What’s the best professional tax software for you? This is the key question to consider as someone who is running a tax preparation business—or planning to start one.

Even if you have been a tax preparer for a while, you might find yourself considering whether you might find a better software solution out there. Many tax preparation software packages increase their annual fees from time to time. What seemed like a good deal a few years ago may not look so rosy today.

If you are just starting your tax practice, then it is definitely a question worth investigating. You’re looking at over a dozen products with fairly similar capabilities. How do you know which one is the right fit for your entry-level tax preparation office?

This chart is for you. UltimateTax’s team has once again updated our comparative study on professional tax software—a project that started in 2020. You will not find a more comprehensive breakdown of the features of the top software options on the market!

UltimateTax is a company that values customer satisfaction above all else. A company that’s motivated not just about making sales, but making its customers happy.

That’s why the team puts in the hard work on the software comparison guide—for the sake of helping customers like YOU make the best decision. And that helps ensure you will truly be a satisfied customer if you choose to go with UltimateTax professional tax software.

Whether you are a new tax preparer or an established one, the tax software guide will save you precious research time. It provides a quick comparison chart of pricing and product features. This is followed by discrete reviews of each software, detailing what they have to offer.

Our in-house team feels confident that the guide achieves a fair and measured comparison of tax preparation business software. If you feel that any information needs updating or correcting, click here to leave your comment. Your feedback as a preparer is welcome.

| Software | Price | Data Entry Style Form | Interview | All States Included *No up charge | All Federal Tax Form Included | Unlimited 1040 E-file | Corporate Returns | |||

|---|---|---|---|---|---|---|---|---|---|

| UltimateTax PPRGo to page Read Review | $388 | ✔ See all forms | Add On | ||||||

| UltimateTax Online 1040Go to page Read Review | $888 | ✔ See all forms | |||||||

| UltimateTax Desktop 1040Go to page Read Review | $988 | ✔ See all forms | |||||||

| UltimateTax Desktop 1040 + CorporateGo to pageRead Review | $1188 | ✔ See all forms | |||||||

| ATXGo to page Read Review | $5,879 | ||||||||

| CCH ProSystems fx Read Review | requires a long call with a salesman | ||||||||

| CCH Axcess Tax fx Read Review | $9,999 | ||||||||

| TaxWiseGo to page Read Review | $3,606 | ||||||||

| CrossLinkGo to pageRead Review | $1,795 | ||||||||

| Drake TaxGo to pageRead Review | $2,495 | ||||||||

| Federal Direct Tax Read Review | $2,499 | ||||||||

| Intuit ProSeriesGo to page Read Review | $3,191 | ||||||||

| Lacerte TaxGo to page Read Review | requires a long call with a salesman | ||||||||

| ProConnect TaxGo to page Read Review | $6,307 | ||||||||

| MyTaxPrepOfficeRead Review | $1,295 | ||||||||

| Olt ProRead Review | $999 | ||||||||

| TaxAct Professional EditionGo to page Read Review | $2,295 | ||||||||

| TaxSlayerGo to page Read Review | $1,695 | ||||||||

| UltraTaxGo to page Read Review | requires a long call with a salesman | ||||||||

Prices reflect December 30, 2024. | Did we get something wrong?

Tax Software Product Evaluation: A Checklist

Our in-house team has done extensive research and hands-on testing on the tax software programs listed here. The team’s collective insights have contributed to this comparison guide. In performing their analyses, the team members relied on a shared set of criteria for evaluating tax professional software, presented as follows:

- Most Essential Features: No program made it on the list if it lacked most of the features seen as crucial to professional tax preparation software. The team was instructed to check if the software provided tax return e-filing, all vital forms and schedules, all state modules, status reports and multi-user access.

- Platform Availability: Is the professional tax preparation software available on a desktop setup, a web-based platform—or both? With more and more businesses offering remote or hybrid work options, this is a major consideration among today’s tax professionals.

- Ease of Use: This is one of the key elements that separates one tax prep tool from another. How easy is it to install the tax software and start using it? Can it be mastered fairly quickly? Are the program settings and functions clear and accessible?

- User Experience: How satisfactory is the experience of using the software, as a whole? Does it make electronic tax preparation a lot faster and simpler? Does it assist you in determining the correct tax forms and how to do them correctly?

- Time Saving & Cost Saving: Does the professional tax software contribute to a more efficient workflow? Are you able to complete tax returns faster without sacrificing accuracy? Can you file multiple returns or access various tax forms without paying additional fees?

- Return Validation: Can running this professional tax software help you mitigate errors? Does it offer diagnostic tools which can tell you if your filled-out form is correct and complete?

- Customer Support: Does the software provider offer tax pro advice and user assistance to their customers? How can they access these support services? Can customers look up specific issues on an online support database or forum?

- Info Security: Tax preparation involves the processing of sensitive customer information. Can the software handle secure data transmission? Does it provide safe and secure file storage? Does it support cyber security features like two-factor authentication?

- Maximizes Earnings: Can you use the software to collect IRS refunds via bank products to earn additional revenue? What bank products are supported? What other services are supported?

A Word About Price Comparison

The key measures of tax software comparison revolve around usage and functionality. But there is one more point of comparison to discuss: Affordability.

Let’s face it, price matters to any business that cares about the bottom line. And while quality shouldn’t take a backseat to cost savings, a purchaser should take a closer look at the difference in quality between products. What if the difference is not that noteworthy?

Tax preparation is an established process that doesn’t change that much from year to year. Electronic tax preparation tools don’t display a great deal of variation from each other, either. They all accomplish the same functions, more or less. The differences lie more in ease of use, user experience design, gated features, customer support and pricing. The price differences between various software products can be significant.

What is behind these differences in pricing? Much of the time, pricing variations indicate the company’s sales strategy. That means offering similar products that are targeted to separate categories of users.

Low-priced tax software options are aimed at new tax preparers, boutique agencies and cost-conscious purchasers. Mid-priced software products are pitched to medium-sized offices. Premium and enterprise editions cater to high-volume tax preparation businesses that serve corporate clientele.

The high-end offerings may pack in features not offered by the lower priced software products. Such premium features might not be necessary for small-and-medium tax preparation businesses.

Price also reflects the market advantage of having an established brand. A well-known name like Intuit can leverage its top-tier branding to demand higher subscription rates compared to the competition.

For the savvy purchaser, the key factor is not price alone, but value for price. You’re looking to get the best value tax software available—one that will satisfy your precise needs at a price point you can be happy about.

One more thing to keep in mind: it can be a good idea to purchase your software months before the start of the tax season. Many products are available at a discounted rate if bought several months before the tax season. The prices on this comparison chart are based on the MSRP of the products. You may be able to find them at a lower price point.

Professional Tax Software Reviews

UltimateTax

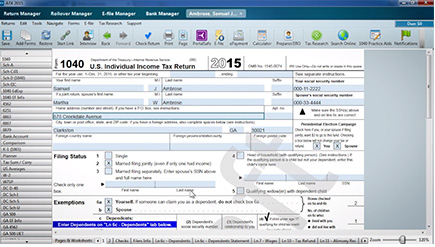

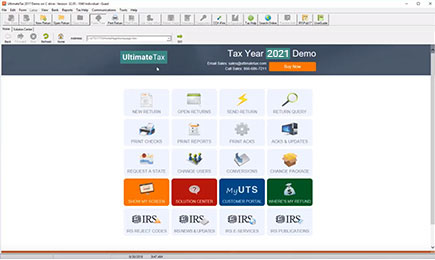

But what about the product itself? UltimateTax gets good reviews on that, too. The company makes easy-to-use, feature-rich tax preparation software for both desktop and online platforms. UltimateTax gives tax preparers two modes for processing tax forms. One is data form entry mode, which simply presents a tax form to be filled out with information. The other is interview mode, which guides you through the process of completing a tax form with prompts and indicators.

Price Range: $388 – $1,188 (Desktop / $888 (Online)

Summary: UltimateTax offers affordable, simple, and accurate tax preparation software for tax pros who mainly prepare individual returns (Form 1040s). It supports business returns as well. UltimateTax’s most comprehensive package—which includes unlimited corporate returns—is one of the most affordable corporate returns solutions on the market.

