Start a Tax Preparation Business Now

The 2022 tax season will begin less than a month from now. If you are going to set up your own tax practice, now is the time to do it! But how do...

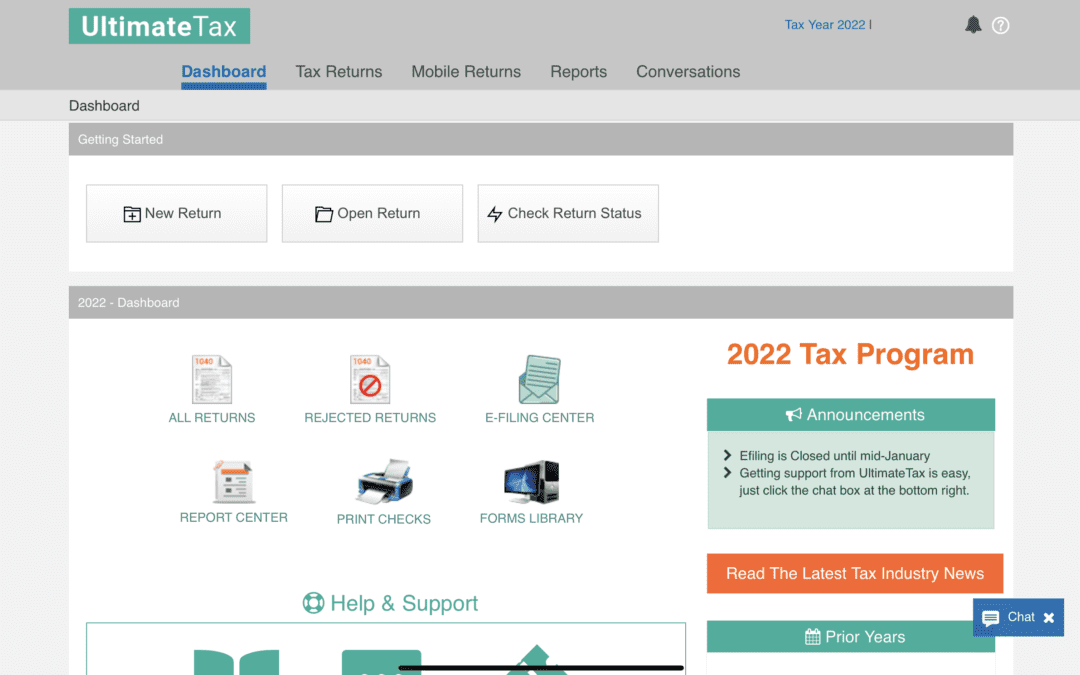

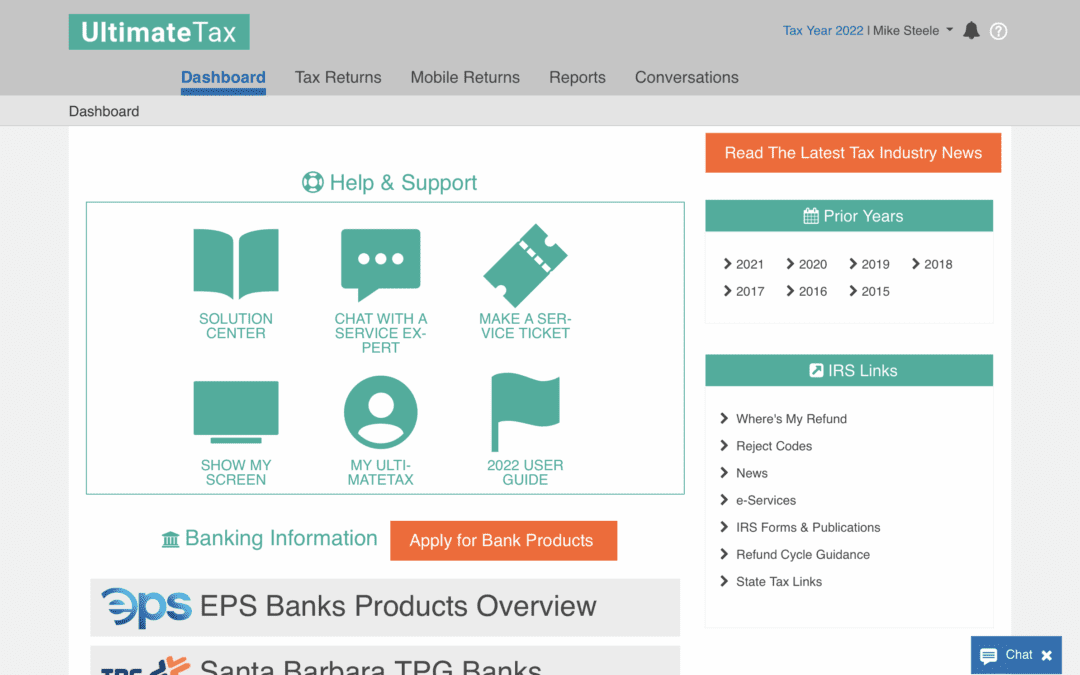

Pre Ack Loans Available Now

If you have applied for bank products and pre ack loans, they are available now. In our online program, the forms are now available. No updates are...

Keep an Eye on These Expiring Tax Breaks

As 2021 draws to a close, a number of tax breaks are set to expire. Tax preparers need to be aware of which tax breaks will be going away—but also...

IRS Child Tax Credit Payments – Letter 6419

The IRS will be sending taxpayers who received Advanced Child Tax credit payment/s in 2021, the letter will be sent out January 2022, Notice 6419. ...

EFC Shut Down

IRS has announced its MeF (e-file) shutdown and cutover for Tax Year 2021. To ensure that all business tax returns e-filed through the MeF system...

How to Do a Great Tax Client Interview

The tax preparation profession involves more than the processing of income tax returns. This is a client-facing profession, where one's reputation...

Tips to Improve Client Experience This Year

Tips to Improve Client Experience This Year Every customer counts for your business. Tax preparation is all about delivering a service. You have the...

Prepare for Disaster: Important Tips for Your Financial Safety

Prepare for Disaster: Important Tips for Your Financial Safety One of the most important things you need to discuss with your clients is financial...

How to Prep Clients Using Handy Resources from the IRS

One of your responsibilities as a tax professional involves prepping tax clients for the coming tax season. While you are being paid to handle their...

