The tax industry is one of many finding new opportunities with artificial intelligence (AI) and automation. The benefits to your business could be substantial once you understand how to utilize it effectively. So, what is AI? How does it help tax preparers? Will it take over all tax preparation work? And what should you be aware of as this technology advances in society?

What Is AI?

Artificial Intelligence is a catch-all phrase for any smart function capability in technology. Soft AI refers to programmable behavior. Hard AI is an intelligent machine that can think beyond programming and act independently of its programmers. Hard AI is still relegated to the pages of fiction, though scientists and programmers continue to work toward that goal. In the meantime, soft AI has proven to be an effective tool in modern society. Here are a few of the functions soft AI can perform for you:

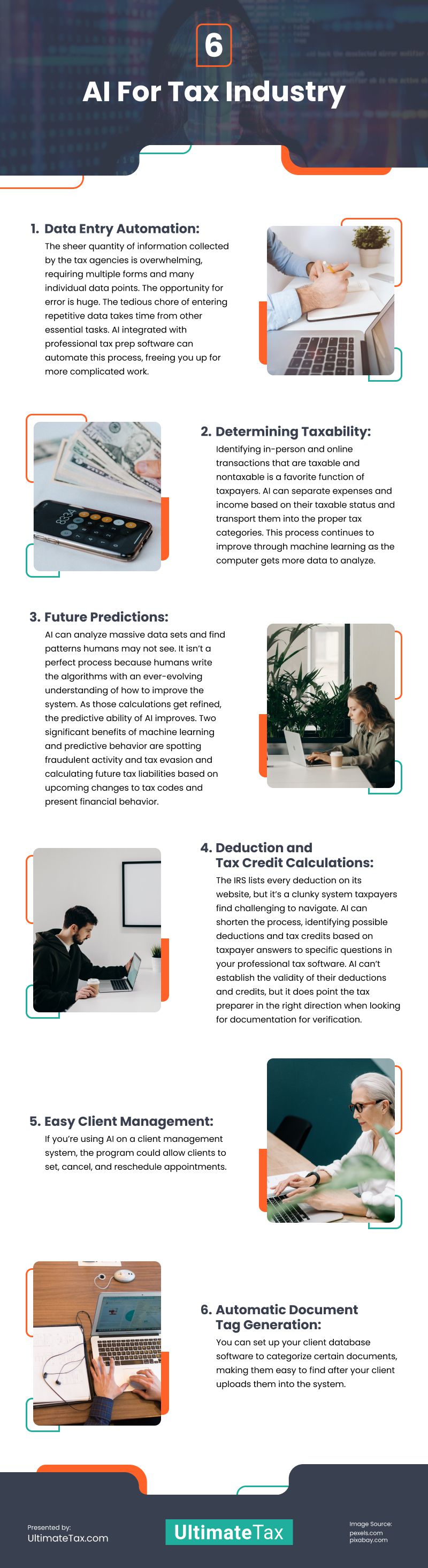

- Data Entry Automation: The sheer quantity of information collected by the tax agencies is overwhelming, requiring multiple forms and many individual data points. The opportunity for error is huge. The tedious chore of entering repetitive data takes time from other essential tasks. AI integrated with professional tax prep software can automate this process, freeing you up for more complicated work.

- Determining Taxability: Identifying in-person and online transactions that are taxable and nontaxable is a favorite function of taxpayers. AI can separate expenses and income based on their taxable status and transport them into the proper tax categories. This process continues to improve through machine learning as the computer gets more data to analyze.

- Future Predictions: AI can analyze massive data sets and find patterns humans may not see. It isn’t a perfect process because humans write the algorithms with an ever-evolving understanding of how to improve the system. As those calculations get refined, the predictive ability of AI improves.Two significant benefits of machine learning and predictive behavior are spotting fraudulent activity and tax evasion and calculating future tax liabilities based on upcoming changes to tax codes and present financial behavior.

- Deduction and Tax Credit Calculations: The IRS lists every deduction on its website, but it’s a clunky system taxpayers find challenging to navigate. AI can shorten the process, identifying possible deductions and tax credits based on taxpayer answers to specific questions in your professional tax software. AI can’t establish the validity of their deductions and credits, but it does point the tax preparer in the right direction when looking for documentation for verification.

- Easy Client Management: If you’re using AI on a client management system, the program could allow clients to set, cancel, and reschedule appointments.

- Automatic Document Tag Generation: You can set up your client database software to categorize certain documents, making them easy to find after your client uploads them into the system.

Will AI Take Over?

So far, AI can’t take over all functions. It may never have the ability to take over for several reasons:

- Artificial intelligence may be able to point out inconsistencies that point to fraud, but it doesn’t necessarily mean it is. Often, the average person preparing their own taxes doesn’t know what they’re doing and makes a mistake. They may have simply entered information on the wrong line of the form. Or, they may have miscalculated their deductions. AI is good at finding errors but cannot analyze whether it was a simple mistake or purposefully fraudulent. AI can bring errors to the auditors’ attention, who then decide if the person filing taxes did it intentionally or by accident.

- Appeal cases are too complex to entrust to AI to gather supporting documents to justify changing the valuation.

- Interpreting expenses and deciding if they fit the criteria for a deduction can be challenging, especially in some non-standard businesses. For example, the variety of food at a fair ranges from deep-fried Twinkies to spun sugar to freeze-dried Skittles. Business expenses could include the frier, the cotton candy machine, the freeze dryer, carts, packaging supplies, balloons to draw attention, custom paint to advertise your prices, etc. AI programming can’t make judgment calls if the programmer hasn’t entered the item in the program parameters.

What To Keep In Mind

Artificial intelligence streamlines many office duties through income tax return filing software, freeing you up for more complex tasks. As technology evolves, you will need to evolve with it to keep your edge in the marketplace. But that doesn’t mean you have to be a computer programmer to enjoy the benefits of AI.

If you have AI as part of an automated tax office manager, they should keep the AI functions in compliance with current tax laws (which will also change as technology advances), making it easier for you. You can learn to manage new features as they come forward, one improvement at a time, rather than tackling them all simultaneously.

Video

Infographic

Like many others, the tax industry is finding new opportunities with AI and automation. Once you understand how to use it effectively, your business could have substantial benefits. Check out this infographic to learn about some of the functions that AI can perform for you.