Summary: UltimateTax offers affordable, simple, and accurate tax preparation software for tax pros who mainly prepare individual returns (Form 1040s). It supports business returns as well. UltimateTax’s most comprehensive package—which includes unlimited corporate returns—is one of the most affordable corporate returns solutions on the market.

UltimateTax might not be one of the big names in tax prep software, but it has been around for 20 years, providing excellent customer satisfaction. It’s a tried and tested product, just as capable as any other solution on the market. And its user base is steadily growing.

Personalized Service

We’d like to highlight the one great advantage of using a less than mega-popular product. And that’s the more personalized brand of service that customers can receive! UltimateTax serves thousands of customers rather than hundreds of thousands, so the company can devote more time and resources to each individual subscriber. Their support team isn’t gonna get stretched thin!

At a time when many companies are moving to integrate AI virtual representatives in their support services, UltimateTax is sticking with human support team members—no AI can truly be as supportive, empathetic and friendly as a real person.

No surprise, great customer service is one of the big selling points of UltimateTax! That’s according to trusted user reviews on Google and TrustPilot.com. “When ever I need some technical support, they respond quickly. It really feels like they are family. I thought about leaving last year but the trust I developed with them forced me to stay,” notes one review. “Their customer service and assistance to get you comfortable with their program is second to none,” says another. And so it goes. Review after review singles out UltimateTax’s top-notch customer support.

A look at the stats shows the deep dedication of the UltimateTax customer service team. The company’s First Call resolution is at 94.30%. UltimateTax’s Customer Satisfaction Rating is a whopping 98.12%! Hold times are very minimal to the point of hardly existing. When hold times do happen, it’s on the busiest days of the tax season. The longest hold time on record is 6 minutes, and no other customer call came close to that. Indeed, around 99.5% of UltimateTax customer care calls have 0 hold time!

Easy-to-Use Tax Software

When completing tax forms in UltimateTax, you can access a built-in help box with comprehensive and context-sensitive advisories. Smart diagnostics can review processed returns and warn you if there are errors or omissions. Don’t experience the hassle of submitting a return only to have it get rejected! Ensure 100% accuracy in your tax form e-filings!

UltimateTax’s Easy Software Interface prioritizes simplicity and usability. The quick access buttons on its Launch Pad feature can be customized to suit your preferences.

You can enjoy paperless filing (if you have an EFIN), detailed reports, real-time progress status on filed returns, regular automatic back-ups (to ensure that your data is protected), e-signature support, check printing and bank product rebates.

Free software data conversions are available to customers who are switching from another program. Software specialists are on standby to provide technical assistance at no additional charge.

Price Break-Down for UltimateTax

Four different UltimateTax packages are available to meet the needs of various users, from new tax preparers to industry veterans.

| Pay-Per-Return | Online 1040 | Desktop 1040 | 1040 + Corporate |

| $388 (then $20 per individual return, $40 per business return) | $888 | $988 | $1,188 |

Note that UltimateTax pay-per-return rates are the lowest you can find in any pay-per-return package available on the market! The closest one in comparison, TaxAct Pay-Per-Return, charges a rate almost $5 higher.

No setup charge is included in any of the UltimateTax packages.

UltimateTax Pay-Per-Return

UltimateTax Pay-Per-Return offers great value to the new tax preparer dipping their toes in the business. Priced at the super affordable rate of $388, UltimateTax PPR is perfect for anyone who wants to quickly get a mini tax office up and running, with support for 1040 tax forms, including federal and all states. The cost for preparing 1040s is only $20 per return.

As of 2025, UltimateTax PPR also lets you prepare partnership and corporate returns upon request: 1120, 1120S, 1065, 1041 and others. The cost for preparing these is $40 per return—a very good price compared to other tax prep solutions.

While it’s well-suited for use by an individual tax preparer, UltimateTax PPR allows for quick expansion in case you need it. The software supports up to 10 users out of the box! No need to send a request to customer support, no need to pay extra for additional accounts. Add up to 10 user accounts as you require—hassle-free!

Another great feature of UltimateTax PPR: you can access your tax software from anywhere using an internet connection. Easily pull up client data via web browsers during a face-to-face meeting, using your laptop or tablet.

UltimateTax 1040 Online

UltimateTax 1040 Online is a step up from the PPR package. This one works well for the small tax office catering to several hundred clients. The package comprises free e-filing, free unlimited 1040 returns both federal and state (all states included), and business returns available upon request.

UltimateTax Online 1040 is perfect for the on-the-go professional. You don’t need to install anything. Access the online tax software from anywhere, file unlimited 1040 returns electronically, view real-time progress reports, and grant account access to as many as 10 users at once. It doesn’t matter whether you’re on the road or meeting a client at their place—you can access the software and review client data with your laptop or mobile device. UltimateTax Online 1040 offers peerless mobility.

UltimateTax Desktop Products

UltimateTax Desktop is nearly identical to 1040 Online in terms of features, functions and supported tax forms and schedules. The key difference is that it needs to be installed on your office computers. UltimateTax Desktop lacks some of the mobility features of 1040 Online—such as accessibility on different types of devices, including Macbooks and other Apple products. It does have the distinct advantage of supporting unlimited user accounts.

UltimateTax 1040 + Corporate is a more advanced desktop solution. This package will serve many CPAs and EAs very well. UltimateTax 1040 + Corporate supports 1040 and corporate returns, all states included, W-2/1099 forms, and prior year tax returns. Unlimited user accounts are provided.

With an MSRP of $1,188, UltimateTax Desktop 1040+ Corporate is one of the most affordable corporate returns solutions on the market.

Customer Support and Bank Products

UltimateTax places a strong emphasis on customer support, offered through its 365 Service. An in-house team provides year-round technical assistance at no additional cost to UltimateTax subscribers. You can contact a help agent via phone, email or live chat. All customer support agents are based in the USA.

Alternatively, you can search for topics at the Solutions Center hosted on the UltimateTax website. You can check out troubleshooting articles or videos.

UltimateTax helps you maximize your earnings through bank products that you can offer your clients. You can get bank product options that let your firm process IRS refunds faster for clients—to earn you additional revenue through rebates. UltimateTax has partnered with EPS Financial, Refund Advantage and the Santa Barbara Tax Products Group (TPG) to offer you this service. (For customers in the states of Arkansas, Connecticut, Illinois, Maine, Maryland and New York that prohibit standard bank products, UltimateTax offers a FeeCollect option.)

For your information, UltimateTax works in partnership with TaxWise for tax calculations and e-filing functions. The UltimateTax software adds several proprietary features, including 365 Service and the easy-to-use Launchpad workflow optimizer.

ATX by Wolters Kluwer

Price Range: $799 – $5,879 (desktop only)

Summary: Professional tax software that provides a large number of IRS forms and schedules including most business tax forms. It is a desktop application, and an expensive program compared to other software options (even products from the same company). It is best used by established tax pros who require regular access to a massive library of tax forms.

ATX software prices are on the higher end—by a good margin. If you’re a novice tax preparer, you’ll appreciate the option of getting the ATX Pay-Per-Return System, which is the lowest costing ATX software package. But this, too, is relatively pricey compared to its counterparts, although ATX Pay-Per-Return System does offer a tad more functionality than other PPRs.

All in all, the appeal of ATX mainly lies with its feature-loaded software packages. The question is whether your tax office would benefit enough from ATX’s features and services to justify the package cost. They can be very good features to have, but is it worth paying a premium for them? It feels that ATX is best suited to a large tax preparation firm that caters to big corporate clients. Indeed, online reviews of ATX included comments such as: “The program can do so much more than I need it to do. It is therefore priced itself out of my range”

It might help to think of ATX by Wolters Kluwer as a “luxury car model” of the tax preparers software sphere. It may be a cut above, but more economical options can also get the job done—that is, they’ll get you to where you need to go.

Even if you are willing to pay the current price of ATX software, bear in mind that the payment only covers a single tax year. There’s a likelihood of the price going up, which means that next year you’ll pay a little more, then the year after that, you’ll pay a little more again, and so on.

