Let’s be honest. The average taxpayer will never read the tax code. They will likely rely on a professional tax preparer like you, using good tax preparation software, to guide them. Otherwise, they’re getting tax advice from family, friends, or worse, a social networking site, who may believe one of these popular tax myths.

As a tax preparer, you should be aware of the misinformation your clients receive to avoid miscommunications and information omissions that could prove costly in the long run. Review these seven popular tax myths below:

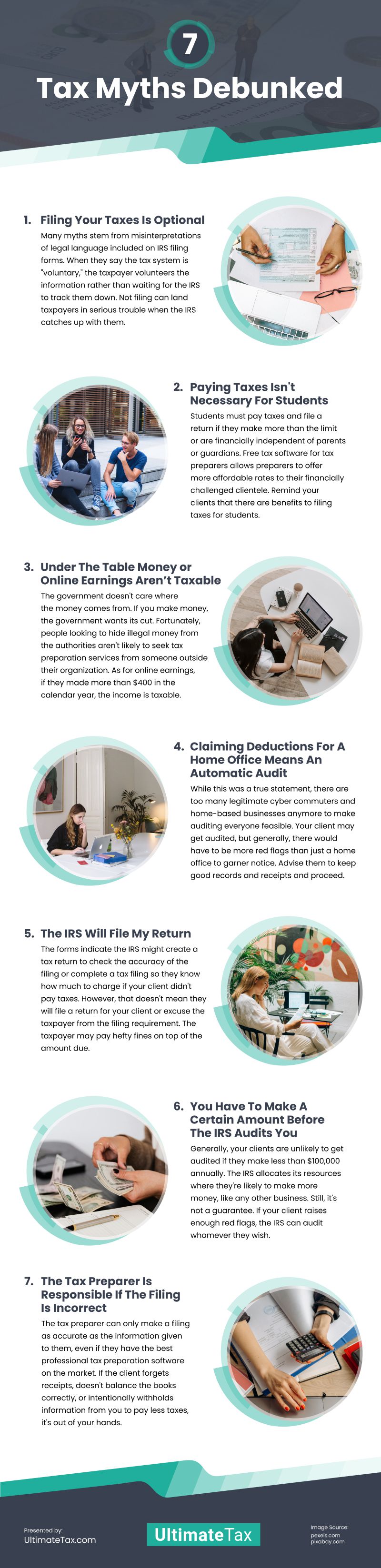

1. Filing Your Taxes Is Optional

Many myths stem from misinterpretations of legal language included on IRS filing forms. When they say the tax system is “voluntary,” the taxpayer volunteers the information rather than waiting for the IRS to track them down. Not filing can land taxpayers in serious trouble when the IRS catches up with them.

2. Paying Taxes Isn’t Necessary For Students

This statement is true if they are claimed as dependents and make less than a specified amount from any side jobs while attending school. Students must pay taxes and file a return if they make more than the limit or are financially independent of parents or guardians. Free tax software for tax preparers allows preparers to offer more affordable rates to their financially challenged clientele. Remind your clients that there are benefits to filing taxes for students. You may want to mention the following:

- Students have access to grants and loans based on their reported income. Funding from loans and grants may mean the difference between completing their degree or technical training or quitting their education early.

- If a student is struggling financially, is a single parent, or needs financial assistance because they lose a job or living arrangement, they can get emergency help with proof of income.

- If a student has a job where the company deducts taxes, they may be entitled to a refund or part or all of their tax contributions based on their annual earnings and available tax credits.

3. Under The Table Money or Online Earnings Aren’t Taxable

Hopefully, this isn’t a conversation you ever need to have with your clients, but money earned through illicit activities is taxable. The government doesn’t care where the money comes from. If you make money, the government wants its cut. Fortunately, people looking to hide illegal money from the authorities aren’t likely to seek tax preparation services from someone outside their organization.

As for online earnings, it doesn’t matter whether your clients earn money from ads on their blog, through digital or physical product sales, or services such as coaching; If they made more than $400 in the calendar year, the income is taxable.

Sales tax depends on your client’s home state when they sell goods and where people are when they buy them. The government bases federal taxes on gross earnings, no matter the source of income. They may fly under the radar for a time, but the consequences for tax evasion are steep. A conviction could lead to a five-year prison sentence and a fine of up to $100,000.

4. Claiming Deductions For A Home Office Means An Automatic Audit

While this was a true statement, there are too many legitimate cyber commuters and home-based businesses anymore to make auditing everyone feasible. Your client may get audited, but generally, there would have to be more red flags than just a home office to garner notice. Advise them to keep good records and receipts and proceed.

5. The IRS Will File My Return

The forms indicate the IRS might create a tax return to check the accuracy of the filing or complete a tax filing so they know how much to charge if your client didn’t pay taxes. However, that doesn’t mean they will file a return for your client or excuse the taxpayer from the filing requirement. The taxpayer may pay hefty fines on top of the amount due.

6. You Have To Make A Certain Amount Before The IRS Audits You

Generally, your clients are unlikely to get audited if they make less than $100,000 annually. The IRS allocates its resources where they’re likely to make more money, like any other business. Still, it’s not a guarantee. If your client raises enough red flags, the IRS can audit whomever they wish.

7. The Tax Preparer Is Responsible If The Filing Is Incorrect

Regarding the IRS, the buck stops with the client, not the tax preparer. The tax preparer can only make a filing as accurate as the information given to them, even if they have the best professional tax preparation software on the market.

If the client forgets receipts, doesn’t balance the books correctly, or intentionally withholds information from you to pay less taxes, it’s out of your hands. That is why every client must review the tax filing for accuracy before they sign on the dotted line or e-signature pad. By signing, they verify your work’s quality and the information included. (This is an excellent time to pitch any bookkeeping services you may provide.)

Unfortunately, there’s no class on how to prepare taxes in high school. The average tax client doesn’t have much tax education or accurate tax preparation information. Hopefully, this information will help you understand the context of your clients’ questions. It should help prevent miscommunications and, with any luck, prevent future tax trouble for your clients.

Video

Infographic

Tax preparers should be aware of the misinformation their clients receive to avoid miscommunications and costly omissions. Check out this infographic debunking seven popular tax myths.