E-filing has made submitting tax returns faster and more efficient. But with those benefits come strict IRS regulations that your clients can’t ignore. From safeguarding customer data under IRS Publication 4557 to ensuring compliance with the latest e-filing standards, companies need to be vigilant. Let’s go over some best practices to keep your clients’ e-filing process both compliant and efficient.

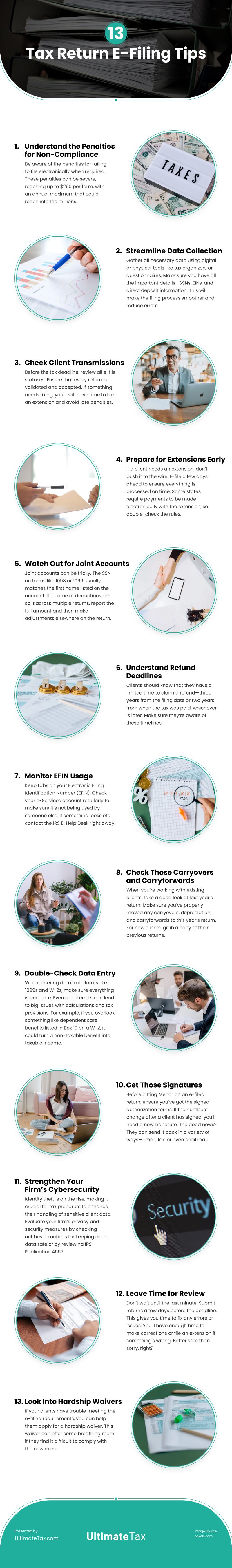

Understand the Penalties for Non-Compliance

Be aware of the penalties for failing to file electronically when required. These penalties can be severe, reaching up to $290 per form, with an annual maximum that could reach into the millions. Penalties apply not only for non-electronic filing but also for non-filing, late filing, or incorrect information. To avoid these costly errors, consider using e-file software for tax professionals.

Streamline Data Collection

Gather all necessary data using digital or physical tools like tax organizers or questionnaires. Make sure you have all the important details—SSNs, EINs, and direct deposit information. This will make the filing process smoother and reduce errors.

Check Client Transmissions

Before the tax deadline, review all e-file statuses. Ensure that every return is validated and accepted. If something needs fixing, you’ll still have time to file an extension and avoid late penalties. Also, remind your clients they can pay any balances using different methods, not just the direct debit info provided on their electronic return.

Prepare for Extensions Early

If a client needs an extension, don’t push it to the wire. E-file a few days ahead to ensure everything is processed on time. Some states require payments to be made electronically with the extension, so double-check the rules.

Watch Out for Joint Accounts

Joint accounts can be tricky. The SSN on forms like 1098 or 1099 usually matches the first name listed on the account. If income or deductions are split across multiple returns, report the full amount and then make adjustments elsewhere on the return. Attach a statement explaining the adjustment to avoid future complications.

Understand Refund Deadlines

Clients should know that they have a limited time to claim a refund—three years from the filing date or two years from when the tax was paid, whichever is later. Make sure they’re aware of these timelines.

Monitor EFIN Usage

Keep tabs on your Electronic Filing Identification Number (EFIN). Check your e-Services account regularly to make sure it’s not being used by someone else. If something looks off, contact the IRS E-Help Desk right away.

Check Those Carryovers and Carryforwards

When you’re working with existing clients, take a good look at last year’s return. Make sure you’ve properly moved any carryovers, depreciation, and carryforwards to this year’s return. For new clients, grab a copy of their previous returns. It’s key to continue any carryovers, asset depreciation, and tracking of suspended losses so nothing gets missed.

Double-Check Data Entry

When entering data from forms like 1099s and W-2s, make sure everything is accurate. Even small errors can lead to big issues with calculations and tax provisions. For example, if you overlook something like dependent care benefits listed in Box 10 on a W-2, it could turn a non-taxable benefit into taxable income. That mistake might also mess up your ability to claim certain credits. Taking the extra time to review and double-check every detail can save you from these problems later.

Get Those Signatures

Before hitting “send” on an e-filed return, ensure you’ve got the signed authorization forms. If the numbers change after a client has signed, you’ll need a new signature. The good news? They can send it back in a variety of ways—email, fax, or even snail mail.

Strengthen Your Firm’s Cybersecurity

Identity theft is on the rise, making it crucial for tax preparers to enhance their handling of sensitive client data. Evaluate your firm’s privacy and security measures by checking out best practices for keeping client data safe or by reviewing IRS Publication 4557, “Safeguarding Taxpayer Data, A Guide for Your Business.” Implement necessary safeguards to protect your systems and client information.

When renewing PTINs, you must:

- Certify your understanding of the legal duty to maintain a written data security plan.

- Recognize that not doing so could breach Circular 230 regulations.

Leave Time for Review

Don’t wait until the last minute. Submit returns a few days before the deadline. This gives you time to fix any errors or issues. You’ll have enough time to make corrections or file an extension if something’s wrong. Better safe than sorry, right?

Look Into Hardship Waivers

If your clients have trouble meeting the e-filing requirements, you can help them apply for a hardship waiver. This waiver can offer some breathing room if they find it difficult to comply with the new rules. But don’t leave it until the last minute. Make sure to start the application process early so there’s plenty of time for approval. By planning ahead, you can help your clients stay compliant and avoid unnecessary penalties.

Conclusion

Keep these best practices in mind as you e-file your clients’ tax returns. You can also look into tax preparation software that automatically updates and stays compliant with IRS regulations. With the right tools in place, you’ll ensure a smooth and secure tax season for your clients.

Video

Infographic

E-filing has made tax return submissions faster and more efficient, but clients must follow strict IRS regulations. This infographic outlines best practices to ensure compliance and efficiency in the e-filing process.