Features of ATX by Wolters Kluwer

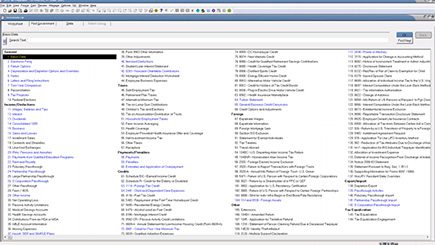

One of ATX’s top features is support for a comprehensive tax form library. Subscribers can access around 6,000 tax compliance forms, including most business returns. This begs the question of whether your business would ever need access to such a phenomenal number of tax forms.

Along with the tax form library, ATX provides a couple of research resources for finding information quickly. These include the U.S. Master Tax Guide and the CCH AnswerConnect service (different tiers of this service are tied to different packages).

The software has a forms-based interface that is easy to use. You also get in-line help options on the tax form entry screen. And ATX provides two alternative ways for filling out the electronic tax form. Users can choose the direct entry method or the interview method.

One thing to note: a cursory glance at customer reviews online suggests that the ATX program interface is not as easy or intuitive compared to other tax preparers software. However, the findings of The Tax Adviser’s 2024 Tax Software Survey obtained a different result suggesting that ATX does have good ease of use. It is probable that the 2024 survey respondents are largely experienced tax pros.

Also, if you are looking for a cloud-based software solution, ATX might not be the right choice for you. It is a desktop application, although you can pay for a service that enables ATX software cloud hosting. This is not a service provided by Wolters Kluwer, so you must go with a third-party provider of such a service.

Price Breakdown for ATX Tax Software Packages

Here’s a chart showing the price/package options for ATX professional tax software:

| ATX Pay–Per–Return System | ATX 1040 | ATX MAX | ATX Total Tax Office | ATX Advantage |

|---|---|---|---|---|

| $799 ($32 per individual return, $57 per business return) | $1,059 (includes 75 free e-filings, then $6.50 per return) | $2,419 | $3,589 | $5,879 |

The Wolters Kluwer website does not publicize the rates for filing returns under the ATX Pay–Per–Return System. The prices shown in the chart reflect the PPR filing costs from a previous year, and the actual current price may differ.

The price for the ATX Pay–Per–Return System plan includes a non-refundable $300 deposit towards returns.

Also, note that the prices shown on the chart reflect the base price for each of the ATX plans. But buyers will also need to pay an extra, one-time processing fee of $48.50 when purchasing the plan on the Wolters Kluwer website.

Optional Add-On Features

After purchasing a package, you can get ATX add-ons that will expand the functionality of the software. The following list shows these optional add-ons and their corresponding prices:

- Advanced Calculations and Compliance: $695 (included in the ATX Advantage plan)

- Enhanced Asset Management: $440 (included in the ATX Advantage plan)

- Return Retrieval: $199

As you can see, the most expensive plan, ATX Advantage, comes bundled with two of these additional features.

Return Retrieval is a purchasable add-on which is not a native feature of any of the plans. This supplemental feature establishes a secure backup solution to guard against the loss of client files. It’s something that every high-volume tax practice really needs to have.

ATX Pay–Per–Return System & ATX 1040

The ATX Pay-Per-Return System (PRS) is most suitable to the new tax preparer who will be filing a low volume of returns. The advantage of this software package compared to many PPR deals is that you are not limited to Form 1040s. You can file any combination of returns, whether that includes individual or business returns, federal or state returns, or more specialized forms.

ATX 1040 is the second most affordable package after the PRS option. This plan is limited to three states and 75 free e-filings.

ATX 1040 comes with a research tool, CCH AnswerConnect Primary Sources. Note that it is not as comprehensive as the research tools included in the higher-priced software packages. CCH AnswerConnect grants tax pros access to expert answers on tax law and compliance. In 2024, the company added an AI-powered research tool that provides you with customized responses to queries, based on the existing tax knowledge and documentation the AI was trained on.

Other features include e-signature support, payroll compliance reporting and the Check Return Track diagnostics tool for returns.

Other ATX Packages

ATX Max is the company’s most popular package. This ATX software version includes all state and federal returns along with unlimited free e-filing. Overall it has the same features you will find in ATX 1040. But for its research tool, ATX Max carries the CCH AnswerConnect Prime Package, an upgrade from the one you get with ATX 1040.

ATX Total Tax Office offers almost the same bundle of features as ATX Max. The primary difference is the inclusion of the most comprehensive research tool option, the CCH AnswerConnect Expert Package.

ATX Advantage is the same, but also includes concierge care and conversion services. Enhanced Asset Management and Advanced Calculations and Compliance come with this package—no need to purchase them as add-ons.

Tech Support

On the Wolters Kluwer website, you can access a dedicated support center for ATX products. You can search an extensive knowledge base for solutions to your software issues, or enjoy a live chat with a virtual agent.

The company also provides phone support during operational hours, which are specified on the support center page.

CCH ProSystem fx Tax

Price Range: Up-market software, must request quote as price varies depending on modules acquired.

Summary: High-end, on-premise tax pro solution priced at a premium. Delivers greater functionality when integrated with other CCH ProSystem fx Suite applications. Price not stated—you must request a quote, as price varies depending on modules acquired.

Wolters Kluwer offers a whole suite of CCH ProSystem fx software products. This review will focus on CCH ProSystem fx Tax. It is a highly automated tax compliance system combined with an office manager. It aims to maximize speed and efficiency while maintaining general ease of use.

CCH ProSystem fx Tax is ideal for an accounting firm that provides client-facing tax services. It is not the best match for a solo entrepreneur running a small tax preparation business.

CCH ProSystem fx Tax software professional services run as an on-premise installation. If you prefer to use an online application, you could consider CCH Axcess Tax. While it is technically a separate product, CCH Axcess Tax offers the same functionality, more or less. And it is a cloud-based application available via online access from anywhere.

A few years ago, there was some indication that Wolters Kluwer was pushing its customers to switch to CCH Axcess Tax from CCH ProSystem fx Tax. But today, CCH ProSystem fx Tax is still very much alive. Our theory is that Wolters Kluwer is aligning CCH ProSystem fx Tax more with accountancy firms and CCH Axcess Tax more with tax professionals in particular. Confusingly, Wolters Kluwer is offering two other professional tax software products: ATX and TaxWise

Pricing and Features

Wolters Kluwer does not give a set price for CCH ProSystem fx Tax or CCH Axcess Tax. It appears that the price can vary depending on the number of users and the specific modules obtained. Subscribers can purchase modules individually or bundled together. Available modules include Individual, Partnership, Corporation, Exempt Organization, Estate and Gift, Fiduciary and Employee Benefit Plan.

CCH ProSystem fx Tax is certainly a robust software solution. It supports e-filing for thousands of calculating forms and schedules. These include federal, state, city and county returns. Among others, the software supports Forms 1040, 1041, 1065, 1120, 1120S, 990, and 5500.

The program features automatic calculations that make return processing fast and efficient. Form eligibility can be checked via diagnostics, which flags any errors and omissions. CCH ProSystem fx Tax software also includes a tool to check the e-file status of a return. It even supports checking the e-file status from a mobile device.

The main interface of CCH ProSystem fx Tax provides quick access to the software tools, including the client list, return list, search box and a handy toolbar. Users can customize the toolbar, adding or removing buttons until they have the configuration they prefer.

Software Integrations

CCH ProSystem fx Tax is a good choice for the user who wants to get the other CCH ProSystem fx Suite applications. You can use them together to create various synergies that can enhance your tax office workflow—particularly a digital workflow.

For example, you can use CCH ProSystem fx Scan and Autoflow Technology with CCH ProSystem fx Tax to achieve effective 1040/1041 data import from scanned documents.

Your tax practice can store client information, electronic workpapers and other information using CCH ProSystem fx Document. You can do intensive research via access to the Wolters Kluwer knowledge base using CCH AnswerConnect.

Other suite applications include CCH ProSystem fx Fixed Assets, CCH ProSystem fx Knowledge Coach, CCH ProSystem fx Engagement, CCH ProSystem fx Planning, CCH ProSystem fx Practice Management and CCH ProSystem fx Workpaper Manager software.

These software solutions can be on-premise, hosted by you. Alternatively, they can be hosted on the cloud. The ease of integration between a software application and CCH ProSystem fx Tax will vary depending on where the solution is hosted.

