Learn the Best Practices for Keeping Client Data Safe

Professional tax software is designed to be secure. Sensitive customer data is protected behind a private account. Only an authorized user can access the information in the system. That doesn’t mean you don’t have to think about security. If an account...

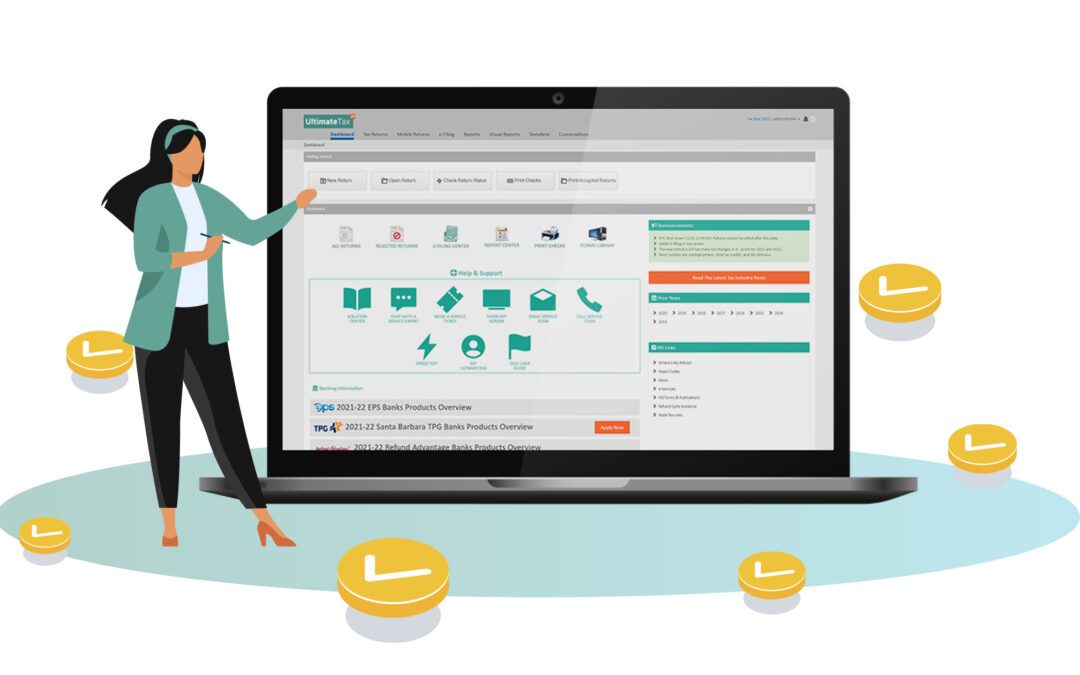

Get Early Tax Refunds for Your Clients with Bank Products

Get Early Tax Refunds for Your Clients with Bank Products With the arrival of October, a tax preparer has to begin preparing for the upcoming tax season’s demands. Including the possibility of offering bank products to clients. Enrollment in bank product...

The Virtual Tax Office

How to work together as team in a virtual tax office The idea of a virtual tax office has become a popular one in recent years. Indeed, months of lockdowns and limited face-to-face interactions have broadened the acceptance of remote office work. We may be seeing now...

After 24 years I switched my tax office from a desktop tax program to an online tax program

After 24 years I switched my tax office from a desktop tax program to an online tax program Our tax office started in the 90s as a family business. We started out as an e-file service center. Clients would bring in their completed tax returns and we would e-file them...

Goals for Your First Year as a Tax Preparer

Goals for Your First Year as a Tax Preparer Setting goals is part and parcel of your job as a tax professional. It is part of the service you offer your clients. They’ll come to your office and ask you to help them with reducing the next year’s tax...

Yes, You Can Start a Tax Business While Working Full-time!

Looking for a good way to supplement your regular income? You might see tax preparation as a viable option. And you’re right! It is a service profession that can easily be integrated with similar types of businesses, such as accounting, bookkeeping, financial...

Cost-Cutting Tips for Your Tax Office Startup

Are you considering a career as a tax preparer? It’s a great option for the self-starter who’s looking for a small business to manage. Tax preparation has a lot of advantages, including the ability to run a business without too many operating costs. No...

Program Update 3/18/21

Your Program should be updated to 35.04 Packages should be updated to the following: 1040 Indirect Ver 6 1120 “C” Corporation Ver 2 1120S “S” Corporation Ver 2 1065 Partnership Ver 2 1041 Fiduciary Ver 3 706 Estate Tax Ver 0 709 Gift Tax Ver 1...