The tax preparation profession involves more than the processing of income tax returns. This is a client-facing profession, where one’s reputation can depend on successful client interactions. Always strive to leave a good impression when you are dealing with clients personally.

The client interview is one of the key interactions that every tax preparer will experience. While you can find other ways of getting the tax information you need from a client, an interview is still your best option. The client interview will give you a chance to build a great service relationship, which will improve your chances of seeing return business.

The Power of a Positive Interaction

As a tax preparer, your primary goal may be the accurate and efficient completion of a tax return. That is the cornerstone of your business. But keep in mind that this only matches the baseline of client expectations. Of course you have to provide a correct tax return! That’s what you do!

You want to stand out from the competition. How can you do that when you are offering the same service provided by all tax preparers? You can work on marketing yourself, creating a postiive image that captures customer attention and grants you a particular appeal.

You can also develop a positive image through outstanding interactions with clients. Make a great impression on people and they will give you their business, simply because they like you! Make your clients feel that you have genuine concern for them, and they will be more willing to trust you to handle their accounts.

The client interview offers an excellent opportunity for you to create a positive interaction.

Preparing for the Client Interview

Before you meet with the client, prepare for the interview by studying their account in detail. Make notes about what topics should be covered and what answers you need them to provide.

You may want to compile a questionnaire to send to your client prior to their appointment. If they can find the time to complete it before the meeting, that’s great! Most of the work will be done, and you can focus on a client’s specific concerns during the interview.

Even if the client doesn’t complete the questionnaire, it will help set the table for the interview. The client will know what to expect from you. That can save you time and allow you to get more done during your meeting.

Gathering Client Information

The main purpose of a client interview is to gather tax information to use in processing the client’s return. The secondary purpose is building a good relationship with your clients, of course! Which is something you want to keep in mind before and during the interview.

But let’s go back to its main purpose, which is gathering information. Be clear and precise when you ask your client for data. You will be dealing with a lot of numbers and dates, so it is important to establish the correct details.

From the start, you should be focused on determining your client’s proper filing status. You may find that there are a number of possible options. You can figure out the client’s correct filing status options based on the answers to your questions. Be sure to look into their allowable exemptions and dependents.

Confirm the taxpayer’s personal information. This data includes the taxpayer name, date of birth, address(es), occupation, company and job title. Request information about the taxpayer’s dependents—children and any other persons who may qualify. You also need to request photo IDs and Social Security Cards.

Determining Sources of Income

During the interview, ask the client about all possible sources of income they may be receiving. You’ll want to look beyond W2s and get a comprehensive picture of your client’s taxable income as a whole.

Some taxpayers may not be aware that certain types of income must be reported. They may be overlooking these sources of income, so make sure your client is disclosing everything. Here are some sources of income that your client needs to report:

State refunds (when taxable)

Unemployment benefits

Social security benefits

Jury duty pay

Adjustments to Income

Go over the taxpayer’s adjustments to income. These can come in many forms. Examples of adjustments to income include:

Educator expenses

Student loan interest

Alimony payments

Tuition and fees deduction

Self-employed health Insurance

Contributions to a retirement account

Adjustments to income are not categorized as Itemized Deductions and can be entered independently on the tax return. Your client will be happy to learn about these deductions to their Adjusted Gross Income (AGI).

Standard or Itemized Deductions

Be thorough in identifying all taxpayer income and adjustments before calculating Itemized Deductions. Depending on your client’s answers, you may decide that it is more beneficial to use Standard Deductions over Itemized Deductions—or vice versa.

If you find it hard to determine what to use, fill out Schedule A completely. That will ensure the inclusion of all possible deductions on the tax form. Be on the lookout for things such as qualified work related education expenses. They can lead you to finding other qualified expenses for the benefit of the taxpayer.