Tech Support

CCH ProSystem fx Tax customers who need tax information or technical support can call for assistance or chat with a virtual representative. They can also access an online knowledge base where they can search for help info and look up product release notes.

CCH Axcess Tax

Price Range: $999 – $9,999 (essentials plan), must request quote for advanced plans

Summary:A sister product to CCH ProSystem fx Tax, offering much of the same functionality in a cloud-based application. More than a tax preparation program, it also includes firm management tools to help you supervise remote teams of tax pros.

CCH Axcess Tax is a software product highly similar to CCH ProSystem fx Tax. As noted above, the latter is being pitched to accounting firms, while CCH Axcess Tax is marketed to tax preparation businesses that also offer tax planning services.

The major difference between this product and ATX by Wolters Kluwer is that CCH Axcess Tax is akin to a cloud-based version of CCH ProSystem fx Tax. That means CCH Axcess Tax offers broader functionality and is not limited to tax preparation features. One of the key purposes of CCH Axcess Tax is enabling centralized firm management in the cloud. It provides a cloud-hosted dashboard to let firms centralize tasks, data and productivity reporting. It even includes a staff management tool.

Additionally, all CCH Axcess Tax packages grant you access to tax planning tools, e-learning resources and software support.

The Tax Adviser’s 2024 Tax Software Survey has some notable findings about CCH Axcess Tax. Of the programs surveyed, CCH Axcess Tax earned the lowest score (tied with UltraTax CS) of 4.3% with regard to ease of use and installation. Survey respondents also indicated that it was not great at handling transfers of data within returns. Only 67% of respondents said that they would recommend it to someone starting a tax practice (the lowest percentage in the survey).

Price Breakdown for CCH Axcess Tax Essentials

Let’s first take a look at the CCH Axcess Tax Essentials plans and prices:

| Essentials Pay-Per-Return | Essentials 100 | Essentials 200 | Essentials 400 | Essentials Unlimited |

|---|---|---|---|---|

| $999 (includes 10 returns, then $82.10 per individual return, $93.25 per business return) | $2,299 (includes 100 returns, then $49.95 per return) | $3,299 (includes 200 returns, then $49.95 per return) | $4,299 (includes 400 returns, then $49.95 per return) | $9,999 |

This chart does not show the prices for the advanced plans, CCH Axcess Tax Complete and CCH Axcess Tax Pro.

The CCH Axcess Tax Essentials plans are marketed to small businesses, and come with 1-4 user licenses. These plans support the following forms and schedules: 1040, 1040NR, 1065, 1120, 1120S, 990

CCH Axcess Tax Essentials Pay-Per-Return is not available to existing customers of Wolters Kluwer. Only a new subscriber would be able to purchase this PPR software package. Essentials Pay-Per-Return supports federal individual returns by default, but not state returns—those must be purchased separately on a pay-by-state basis.

The other Essentials packages support state returns—up to 5 states, which must be selected while making your software purchase. Additional states must be purchased separately on a pay-by-state basis.

Other CCH Axcess Tax Packages

Wolters Kluwer does not give a set price for CCH Axcess Tax Complete or CCH Axcess Tax Pro. You need to contact a sales representative to discuss pricing for either of those packages.

Note that these packages are only offered to new customers. If you are an existing Wolters Kluwer customer, you can’t purchase the Complete or Pro plan.

CCH Axcess Tax Complete comes bundled with 1-9 user licenses and the CCH Axcess Planning software. It also includes a number of services, such as implementation consulting and set-up and introductory training.

CCH Axcess Tax Pro grants you 1-19 user licenses and access to CCH ProSystem fx Scan and Autoflow. It also includes a number of services, such as professional onboarding, software conversion and software training. Supplementary software modules can be added, which will affect the package price.

Software Integrations

The price of your CCH Axcess Tax package can vary depending on the number of user licenses and specific modules obtained. Subscribers can purchase modules individually or bundled together. Available modules include CCH Axcess Document, CCH Axcess Workstream, CCH Axcess Practice, CCH Axcess Client Collaboration, CCH Axcess iQ and CCH Axcess Engagement Essentials.

CCH Axcess iQ is one of their newer offerings. It is an AI-powered “predictive intelligence” tool aimed at supporting your tax advisory and planning services. You can use this tool to quickly discover which of your clients are directly affected by the latest changes in tax laws.

Tech Support

CCH Axcess Tax customers can get answers to their questions at the online Support Center hosted on the Wolters Kluwer website. You can quickly find articles on all kinds of topics, including product information, software functions and troubleshooting. You may also use live chat to seek help from a virtual assistant or a CCH expert.

The website also hosts a support community where you can get advice from fellow subscribers.

Phone support is available during operational hours, which are listed on the Wolters Kluwer website.

TaxWise

Price Range: $1,565 – $3,606 (desktop) / $356 – $3,606 (online)

Summary: TaxWise provides desktop and software based packages, with the online application specialized in the processing of individual 1040 returns. Add-ons like a mobile app are available at an extra cost.

TaxWise operates under the banner of Wolters Kluwer, the same company that offers ATX tax preparers software. Unlike ATX, TaxWise provides a cloud-based version of their application. But a desktop version is also available for tax pros who prefer that option.

TaxWise used to offer a low-cost Pay-Per-Return package, which is not currently being offered for the desktop version. TaxWise Online Limited is now the lowest priced option providing a pay-per-return only solution.

Features of TaxWise

While TaxWise software provides forms and features that let you prepare and file taxes, and a central office management tool, certain functions and services are only available as purchasable add-ons. These include mobile app access and a refund estimator.

All TaxWise software packages come with e-signature support. However, extra costs are involved. Each e-signature use requires a $4.25 payment.

In terms of interface design, TaxWise has a simple and straightforward look and feel. Maybe not exactly a “jump into it” ease of use, but you face a relatively short learning curve to figure it out. Main functions are navigated via the dashboard, from which you can get to the tax returns, the e-filing area, text and email messaging, and the digital reports.

TaxWise offers both standard tax form entry and interview mode. The interview mode provides guide questions for a new user or new tax preparer working to complete a tax form. It assists one in filling out the tax information correctly without skipping anything of importance. The diagnostics tool adds an extra layer of accuracy checking to prevent errors that may result in rejected e-filings.

Comparing TaxWise with UltimateTax shows that the tax software programs offer similar features: on-premise and online application options, form-entry and interview modes, interface customization, diagnostics, online tax preparation and bank product integration.

Price Breakdown for TaxWise

With the two products sharing many similarities, customers are left to look at how their prices compare. TaxWise has fairly competitive market pricing, but it remains significantly more expensive than its UltimateTax counterpart across several categories of price and package.

| Limited | 100 Package | 400 Package | Unlimited Package | |

|---|---|---|---|---|

| TaxWise Online | $356 (then $35 per individual return and $55 per business return) | $1,565 (includes 100 individual 1040 returns, then $35 per individual return and $55 per business return) | $3,293 (includes 400 tax returns, then $35 per individual return and $55 per business return) | $3,606 |

| TaxWise Desktop | $1,565 (includes 100 individual 1040 returns, then $35 per individual return and $55 per business return) | $3,293 (includes 400 tax returns, then $35 per individual return and $55 per business return) | $3,606 |

TaxWise Online Limited buyers are required to pay an extra, one-time processing fee of $29 when purchasing the plan on the Wolters Kluwer website.

Unlimited Package, 400 Package and 100 Package buyers are required to pay an extra, one-time processing fee of $59 when purchasing the plan on the Wolters Kluwer website.

Optional Add-On Features

TaxWise software features can be supplemented by various add-ons that provide useful and convenient functionality. None of the TaxWise plans includes these add-on features by default. They can only be accessed by purchasing them separately.

Not all add-ons are available for all TaxWise plans. The TaxWise Mobile add-on is only for TaxWise Online packages. Similarly, the Refund Estimator add-on is only available for TaxWise Desktop packages.

Here’s a list of the optional add-ons and their corresponding prices:

- TaxWise Mobile: $431 (for TaxWise Online only)

- Return Retrieval: $139 (for TaxWise Desktop only)

- TaxWise Expert Services: $323

- Refund Estimator: $99

- Textellent Integration: price varies by package

- Prior Year Individual 1040 & Business E-File ($5.50)

As you can see, the most expensive plan, ATX Advantage, comes bundled with two of these additional features.

