Top Tax Preparation Software for Accountants: Streamline Your Tax Season

It’s no secret that taxes can be a difficult and time-consuming task to complete. Without the proper knowledge and expertise, it is easy to make costly mistakes that lead to bad consequences. To help simplify this process, many tax preparation software programs...

Cloud-Based Tax Preparation Software: The Future of Tax Filing

Tax software is an invaluable tool for anyone who needs to file their taxes each year. It helps users quickly and easily enter their financial information and e-file their federal and state tax returns. There are several highly recommended options available, from...

Tips for Choosing the Right Professional Tax Software

Anyone who pays taxes knows they’re complicated. And with the ever-widening tax brackets, numerous deductions, and other nuances, it can be challenging to figure out how much money you’ll owe and then how to pay it. That’s why so many people turn to tax software...

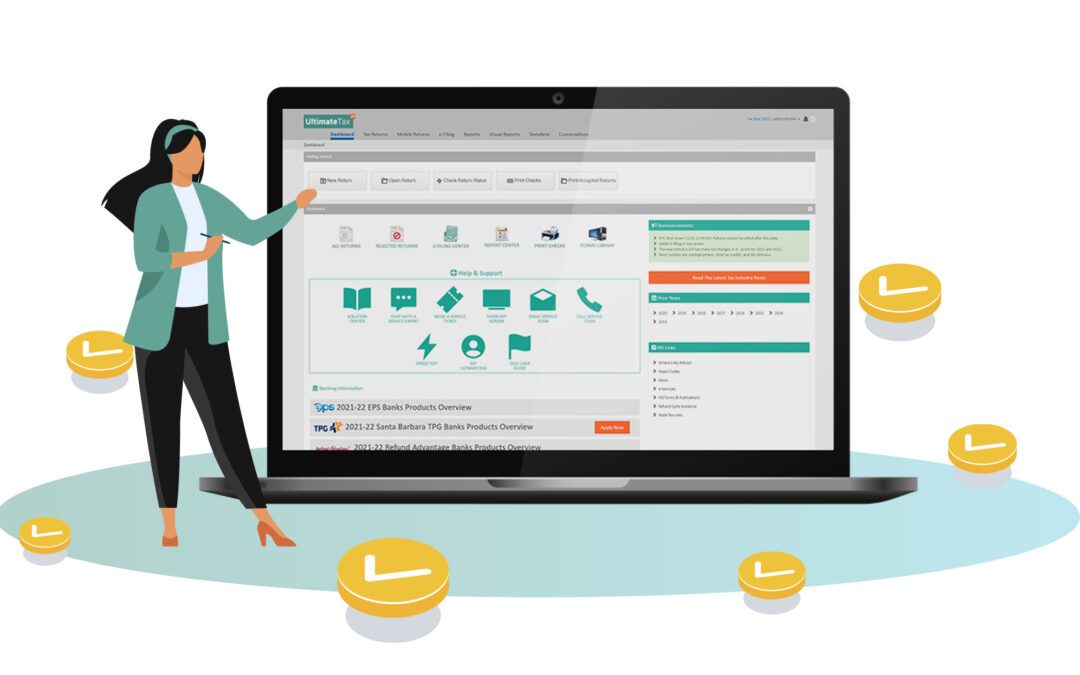

Advantages of a Tax Software for Tax Preparers

If you are a tax preparer and you are getting tired of manually recording all your transactions then it’s high time you get yourself tax software for tax preparers. Tax software is an online program that helps you manage and organize the data from your business,...

How to Start a Tax Preparation Business: Get Tips and Advice Here!

Tax season can be stressful. Between managing your tax return, the ever-changing tax laws, and preparing your taxes for each new year, it can be daunting to tackle as a small business owner. Luckily, starting your own business can help you manage these challenges and...

How to Start a Successful Tax Preparation Business?

Starting your own business can be an exciting prospect, but it can also be a challenging one. That’s why you need to start as early as possible. Starting a business requires time and patience and not everyone has this in abundance. However, doing so doesn’t have to...

8 Things Everyone Should Know About Tax Preparation

The IRS imposes a wide variety of taxes on Americans. These include federal income taxes, which are based primarily on your taxable income, and payroll taxes, which are based on the amount you earn. Most people have some amount of money coming in each year. As such,...

Why You Need a Tax Preparation Software

Whether you own a large tax firm or work as an independent tax preparer, you want to use the best tax software for professionals. There are numerous tax preparation tools on the market today, but it is critical to choose one that meets the needs of your clients. A...