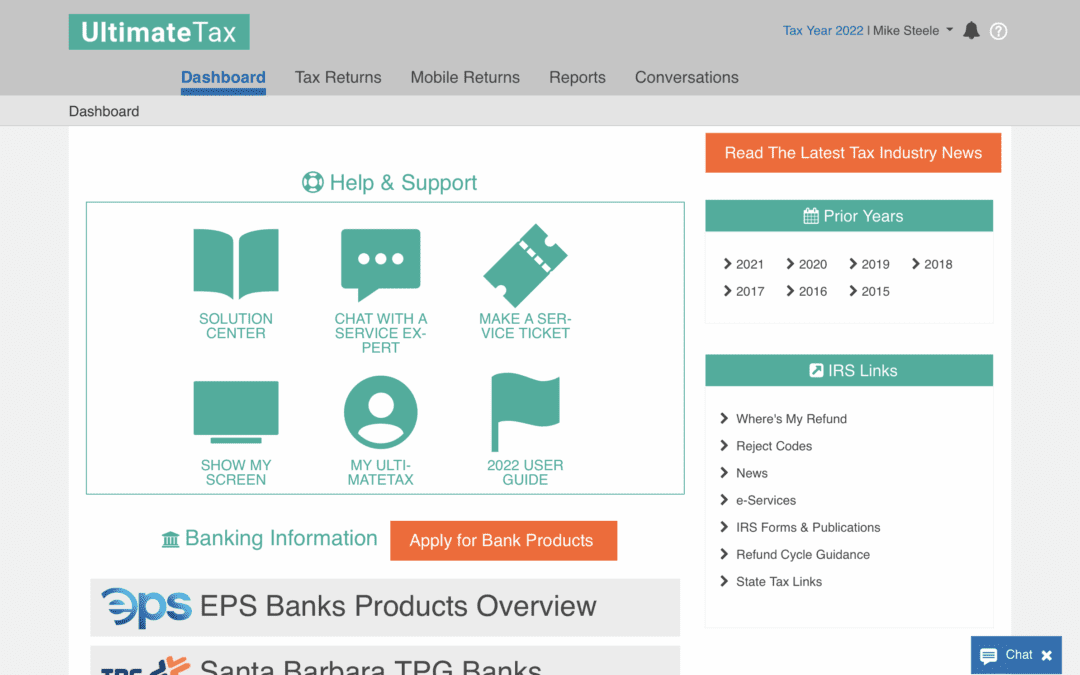

WOULD YOU LIKE TO OFFER FREE TAX LOANS TO YOUR CLIENTS? Yes, you read right. FREE. UltimateTax premium professional tax software customers that use...

Professional Tax Software ? This Is How We Do It

TRADESHOW REVELATIONS! There were so many professional tax software companies at the IRS Tax Forums in Washington, DC. I’m curious to see what...

Professional Tax Software ? Home Sweet Home

Every professional tax software company has a home base. Ours is Muscatine, Iowa, right in the heart of the Midwest. It’s a small but diverse town...

Professional Tax Software ? IRS, Please Pass The Pudding

Sure, we are a professional tax software company, but we are also human and sometimes we need protection too. One of our Account Managers, Mike, was...

Professional Tax Software ? Power To The Tax Professionals

Professional tax software companies can’t always be the hero, this time we pass the torch to those witty accountants that fight for tax...

Professional Tax Software ? Here We Go?More IRS Budget Cuts Could Be Coming

UltimateTax isn’t just about selling professional tax software. We care about the tax industry as a whole! Here is some cringe worthy news that...

Recent Posts

Understanding Tax Garnishment: How to Check If Your Tax Return Will Be Affected

Tax garnishment is the process where a creditor can legally seize part of a taxpayer’s wages, bank accounts, or other assets to pay for an outstanding debt. During tax season, this garnishment process can cause complications and delays in receiving your tax return if...

Top Tax Preparation Software for Accountants: Streamline Your Tax Season

It's no secret that taxes can be a difficult and time-consuming task to complete. Without the proper knowledge and expertise, it is easy to make costly mistakes that lead to bad consequences. To help simplify this process, many tax preparation software programs are...

Cloud-Based Tax Preparation Software: The Future of Tax Filing

Tax software is an invaluable tool for anyone who needs to file their taxes each year. It helps users quickly and easily enter their financial information and e-file their federal and state tax returns. There are several highly recommended options available, from...

Checking the Status of Your Amended Tax Return: A Step-by-Step Guide

Filing a tax return can be a tedious process, but it is necessary to ensure that individuals pay the correct amount of taxes owed and receive any refunds that they are eligible for. However, it is sometimes easy to make mistakes when filing your taxes. An amended tax...

IRS Hub Testing what is it?

Each year the IRS will shut down and do a switchover. Usually, at the end of the year, late November, the IRS will shut down its e-file systems. They do this to switch over from year to year. You might think with technology today, that they would not have to shut...