Return Retrieval is a file backup system that lets you restore returns previously e-filed through the application. You can use it to retrieve e-filed tax returns of the current year and two prior years. If you have multiple tax offices, each purchase of the Return Retrieval service is enabled for use by just a single office. You will need to purchase the service separately for each office. This service is only able to retrieve the following types of federal and state returns: 1040, 1120, 1120S, 1065, 1041, 990, 5500

Refund Estimator sets up a customizable website that works like a very basic client portal. Tax preparers can direct clients to the website to get a quick estimate of their federal refund.

Textellent is a service that provides an automated text messaging platform that can be integrated with your professional tax software. For example, the platform can automatically send your client a message to notify them of an update concerning their return or refund.

TaxWise Online Limited

The online-only pay-per-return plan lets you file individual 1040 returns, both federal and state (all states included). The application also supports business returns (including 1065 and 1120S), both federal and state (all states included).

TaxWise charges you $35 per individual return and $55 per business return. This pricing is consistent across all of their packages.

Other TaxWise Packages

The 100 Package (available for desktop or online) is a plan that includes 100 individual 1040 returns free of charge. After e-filing 100 returns, additional returns can be processed at the same pay-per-return rates as the TaxWise Online Limited plan.

The 100 package also comes with the CCH AnswerConnect Mini Package from Wolters Kluwer. This is a service that helps subscribers get answers to their questions on tax law. It provides reference materials and lets users access the U.S. Master Tax Guide and primary sources. TaxWise subscribers can also browse the TaxWise Online Education Video Library. All kinds of tutorial and training videos can be explored to expand users’ understanding of the software and the tax preparation process.

The 400 Package is the most popular plan among TaxWise subscribers. It is almost the same as the 100 package, only it supports 400 total tax returns.

As its name suggests, the Unlimited Package includes unlimited tax returns. It also has an upgraded version of the CCH AnswerConnect service—it comes with the Prime Package. In all other respects, it carries the same features and functions as the other TaxWise plans.

Mobile Apps, Bank Products and Tech Support

If you purchase it as an add-on, TaxWise Mobile lets your clients use a mobile app to get started on their tax return. The app conducts a kind of interview to gather client information.

TaxWise offers bank product integration with the following partners: Santa Barbara Tax Products Group (TPG), Republic Bank, Refund Advantage and EPS.

Customer support is available via a Solution Center on the Wolters Kluwer web site. The center hosts a troubleshooting knowledge base and “ask the community” section. You can also chat with a virtual representative or call the customer support desk (during operational hours only).

CrossLink

Price Range: $1,795 (desktop/online)

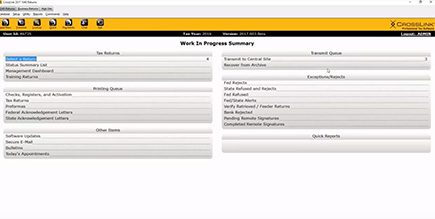

Summary: CrossLink software is pitched at high-volume retail tax preparation businesses. Its flagship product is CrossLink 1040 Desktop. An online software version is available.

As a software solution for high-volume tax return preparation, CrossLink is well-suited to businesses serving hundreds of clients. It’s not necessarily the go-to option for someone just starting out, or maintaining a limited clientele count.

The flagship version is CrossLink 1040, which is available on desktop and online platforms. CrossLink 1040 Desktop and CrossLink 1040 Online are priced the same. As the name suggests, the software lets you file individual 1040 returns. If you want to prepare and file business returns through a CrossLink application, you’ll need to acquire the CrossLink Business software as well. This software is fully integrated with CrossLink 1040—either Desktop or Online.

CrossLink Business comes in two “flavors.” Unlimited ($999) places no limitations on the number of business 1040 returns you can process. Pay-Per-Return ($600) will incur costs of $35 per federal individual return and $0 per state individual return.

Price Breakdown for CrossLink

Here’s a quick reference chart for the Crosslink packages and prices:

| Unlimited | Pay-Per-Return | |

|---|---|---|

| CrossLink 1040 Desktop | $1,795 | - |

| CrossLink 1040 Online | $1,795 | - |

| CrossLink Business (add-on) | $999 | $600 (then $35 per federal individual return, $0 per state individual return) |

CrossLink 1040 Desktop

CrossLink claims that its software provides high-speed, accurate tax return processing that lets you deliver legitimate tax refunds and bank products to your clients with little delay. “Speed” seems to be the company byword, and it is alluded to frequently in CrossLink’s promotional materials. As for accuracy, CrossLink offers its Point-and-Shoot Error Correction diagnostics tool to help you achieve that. It is a fairly elegant solution that points you to calculation and data entry errors without having to switch between too many screens.

You can use CrossLink 1040 for e-filing with ease. CrossLink implements a Work-In-Progress Screen with an instant status display for e-filed tax returns. This will keep you up to date on IRS acknowledgements, rejections and bank product check availability.

CrossLink 1040 supports automatic tax calculators that can handle state tax returns (all states), city tax returns and home-based business filing for Schedules A, C, E, F, and K-1, plus Forms 2106 and 4835.

CrossLink 1040 Online

CrossLink 1040 Online works like the desktop version and has the expected simple, unexciting and easy-to-use interface. The program can be run on Windows, Mac OS and mobile devices including tablets—basically any internet-accessible device should be able to run it.

As tax preparation software, CrossLink 1040 Online is designed to serve as a scalable solution, just as usable by a new tax preparer as an established service bureau.

CrossLink Business

If you wish to get support for business forms, CrossLink Business tax software can be purchased additionally, and it integrates with either CrossLink 1040 Desktop or CrossLink 1040 Online. CrossLink Business enables the processing and filing of federal and state business tax returns.

Another handy feature of CrossLink Business is its management dashboard, which consolidates project supervision of multiple tax offices. If you have to manage a number of tax preparers or teams, you can use CrossLink Business to set up sub-sites that all link up to the central dashboard. This lets you keep track of your tax preparers and how their tasks are going. You can even view all returns processed, if you like!

Mobile Apps, Bank Products and Tech Support

CrossLink software can work with the TaxPass mobile site—no need for customers to download an app to their phone. TaxPass is fully integrated with CrossLink 1040. Customers can start their tax returns on TaxPass, and you can complete their returns using CrossLink 1040.

CrossLink supports Refundo, Republic Bank and the Santa Barbara TPG family of bank products.

The company provides technical support through phone and email. The CrossLink official website leads you to various product introduction and training videos (which are hosted on YouTube). Its software walkthrough videos have been updated recently.

Also on the website is the CrossLink Support Center, which provides an extensive FAQ detailing the functions of the products, as well as advice and troubleshooting.

Drake Tax Software

Price Range: $349.99 – $2,495 (desktop) / must call for pricing on online solutions

Summary: Drake Tax is meant to be used with Drake Accounting & Payroll software, which comes bundled in many of its current plans. Single user and multi-user plans are available. Drake Tax also offers specialized online solutions, but the pricing for these is not transparent.

Drake Tax provides a mainly desktop-based solution for speedy tax preparation via automatic form filling, with which it offers multiple tax-year analysis. The application plays well with Drake Accounting software, which comes bundled with many of the Drake Tax software packages. However, if you wish to use other accounting programs such as Quicken, you may find that Drake Tax has less compatibility with your choice of software.

As a whole, Drake Tax is an affordable and functional solution when it comes to processing simple tax returns. The software is not as adept in handling complex returns, and the greater the complexity, the less intuitive it will be to complete a return in Drake Tax.

Drake Tax can be a viable option for the entry-level tax preparer or the tax pro who handles a low volume of returns. According to The Tax Adviser’s 2024 Tax Software Survey, Drake Tax is the leading choice of software used by sole proprietor tax preparers, handily beating its closest contenders, Intuit ProSeries and UltraTax CS.

The Drake Tax program interface is workmanlike. Online reviews cite the inconvenience of having to navigate between different screens during the data entry process, and some find the software clunky and error-prone when preparing complicated business returns. A CPA reviewing Drake Tax for Fit Small Business has these findings: “Praised for ease of use and overall affordable pricing; complaints that it sometimes requires substantial manipulation for complex returns.”