Learn the Best Practices for Keeping Client Data Safe

Professional tax software is designed to be secure. Sensitive customer data is protected behind a private account. Only an authorized user can...

Recent Posts

Tax Preparation Resources for Small Business

Tax preparation can be a complex and time-consuming process, especially for small businesses. Understanding the intricacies of tax regulations and properly managing financial records are crucial for maintaining compliance and optimizing financial health. In this...

How Much Does Tax Software Cost? A Detailed Cost-Benefit Analysis for Businesses

Managing finances and ensuring compliance with tax regulations are vital aspects of running a successful business. As tax-filing becomes increasingly complex, businesses face the challenge of efficiently managing their taxes. This article explores the costs...

How to Get a PTIN: Requirements for Tax Return Preparers

As a tax preparer, obtaining a Preparer Tax Identification Number (PTIN) is a crucial step in establishing your credibility and compliance with the Internal Revenue Service (IRS). In this article, we will delve into the details of what a PTIN is, why it is necessary,...

The Pros and Cons of Professional Tax Preparation

Tax preparation is a critical aspect of managing one's finances and ensuring compliance with tax laws. Taxpayers often find themselves facing a dilemma: should they tackle their taxes themselves or hire a professional tax preparer? In this article, we will explore...

E-file Software for Tax Professionals in 2023

In today's digital era, the landscape of tax services is undergoing a significant transformation. The advent of electronic tax filing, facilitated by e-file software, has revolutionized tax practices for professionals. This article explores the increasing importance...