Tax season challenges keep getting more complicated. Between shifting regulations, tighter deadlines, and the constant juggling of client needs, it’s easy to feel overwhelmed.

Small firms have it even harder. With fewer hands on deck, managing it all can seem like a never-ending challenge.

The good news is that there are ways to overcome tax service challenges and even turn them into opportunities (opportunities to streamline, scale, and grow your business).

Here are the top challenges:

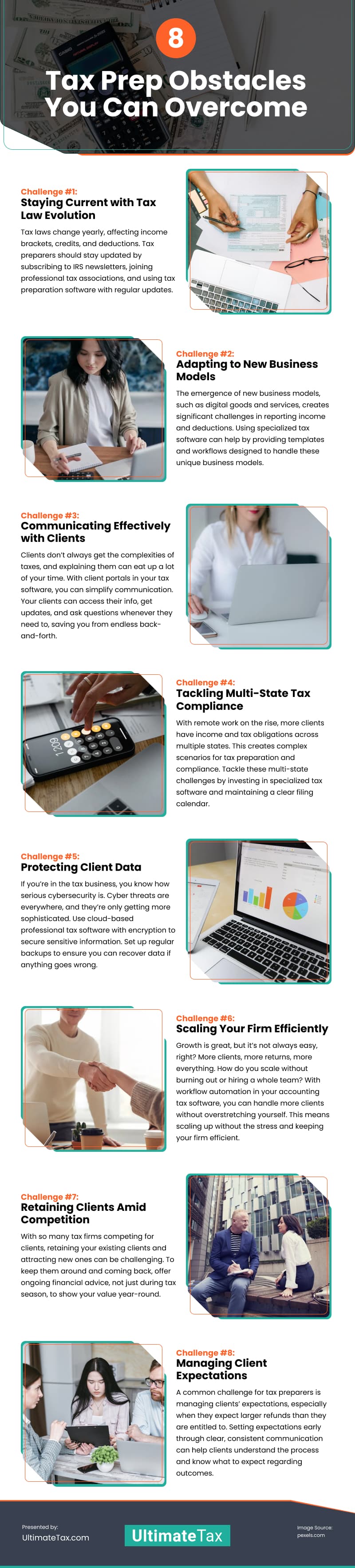

Challenge #1: Staying Current with Tax Law Evolution

The tax laws can change dramatically each year, from adjusted income brackets to new credits and deductions. As a tax preparer, these updates directly impact how you serve your clients and prepare returns.

Recently, there have been significant changes to standard deductions, retirement contribution limits, and electric vehicle credits. Each change requires you to adapt client guidance and update preparation processes.

Make It a Win: Stay ahead by subscribing to IRS newsletters, joining professional tax associations, and using tax preparation software that includes regular regulatory updates.

Challenge #2: Adapting to New Business Models

The emergence of new business models, such as digital goods and services, creates significant challenges in reporting income and deductions.

Tax preparers now have to navigate the complexities of income reporting for businesses that deal in digital products or services that don’t fit neatly into traditional tax structures.

For example, the rise of the gig economy and 3D printing has brought additional complexity to income calculation and reporting.

Make It a Win: Using specialized tax software can help by providing templates and workflows designed to handle these unique business models.

Challenge #3: Communicating Effectively with Clients

Clients don’t always get the complexities of taxes, and explaining them can eat up a lot of your time.

You probably find yourself repeating the same things or dealing with clients who just don’t understand their returns.

Make It a Win: With client portals in your tax software, you can simplify communication. Your clients can access their info, get updates, and ask questions whenever they need to, saving you from endless back-and-forth.

Challenge #4: Tackling Multi-State Tax Compliance

With remote work on the rise, more clients have income and tax obligations across multiple states. This creates complex scenarios for tax preparation and compliance.

For example, a client living in New York while working remotely for a California company and temporarily residing in Florida faces three different state tax returns. Each state has unique rules about residency status, income sourcing, and tax credits that you must carefully navigate to prevent compliance issues and double taxation.

Make It a Win: Tackle these multi-state challenges by investing in specialized tax software and maintaining a clear filing calendar.

Challenge #5: Protecting Client Data

If you’re in the tax business, you know how serious cybersecurity is. Cyber threats are everywhere, and they’re only getting more sophisticated.

That’s why it’s crucial to take action now.

Here are a few steps to protect your clients’ data:

- Use cloud-based professional tax software with encryption to secure sensitive information.

- Set up regular backups to ensure you can recover data if anything goes wrong.

- Keep your software and security protocols up to date to prevent breaches.

Make It a Win: The above steps will help protect your clients’ sensitive information and reduce the risk of costly data breaches.

Challenge #6: Scaling Your Firm Efficiently

Growth is great, but it’s not always easy, right? More clients, more returns, more everything. How do you scale without burning out or hiring a whole team?

Psst—you don’t have to hire extra staff.

Make It a Win: With workflow automation in your accounting tax software, you can handle more clients without overstretching yourself. This means scaling up without the stress and keeping your firm efficient.

Challenge #7: Retaining Clients Amid Competition

With so many tax firms competing for clients, retaining your existing clients and attracting new ones can be challenging.

Clients expect not only tax prep services but also financial advice, personalized service, and quick response times.

Make It a Win: To keep them around and coming back, try the following steps:

- Offer ongoing financial advice, not just during tax season, to show your value year-round.

- Set up reminders for important deadlines so clients never miss a beat.

- Have regular check-ins to stay on top of their changing needs and ensure you’re providing the best service.

Challenge #8: Managing Client Expectations

A common challenge for tax preparers is managing clients’ expectations, especially when they expect larger refunds than they are entitled to.

The rise in “too good to be true” promises can create misunderstandings about tax law and eligibility for deductions and credits.

Make It a Win: Setting expectations early through clear, consistent communication can help clients understand the process and know what to expect regarding outcomes. This might include:

- Providing a written overview of qualifying criteria for common credits and deductions

- Scheduling an initial consultation to review prior year returns and discuss life changes

- Sending regular updates about the status of their return preparation

Conclusion

Tax challenges will always be part of our profession. How you respond to these challenges determines your practice’s success.

Take the time to address each challenge head-on by implementing proven solutions. Whether protecting client data, managing multi-state returns, or streamlining client communications, each step strengthens your practice.

Video

Infographic

With stricter regulations, tight deadlines, and the need to balance client requirements, it’s easy to feel overwhelmed by tax services. However, there are strategies to turn these challenges into opportunities. Find out in this infographic about the top challenges in the industry.