Price Breakdown for Drake Tax

This chart presents the Drake Tax packages and prices. Many of the packages differ only slightly based on whether single user or unlimited user support is provided.

| Single User | Unlimited Users | Custom | |

|---|---|---|---|

| Drake Tax PPR (desktop) | - | $349.99 (includes 10 individual returns, then $39.99 per individual return, $59.99 per business return) | - |

| Drake Tax 1040 (desktop) | $1,795 | $1,995 | - |

| Drake Tax Pro (desktop) | $2,195 | $2,495 | - |

| Drake Zero (online) | - | - | must call for pricing |

| Web1040 (online) | - | - | must call for pricing |

According to the 2023 Drake Tax Manual, customers who started on the Drake Tax Pay-Per-Return (PPR) package cannot upgrade to Drake Tax 1040. They can only upgrade to Drake Tax Pro. Customers must meet the total cost to customer threshold of $2,450; once that threshold is reached, they will be prompted to upgrade. The cost to upgrade is equal to the base price of Drake Tax Pro ($2,195) minus the total amount spent on additional returns under the PPR package.

The package prices of online solutions Drake Zero and Web1040 are not specified on the Drake Tax website. You must call and speak to a sales representative to determine the price of your custom package.

Drake Tax has partnered with Rightworks to provide cloud-based hosting for their desktop applications. Rightworks cloud hosting incurs a monthly fee of $104 per user for 1-9 users, $94 per user for 10-19 users, and $84 per user for 20 users or more.

Features of Drake Tax

Drake Tax is your basic tax preparation software. It is designed to make the process of completing a return more efficient and streamlined. The software can automatically calculate a return as you fill out the data fields. You can set up shortcut keys and macros to speed up tax return data entry tasks.

One Drake Tax feature, Look Back, lets you view the prior year’s tax return data. You can easily compare it with the current year’s return. With a keyboard shortcut, you can toggle between Look Back and the current view.

DoubleCheck is the name of the Drake Tax diagnostic tool. It can track any changes that affect verified data entry items. If DoubleCheck detects such changes, it will automatically flag the entry for review.

You can further speed up tax preparation using optional hardware add-ons. These include an e-signature pad and a 2D barcode scanner. The signature pad can simplify electronic tax filing by letting clients digitally sign returns. The barcode scanner enables importing data from W-2s or K-1s with 2D barcodes.

Drake Tax Planner provides tools for analyzing tax scenarios to better equip you in finding the most optimal options when filing returns.

Drake Tax supports the e-filing of both federal and state returns (unlimited states). Other services bundled with Drake Tax include onboarding (getting started) and customer support via phone, fax, chat and email.

Drake Tax Pay-Per-Return

Drake Tax PPR provides you with the flexibility of paying only for the number of returns you need for the current tax season—on top of the annual software license you paid to use the product. Drake Tax PPR does come with 10 returns (Form 1040s) ready to use at no extra cost. Once you have redeemed these initial 10 returns, you must purchase any additional returns you wish to complete in Drake Tax.

While Drake Tax PPR is a desktop application, you need an internet connection to redeem or purchase returns. This is because each return you have purchased is stored on the Drake Tax web servers, and kept there until you redeem (“use”) it. Upon redeeming it, the data is transferred to your Drake Tax PPR installation, allowing the return to be stored in your local system. Without an internet connection, this redemption and transfer cannot be completed.

If you ever find that you do not have an internet connection, you can still work on any redeemed return that is already stored in your system. But no more returns can be purchased or redeemed until the internet connection is reestablished.

While Drake Accounting & Payroll is bundled with Drake Tax 1040 and Drake Tax Pro, that is not the case with Drake Tax PPR. If you want the Pay-Per-Return package and also want the accounting software, you must purchase it separately as an add-on feature.

Drake Tax 1040

The Drake Tax 1040 package is made for the tax preparer whose business focuses on preparing individual returns. The software does support over 4,300 types of tax forms and schedules, but most of those will incur a pay-per-return cost. However, you can prepare and file an unlimited number of any combination of 1040, 1040NR and 1040SS returns at no extra cost.

You can use Drake Tax 1040 to prepare the following returns: 1120, 1120-S, 1120-H, 1065, 1041, 990, 706. Each of these must be purchased for use at a price of $59.99 per return.

Drake Accounting & Payroll is bundled with this package.

Drake Tax Pro

Drake Tax Pro is the most comprehensive software package that the company offers. It is suitable for a full-service tax practice that handles more than individual returns. Drake Tax Pro supports unlimited returns of the following classifications: 1040, 1040NR, 1040SS, 1120, 1120-S, 1120-H, 1065, 1041, 990, 706

Drake Accounting & Payroll is bundled with this package.

Drake Zero & Web1040

Drake Zero and Web1040 are both cloud-based tax software solutions. Drake Zero is the simpler application, which can handle a standalone site. Web1040 is capable of supporting multiple sites at 20 or more physical locations. You can use Web1040 to manage multiple tax offices or remote teams of tax pros.

As web apps, Drake Zero and Web1040 can be used on your mobile device (tablet or phone).

When it comes to preparing returns, Drake Zero applies pay-as-you-go pricing for better flexibility. Web1040 lets you pay one flat rate to file unlimited returns, including state returns (unlimited states).

While these are online software solutions, being a Drake Zero or Web1040 customer grants you access to the desktop version of Drake Tax PPR. You can retrieve the program at the Downloads page of your web user account. With Drake Tax PPR installed, you will be able to file business returns on demand. However, it cannot be used to prepare or file individual returns. Drake Zero and Web1040 customers are not eligible for a desktop software upgrade to Drake Tax Pro.

Bank Products and Tech Support

If a subscriber has issues using the tax preparation software, they can get support via phone or email. The Drake Tax website also hosts a knowledge base of troubleshooting information. Also available on the website are learning resources, including a video tutorial library.

Drake Tax customers can also get help via phone during the support hours listed on the website. Email support is also available.

Drake Tax is partnered with a number of financial services to provide bank product access to their customers. The supported partners include EPS Financial, Refund Advantage, Refundo, Republic Bank and Santa Barbara TPG.

Federal Direct Tax

Price Range: $299 – $2,499

Summary: Offers tax business partnership packages that include cloud-based tax software along with various tax office resources. Apart from the software, you also get assistance for starting your tax preparation business. As your partner, the company takes a cut of the fee you charge each customer.

The company has an in-house team of tax professionals and IRS Enrolled Agents who can aid your business with tax research and tax return preparation. So when you purchase a partnership package, you gain access to a number of services, including technical support, tax preparer training and IRS registration assistance.

If your main interest lies with the software… basically, you can expect to get the usual tax preparation toolkit.

Features of Federal Direct Tax

The program interface is fairly easy to use, especially in interview mode. This “easy interview module” will guide you in filling the data fields on a tax return. Or you can turn it off and directly enter info on the tax forms.

The software supports tax return e-filing and you can track the e-file status of a return in real time. Users can enjoy unlimited filings of federal and state returns. The Quick Tax Estimator will speedily calculate a client’s refund estimate.

Price Breakdown for Federal Direct Tax

Federal Direct Tax offers four partnership packages at different price tiers.

| Quick Start Package | Silver Package | Gold Package | Platinum Package |

|---|---|---|---|

| $299 | $599 | $999 | $2499 |

All Federal Direct Tax packages include unlimited filings, though certain packages support only individual returns. All packages also come with the following services: one-on-one personalized software orientation, 6 step tax preparer training, IRS registration assistance

Not shown here are the terms of your partnership agreement with Federal Direct Tax, should you purchase one of their service packages. You can expect that a portion of the fees you charge your clients will go to Federal Direct Tax instead of your pockets.

Comparison of the Partnership Packages

Each partnership package includes the same professional tax software. The main difference is in the included tax resources and services, as well as the number of users provided with system access.

The Quick Start and Silver packages do have limitations. They include all individual forms and schedules, and no more. The Quick Start subscription provides only one user with system access.

The Silver package lets up to three users access the online software system. It also includes tax office marketing services.

