Nobody enjoys hearing the word audit, but every accountant should keep it in mind. While most returns fly under the radar, certain red flags can make the IRS take a closer look.

Let’s walk through some common audit triggers, from high income to large deductions. Knowing these factors can help you guide your clients through the process confidently, ensuring they avoid unnecessary stress down the line.

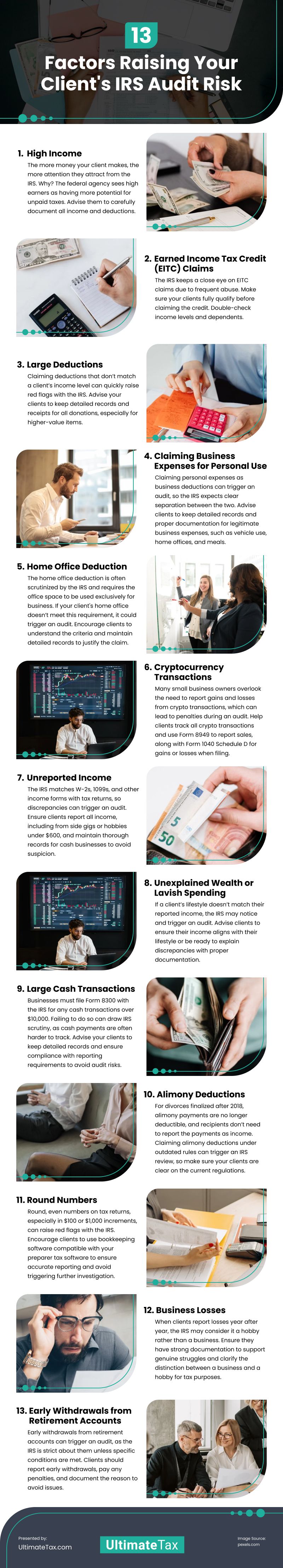

1. High Income

The more money your client makes, the more attention they attract from the IRS. Why? The federal agency sees high earners as having more potential for unpaid taxes.

In 2023, audit rates jumped for those making over $500,000. If your clients fall into this bracket, advise them to carefully document all income and deductions. Proper records will help protect them from any unexpected issues.

2. Earned Income Tax Credit (EITC) Claims

The IRS keeps a close eye on Earned Income Tax Credit (EITC) claims due to frequent abuse.

Make sure your clients fully qualify before claiming the credit. Double-check income levels and dependents. It’s also a good idea to have all necessary documentation ready in case the IRS asks for verification.

3. Large Deductions

Claiming deductions that don’t match a client’s income level can quickly raise red flags with the IRS. If someone earning $50,000 claims $25,000 in deductions, it’s bound to look suspicious. The IRS will probably dig deeper to verify if the client can justify those deductions.

Advise your clients to keep detailed records and receipts for all donations, especially for higher-value items. This practice will help them avoid potential issues if the IRS audits them.

4. Claiming Business Expenses for Personal Use

Claiming personal expenses as business deductions is a common audit trigger.The IRS expects clear separation between personal and business expenses.

Ask your clients to maintain detailed records to justify legitimate business expenses. This includes proper documentation of things like vehicles, home offices, and meals.

5. Home Office Deduction

Claiming the home office deduction can be tricky and is often scrutinized by the IRS. To qualify, the office space must be used exclusively for business purposes.

If your client’s home office doesn’t meet this criterion, they risk raising an audit flag. Help clients understand the specific requirements for claiming this deduction, and encourage them to keep detailed records to justify the claim.

6. Cryptocurrency Transactions

Many small business owners don’t realize they must report gains and losses from crypto transactions. Failing to do so can lead to serious penalties during an audit.

To avoid issues, help your clients track all crypto transactions throughout the year. When it’s time to file, use Form 8949 to report sales and Form 1040 Schedule D to document gains or losses.

7. Unreported Income

The IRS gets copies of all W-2s, 1099s, and other income forms. They match these against what’s reported on tax returns. Any discrepancies are audit bait.

Make sure your clients report all income, even from side gigs or hobbies that earned less than $600. Cash businesses like restaurants or salons need thorough recordkeeping to avoid suspicion.

8. Unexplained Wealth or Lavish Spending

If your client’s lifestyle doesn’t match the income they report, the IRS may take notice.

A taxpayer reporting a modest income but showing signs of significant wealth (like expensive cars or homes) could trigger an audit.

Encourage clients to ensure their reported income aligns with their lifestyle or be prepared to explain any discrepancies with proper documentation.

9. Large Cash Transactions

Businesses must file Form 8300 with the IRS for any cash transactions over $10,000. Failing to do so can draw IRS scrutiny, as cash payments are often harder to track.

Advise your clients to keep detailed records and ensure compliance with reporting requirements to avoid audit risks.

10. Alimony Deductions

The rules around alimony deductions have changed, and clients may still be confused.

For divorces finalized after 2018, alimony payments are no longer deductible, and recipients don’t need to report the payments as income.

Claiming alimony deductions under outdated rules can trigger an IRS review, so make sure your clients are clear on the current regulations.

11. Round Numbers

When clients fill out tax returns with round, even numbers, the IRS sees it as guesswork. Numbers ending in zeros, especially in $100 or $1,000 increments, often raise red flags and trigger further investigation.

Encourage clients to use bookkeeping software that works with your preparer tax software. This can help them report exact figures in their records. Rounding to the nearest dollar is acceptable, but consistently rounded numbers indicate inaccurate bookkeeping. Precise numbers show that clients maintain well-documented records, reducing the likelihood of an audit.

12. Business Losses

When clients report losses year after year, the IRS may view it as a hobby rather than a business. Typically, a business should show a profit in at least 3 out of 5 years.

If your client’s business is facing genuine struggles, ensure they have strong documentation to back it up. Clarify the distinction between a business and a hobby for tax purposes to avoid any complications.

13. Early Withdrawals from Retirement Accounts

If a client takes money out of their retirement accounts early, this could trigger an audit. The IRS is strict about early withdrawals unless specific conditions are met, like medical expenses.

Clients must report early withdrawals and pay any associated penalties. Remind clients to document the reason for early withdrawals to stay on the safe side.

For Freelancers: Multiple 1099s

If your client receives multiple 1099s from freelance or gig work, the IRS will likely scrutinize whether all income is properly reported. Multiple income sources often lead to reporting mistakes.

Make sure your clients maintain accurate records and account for every 1099 on their tax return.

Final Thoughts

When it comes to taxes, the devil’s in the details. Keeping track of everything—income, deductions, and those pesky 1099s—can help you steer clear of unwanted IRS attention. Reliable accounting tax software can help streamline the process, ensuring your clients don’t miss anything and stay audit-ready.

Video

Infographic

Some tax returns may attract IRS attention due to specific red flags, like high income and large deductions. Knowing these triggers can help you confidently guide your clients and minimize future stress. Read more in this infographic.