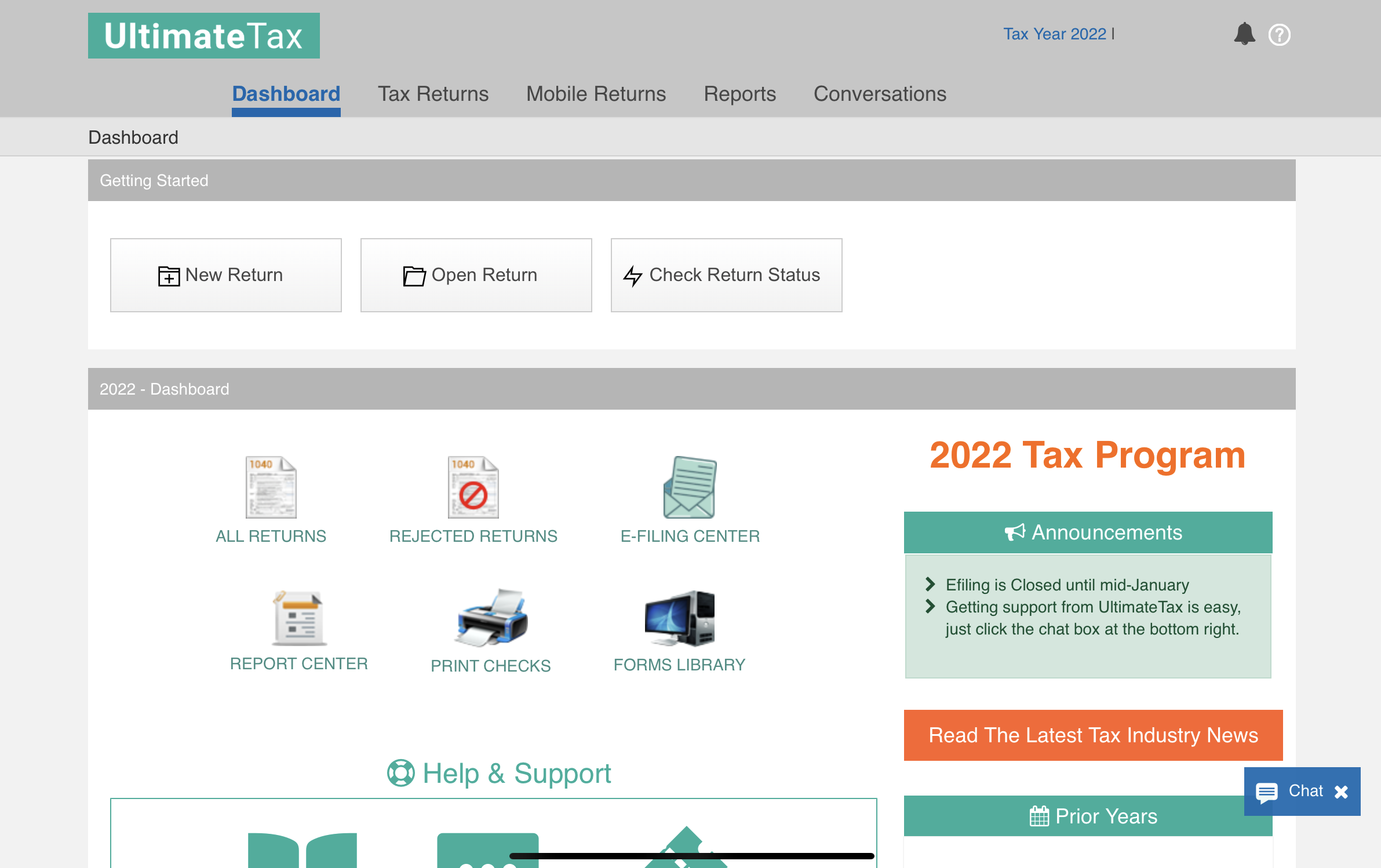

UltimateTax Professional Tax Software includes an interview mode that can guide you through the Schedule A form. Using inteview mode will help you achieve comprehensive coverage of all possible tax deductions—empowering you to better serve your clients.

Determining Tax Credits

Another important line of questioning involves tax credits. Your client may very well qualify for a number of tax credits, which you can determine during the interview. Make sure that you’re asking the right questions!

As a tax preparer, you should take note of client information that can help you discover qualifying expenses which can benefit a taxpayer. For example, has your client been paying tuition and fees? Look into how such qualifying expenses can be used in the most favorable fashion. Can they be used as Education Credit? You don’t have to make a final decision during the interview, but take note of such considerations for further review later.

Closing the Interview

Before you end the interview, give the client a summary of what you covered. You want to leave the impression of having had a productive meeting—which you did have, of course!

After reviewing the results of the interview, you should allow the client some time to ask their questions of you. Listen to feedback, clarify things for the client, provide reassurance and promise a follow-up on anything you cannot answer immediately.

If possible, set aside a portion of the interview to focus on tax planning. Ask the taxpayer to think about possible changes to their situation that are likely to occur. Advise the client on how such changes would affect their tax liability for the upcoming year.

As you close the interview, consider asking the client to rate their satisfaction with your tax preparation services. If the client gives you a good rating, then ask them to recommend your services to their family and friends. It’s an excellent tactic for expanding your client base!