The Gold package includes everything from Silver and adds support for all individual state returns, plus a multi-year filing program (up to 3 prior tax years). Gold also unlocks these services for the subscriber: marketing campaign budget matching, backup and recovery services. It supports up to 5 total users.

Platinum, the most expensive package, comes with individual and business returns, both federal and state (all states included). Platinum supports Forms 1040, 1065, 1120, 1041, 990, 706 and more. You also get a more expansive multi-year filing program (up to 5 prior tax years). It also comes with the most comprehensive suite of services. In addition to the Gold package services, Platinum provides enhanced marketing programs and an immigrant tax filing program with training and support for your office. It grants system access to as many as 10 total users.

Services and Tech Support

Technical support is available over the phone. This can be coupled with a browser-based HelpDesk app that shares your screen with the support technician.

Bank product integration is not available, but you can make use of rapid tax refund options. You can offer your clients as much as $6,000 as a same-day, in-season refund advance.

Intuit ProSeries & ProConnect Tax

Price Range: $1,052 – $2,312 (basic desktop) / $661 – $3,191 (professional desktop) / $3,483 – $6,307 (online)

Summary: Intuit ProSeries is an attractive tax software solution for existing users of QuickBooks Accountant. It is also a product that has earned a high score on ease of use in a recent tax software survey. ProSeries is desktop only. ProConnect is its cloud-based alternative. Both products are viewed as too pricey by a majority of users.

You’ve surely heard of the QuickBooks accounting software. It’s gained widespread acceptance as the go-to application for accounting tasks in many companies. The Intuit brand has become a household name as a result. Indeed, you might already be using QuickBooks Accountant, in which case you have a good reason to try another Intuit product. But if you’re reading this product comparison guide, you probably aren’t in that position, and are still on the lookout for a tax preparation software option that works for you.

Another thing to consider is that Intuit ProSeries, its tax preparation application, does not feature an automatically integrated workflow with QuickBooks. You still have to export the QuickBooks Accountant client file and import this to Intuit ProSeries Professional, whereupon you map the imported data to the client’s tax return. It’s not a huge departure from the data file transfer methods you can use with other tax preparation programs. If transferability is your sole measure for considering Intuit ProSeries Professional, we don’t view that as a highly compelling factor. Furthermore, the lower-priced version of the program, ProSeries Basic, does not support QuickBooks Accountant file import.

In The Tax Adviser’s 2024 Tax Software Survey, Intuit ProSeries earned the highest ranking for “ease of use” at 79.3% of the respondents. However, a significant number expressed dislike for ProSeries pricing—60% of ProSeries users cited “price” as their biggest issue with the product, while 35.8% pointed to “tax research included in package” as what they disliked most about it.

(Reviewer’s note: Of all the software products we researched, this was the most complicated and confusing when it came to understanding the differences between the packages. We hope that this overview will make things easier for you.)

ProSeries Basic

Intuit ProSeries is available in two versions: ProSeries Basic and ProSeries Professional. Both of these packages provide you with a desktop application that supports form-based data entry. Here’s a price breakdown of the currently available ProSeries Basic plans:

| Basic 20 | Basic 50 | Unlimited | |

|---|---|---|---|

| ProSeries Basic | $1,052 | $1,528 | $2,312 |

The Manufacturer’s Suggested Retail Price (MSRP) is given for the package prices in the chart. A better offer may be available at the time of your purchase.

No matter which option you get, your ProSeries Basic plan grants you a single user license, a guided workflow for first-time software users, a tax planner tool, a financial institution download tool, a client billing tool, client letter templates and single user access to an Intuit Link client portal setup.

ProSeries Basic is fairly limited in functionality and is best used by sole proprietors. Since the program only supports one user account, it is not ideal for businesses with more than one active tax preparer. You’ll also note that some of the features, such as guided workflow, will be more beneficial to new tax preparers.

ProSeries Basic also has limited support for tax forms. It is primarily designed to process 1040s and individual state returns—but not for all states, and the number of states supported depends on which ProSeries Basic package you paid for. The program’s tax calculation functions are also rudimentary.

When you get ProSeries Basic, you choose one out of three packages. Basic 20 is the most affordable, meant for the tax preparer who is just getting started. It allows you to process up to 20 state returns and 20 Form 1040s, though it only supports a single state (of your choice). Basic 50 offers a bit more, up to 50 instead of 20, and two states are supported. Basic Unlimited is the most expansive option, allowing for unlimited returns with 4 states supported.

ProSeries Professional

Whereas ProSeries Basic is ideal for an entry-level tax preparer, ProSeries Professional offers a desktop-based tax preparation solution geared toward small and medium sized tax offices. You can choose from four different ProSeries Professional packages. Their prices listed below:

| Pay-Per-Return | 1040 Complete | Choice 200 | Power Tax Library | |

|---|---|---|---|---|

| ProSeries Professional | $661 (then $61 per federal individual return, $55 per state business return) | $3,191 (unlimited 1040s, $55 per state business return) | must call for pricing | must call for pricing |

The MSRP is given for the prices in the chart. A better offer may be available at the time of your purchase.

Only new customers are eligible to purchase the ProSeries Choice 200 package. Anyone who has previously purchased a ProSeries, ProConnect or Lacerte product cannot take advantage of this offer, and it is not available as an upgrade to your current ProSeries Professional package if you have one.

All of the ProSeries Professional plans support multiple user access, but (except for Choice 200) this involves an additional fee to pay for each user. The fee amount is not stated on the Intuit website, but we did find that ProConnect Tax charges $99 per user access (capped after 10 users at $990). We expect the ProSeries Professional user access fee to be comparable.

ProSeries Pay-Per-Return can process individual 1040 and business returns. Indeed, it supports an extensive list of state and federal forms, schedules and reports (over 3,700 as of this review). Among the forms it can handle are: 1040, 1040 NR, 1041, 1120, 11205, 1065, 990, 706, 709

The pay-per-return pricing for these forms is as follows:

Form Classification Price Per Return

Federal Business Module: 1120, 1120S, 1065, 1041, 990 $87

Federal Estate Return: 706 $70

Federal Gift Tax Return: 709 $63

Individual Return: 1040, 1040NR $61

State Business Module: 1120, 1120S, 1065, 1041, 990 $55

State Individual Return $53

The ProSeries 1040 Complete package allows unlimited federal 1040 and state returns, excluding 1040 NR. For all other forms and schedules, the pay-per-return prices shown above will apply.

Two of the ProSeries Professional packages, ProSeries Choice 200 and Power Tax Library, are not priced on the Intuit website. You have to call an 844 number and speak with a sales representative about the pricing of these options.

ProSeries Choice 200 doesn’t let you file unlimited returns. However, you can file up to 200 returns in any combination of these forms: 1040, 1040 NR, 1120, 1120S, 1065, 1041, 990, 709, 706

ProSeries Power Tax Library enables unlimited returns, which include filing any combination of 1040s and forms supported by Choice 200. It is essentially the same as ProSeries Choice 200 except for the unlimited filing of returns.

ProConnect Tax

ProConnect Tax is a cloud-based tax preparation solution with customizable pricing based on your practice’s needs. As of 2024, it has been bundled with Intuit Tax Advisor, giving you tax advisory services within one software package. Another important feature of the product is its seamless integration with QuickBooks Online Accountant. Finally, its interface is modern and easy to use.

Here’s a price breakdown for ProConnect Tax software packages:

Essentials 50 Essentials 100 Plus Advanced Enterprise

ProConnect Tax $2,799 $3,483 $6,307 must call for pricing must call for pricing

Now let’s talk about what each software package entails:

- Essentials 50: The entry-level package has support for up to 50 total returns (including up to 5 business returns), 50 e-signatures and one user access license. Ideal for small and new businesses.

- Essentials 100: This package supports up to 100 total returns (including up to 25 business returns), 100 e-signatures and one user access license. It is recommended for tax preparers who mainly file individual returns.

- Plus: The Plus package supports up to 200 total returns (including up to 50 business returns), 200 e-signatures and three user access licenses. It is good for small-to-medium tax offices who want to file some business returns alongside individual returns. Pricing starts at $6,307 and may increase if you go for package customization.

- Advanced: This one is very similar to the Plus package. Advanced supports up to 300 total returns (including up to 100 business returns), 300 e-signatures and three user access licenses. Pricing is not provided upfront. You need to call an 844 number and speak with a sales agent to initiate a discussion on pricing.

- Enterprise: Clearly the enterprise-level option. This package is for firms that need to process a high volume of tax returns—over 300 returns. Pricing for this package is not provided upfront. You need to call an 844 number and speak with a sales agent to initiate a discussion on pricing.

A note on user access: ProConnect Tax requires you to purchase a $99 user access license for each person authorized to use the software. This license fee is paid on an annual basis. Remember, this is a cloud-based application. The software is not downloaded to your machine. Instead, you pay to gain access to software that is hosted online. When you purchase a ProConnect Tax package, the price does include one or more user access licenses according to the package details. For example, the Essentials 100 price is inclusive of a single $99 user access license.

The total of your user access fees is capped after 10 users at $990. So if you have a tax firm with 10 or more persons needing account access, you will be charged a flat fee of $990 that covers all of your firm’s user access licenses.

ProConnect Tax is a well-reviewed product with a high price point and some minor drawbacks. According to a 2024 analysis by a CPA reviewer on Fit Small Business, ProConnect Tax has issues with handling complex tax returns such as consolidated returns. The CPA also calls out its pay-per-return pricing as costly, especially for tax pros filing high volumes of returns. Furthermore, its year-over-year price increase is described as “oppressive.”

Tech Support and Bank Products

ProSeries subscribers enjoy access to Intuit’s reliable help and support resources. The official Intuit website hosts an Education Resource Center. You can check it out to find useful information about ProSeries and ProConnect Tax. It provides FAQs, knowledge articles and tutorial videos. You can also enroll in live webinars. First-year subscribers can make use of the Easy Start onboarding service for new customers, which includes step-by-step support on both tax forms knowledge and technical concerns.

Telephone, email and chat support options are also available, with customer support costs bundled into the ProSeries software package pricing.

Intuit ProSeries and ProConnect Tax support bank products from the following partners: Santa Barbara Tax Products Group and Refund Advantage.

Lacerte Tax

Price Range: $860 (pay-per-return) / must call for pricing on other packages

Summary: Lacerte Tax is a tax preparation solution and a tax planner in one application. It is a good option for a full-service tax bureau that offers tax advice to clients. Lacerte Tax is a decidedly expensive option—too costly for most entry-level tax preparers.

Lacerte Tax is another product offered by Intuit. This is not simply a tax preparation solution, it also comes with a robust tax advice and planning toolkit called Intuit Tax Advisor. This helps you build tax plans for your clients, using data collected from Lacerte Tax automatically.

Remote access capabilities are another feature that sets Lacerte Tax apart from the Intuit ProSeries line (except for ProConnect). Lacerte can be run as a desktop application, but Intuit provides a cloud hosting solution available to all software packages. Hosting for Lacerte enables a cloud-based workflow and far-ranging mobility.

Lacerte Tax is not ideal for someone new to the tax preparation business. While it does offer guidance tools, it is geared more to the experienced tax pro who can benefit from the occasional tip—not a novice tax professional who is still learning the ins and outs of tax preparation.

The software is also on the high end when it comes to pricing. We can’t tell you the prices of Lacerte Tax software packages, but what we do know is that a Lacerte Tax package comparable to a ProSeries package can be twice the cost. A CPA reviewer for Fit Small Business wrote this observation regarding Lacerte Tax: “Has above-average ratings for its comprehensive platform and coverage of obscure tax rules; that exhaustive access comes at a cost, however, and users note that the biggest downside of Lacerte Tax is the high software cost.”

Features of Lacerte Tax

All Lacerte Tax desktop software packages (including pay-per-return) include the following forms and schedules: 1040, 1041, 1065, 1120, 1120S, 5500, 706, 709, 990

They all support the following features and services: Intuit Tax Advisor (built-in), Hosting for Lacerte, Intuit Link client portal, consolidated corporate returns, financial institution downloads, K-1 transfers, access to training content and e-signature sign-offs for 5,700 forms.

Price Breakdown for Lacerte Tax

Lacerte Tax desktop software packages may be modular. Three types of software plans are specifically described on their website:

| Lacerte Tax REP | Lacerte 200 | Lacerte Unlimited |

|---|---|---|

| $860 | must call for pricing | must call for pricing |

The MSRP is given for the Lacerte Tax REP price in the chart. A better offer may be available at the time of your purchase.

Lacerte Tax is not transparent about the prices of their packages—all of them except the pay-per-return option require a call with a sales representative to produce a quote.

Lacerte Remote Entry Processing (REP)

The Lacerte Tax pay-per-return package offers great flexibility if you want to be able to file a combination of individual, business, corporate and specialty returns. And you “pay as you go” for each return that you prepare.

Here’s a breakdown of the Lacerte Tax REP pay-per-return rates:

| Form Classification | Price Per Return |

|---|---|

| 1040 federal and one state | $96 |

| 1040 additional states | $73 |

| business/trust/estate: federal and one state | $125 |

| business/trust/estate: additional states | $81 |

| gift tax/employee benefit: federal | $83 |

| consolidated corps | $124 |

| tax scan and import | $14 |

Other Lacerte Tax Software Packages

Lacerte 200 allows the preparation of up to 200 federal individual returns. This package includes access to Lacerte eOrganizer, on top of the other included features specified earlier.

Lacerte Unlimited, as the name suggests, gives you an unlimited number of individual and business returns. State e-filing is included. This package includes access to Lacerte eOrganizer.

Tech Support and Bank Products

Customers of Lacerte Tax software can benefit from the same support resources as ProSeries customers. FInd the relevant info in the ProSeries overview above this entry.

Lacerte Tax lets you offer pay-by-refund solutions to your client via bank products from Refund Advantage or Santa Barbara Tax Products Group.

MyTaxPrepOffice

Price Range: $695 – $1,295 (online)

Summary: Cloud-based system suitable for virtual tax offices. Also handy for in-person consultations with clients. No corresponding desktop application available.

From its inception, MyTAXPrepOffice has been pitched at remote teams working together as a virtual office. It offers a cloud-based tax preparation app that runs in your web browser. Users can access their MyTAXPrepOffice account from a desktop computer, laptop, tablet or mobile device.

Wondering whether they offer a desktop-based application? No, MyTAXPrepOffice is online software only. Fortunately, you can set the tax software to offline mode, allowing you to work on a project in the event that you have no access to the internet. When you do get an online connection, MyTAXPrepOffice will sync with the cloud. This will update your project with the changes you made in offline mode.

Given the shift to virtual office setups that began ramping up in 2020, MyTAXPrepOffice is in a good position to answer the needs of today’s remote workers—though it is scarcely alone in this. UltimateTax, OLT Pro and other applications also stand out as viable solutions for a virtual tax office.

Price Breakdown for MyTAXPrepOffice

MyTAXPrepOffice only offers three plans:

| Individual Pro PLan | Essential Plan | Unlimited Plan |

|---|---|---|

| $695 | $995 | $1,295 |

Individual Pro Plan

Individual Pro Plan gives you access to a single user account and 5GB of cloud storage for tax returns and client data. Pro Plan subscribers enjoy free unlimited e-filing (individual 1040s only), federal and all states included. Other features include a client portal and a signature pad app.

The price is attractive, but the plan is fairly limited. If you want to file business returns, you would have to go with the Essential or Unlimited Plan.

Essential Plan vs Unlimited Plan

These two plans are very similar, although Essential is clearly aimed at small to medium businesses, and Unlimited to a large tax practice doing a high volume of tax returns.

MyTAXPrepOffice Essential Plan includes the features of Individual Pro Plan, and adds support for business returns. It can be used to prepare the following tax forms: 1065, 1120, 1120S, 1041, 990, 706, 709

Note that the Essential Plan only supports two user accounts and 10GB of cloud storage. You can add extra users at $20 per account, and an extra 5GB of storage for $20.

MyTAXPrepOffice Unlimited Plan includes the same features, plus it supports up to 999 user accounts and unlimited cloud storage. MyTAXPrepOffice touts the Unlimited Plan as a multi-office management solution. It is well suited to a company running multiple teams of remote workers.

Features of MyTAXPrepOffice Web Software